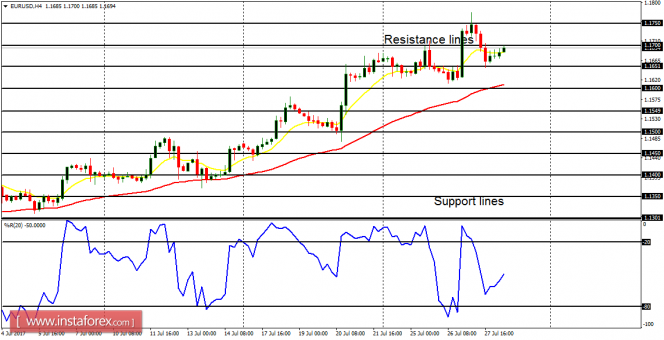

EUR/USD: This is a bull market – as shown by the Bullish Confirmation Pattern on it. The price is currently around the resistance line at 1.1700, which is almost being breached the upside. After that, the next target would be the resistance line at 1.1750.

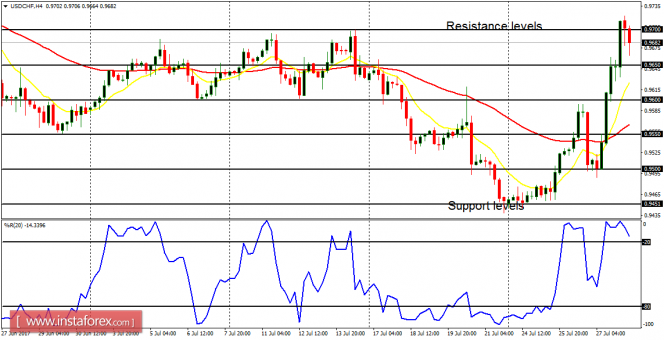

USD/CHF: Perpetual weakness in CHF has helped the USD/CHF to generate a clean bullish signal (most CHF pairs have also skyrocketed while the CHF/JPY plummeted). The price has gained about 250 pips this week, and it is slightly above the support level at 0.9700. The market would continue going upwards as long as CHF shows weakness. This is a classical example of when both the USD/CHF and EUR/USD go into a positive correlation; I.e, they both go upwards. The USD/CHF normally go into opposite directions. But this time around, the case is being influenced by exponential weakness in CHF.

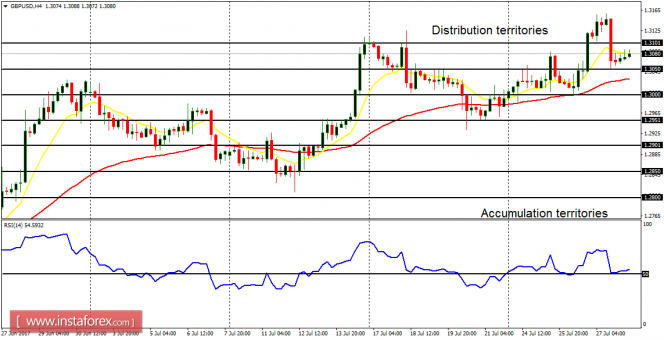

GBP/USD: Just like the EUR/USD, with which the Cable normally gets positively correlated, the bullishness on the market has held out so far. The distribution territory at 1.3150 was tested before the bearish retracement that is being experienced. It is expected that price would go upwards again to test that distribution territory, and possibly breach it to the upside.

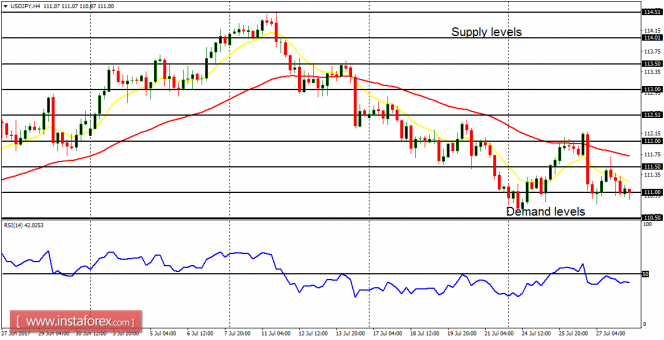

USD/JPY: Bears have tried to maintain the bearishness on this pair for this week. The EMA 11 is below the EMA 56, and the RSI period 14 is below the level 50. The demand level at 111.00 has been tested repeatedly and it may be breached to the downside anytime soon. Then another demand level at 110.50 would be aimed.

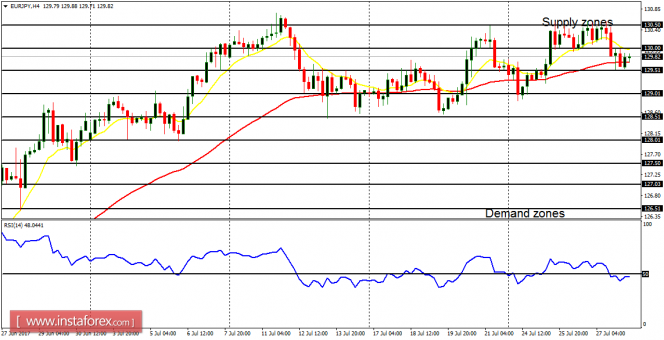

EUR/JPY: This currency trading instrument has gone neither upwards nor downwards this week, although the major bias is bullish. There is a demand zone at 129.00 and there is a supply zone at 130.50. The market would need to move above the supply zone or below the demand zone, in order to invalidate the current bullish bias or corroborate it.