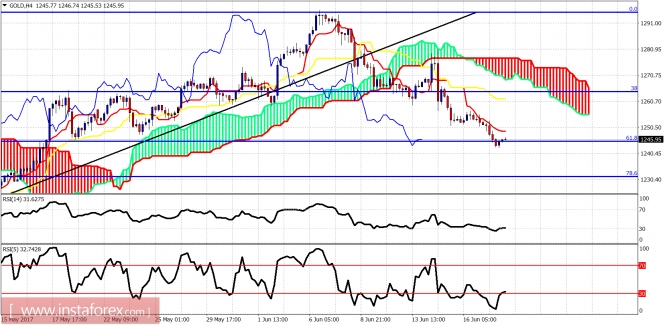

Gold price has reached our $1,245 target yesterday. It is time for Gold bears to be cautious and use protective stops as any day now we could see a reversal in Gold back towards $1,260-70.

Red line - short-term support

Blue line - long-term support trend line

The double top in Gold and the new rejection at the black trend line does not make me change my longer-term bullish view, however opens up a short-term bearish scenario where we can test the blue trend line support specially if we break below the weekly Kumo. Therefore it is important for short-term bulls to hold above $1,200.

The material has been provided by InstaForex Company - www.instaforex.com