The single European currency has had a commotion after investors had to reconsider the outcome of the FOMC meeting in July and hastily started to form long positions. Indeed, there is nothing special from the commentaries of the Fed. The inflation rate was maintained below the target of 2%, same goes for the accomplishment in the medium term and maintained the moderate optimism of the U.S. economy. By the time of the announcement of the results of the Open Market Committee, the tension was so high that the slightest changes could have a big impact to the EUR / USD pair to move aside. Now it is time to be skeptical.

What was the reason for the USD index to collapse at the fastest pace since 2008 and reach the level of the 200-week moving average? The FOMC statement practically did not change, moreover, it contained "hawkish" notes: the Central Bank said it was ready to begin normalizing the 4.5 trillion balance soon enough. Most likely, the announcement of the anti-QE process will follow in September. Henceforth, reinvestment will slowly cease and a large player will leave the debt market that could put the yields to go north along with the U.S. dollar.

Dynamics of the dollar index

Source: Bloomberg.

Generally, a clear breakout in the 200-week average is believed to be a signal of a change in trend. This has not happened yet, although the dollar is at bay. Could it move out of that position? It is possible, that is if the plans of the Federal Reserve are gradually implemented. To begin with, it is necessary that GDP in the second quarter show an increase of 2.5% q / q or higher, which will convince investors of the validity of Janet Yellen's statements about the temporary nature of economic slowdown and inflation.

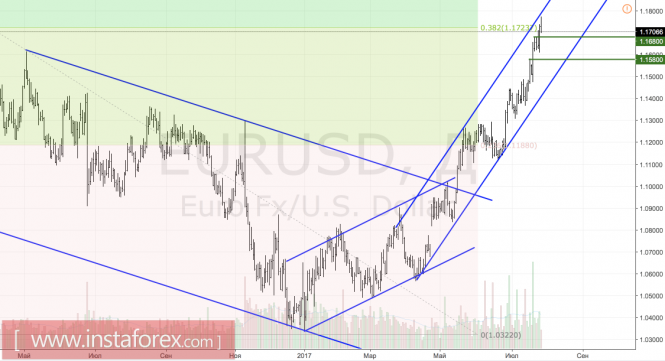

In the meantime, we should closely monitor the ability of the bulls to EUR / USD to gain a foothold above the historical highest level of 1.1714.

In the next few days, it is expected for the US GDP data to be released as well as the eurozone for the second quarter. The news of a political nature from the States is also anticipated. If the scandal around Trump settles, and the Senate accepts amendments to the health care laws, the investors' interest in the dollar will return.

Technically, if the bulls of the EUR / USD pair failed to keep the quotes above the resistance at 1.1723 (38.2% of the last long-term downward wave) indicates their weakness.

EUR / USD, daily chart