The dollar is on the back of weak macroeconomic data, growth of domestic political risks, and increasing confidence in the europe.

The reports of regional offices.

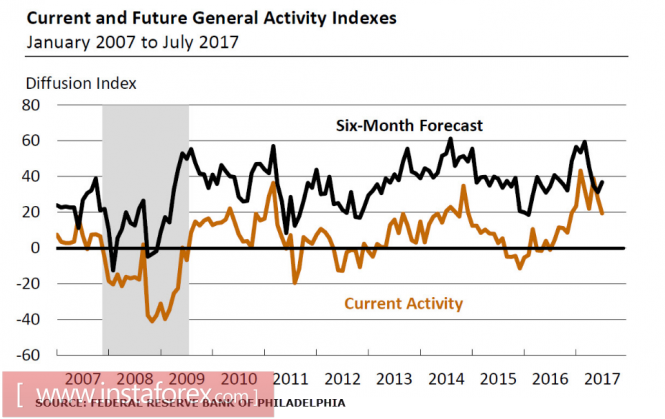

The indicators for all the components of the index-total activity, new orders, supplies, employment and hours of work declined, with the result for July.

The worsening of indicators did not go unnoticed by investors.

This change in sentiment is the first in at least six months, and is based on deeper reasons.

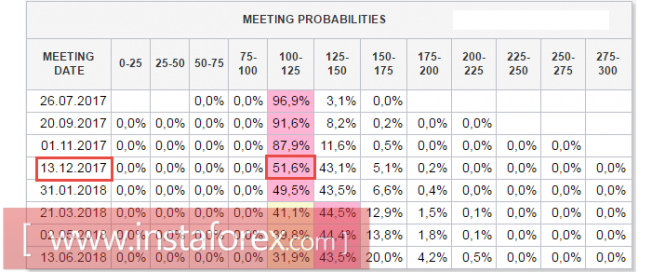

Investors are waiting for the promised reforms, but they only see streamlined formulations. Janet Yellen, speaking in Congress on July 12, noted that the Fed at the current stage can not implement an effective monetary policy because the "Trump team" does not have a clear fiscal policy. In other words, Yellen directly shifted responsibility for further actions to the Minister of Finance, which should submit a detailed plan for tax reform in the very future.

However, so far the situation is developing according to a different logic. On Thursday, the Securities and Exchange (SEC) introduced new regulations that effectively abolish the Dodd-Frank Act of July 21, 2010. This law was put in place to control the activities of financial institutions during the financial crisis. It was adopted despite the resistance of Republicans, and its abolition actually means the return of the right to banks to directly invest investors' funds in hedge funds and private equity funds. In other words, financial companies and banks will regain the right to work, including in the raw materials market, and on the securities market for speculative operations. Trump stands for the repeal of this law, suggesting that this will increase business activity, and banks will have more opportunities to invest in the economy. As part of the overall logic of Trump's reforms, the move to lift restrictions seems logical, especially in the area of the likely removal of the Fed from the excess reserves of commercial banks.

Banks, therefore, will pull out their reserves from the Fed's correspondent accounts and invest them in riskier, but at the same time, more profitable operations. Perhaps this is where one should look for the answer to the question of where does Trump intends to take the money for the reform?

The dollar will continue to remain under pressure at the opening of the week. There are no reasons to expect a change in sentiment, since the main macroeconomic indicators point to a negative trend. The dollar is also being pressured by the domestic political situation, in particular, the intention of special prosecutor Robert Mueller to collect information about a number of business operations by Donald Trump and a number of related people.

The material has been provided by InstaForex Company - www.instaforex.com