The fall of the dollar index to its lowest levels since early October has remained relatively unnoticed by gold. The fierce speech by Mario Draghi on victory over deflation and the temporary nature of the soft CPI drove up euro prices, however, traders in the precious metal market prefer to focus on different news. During the auction on June 26, futures were quickly sold within a minute, the amount was equivalent to 1.8 million ounces, which is more than Finland's entire gold reserves. A few hours later during forex trading of the European session on June 27, in just five minutes, buyers purchased 815 thousand ounces. Presumably, it was attributed to an erroneous order, which the market refers to as a "fat finger". Where the wrong key was pressed which executed a large position.

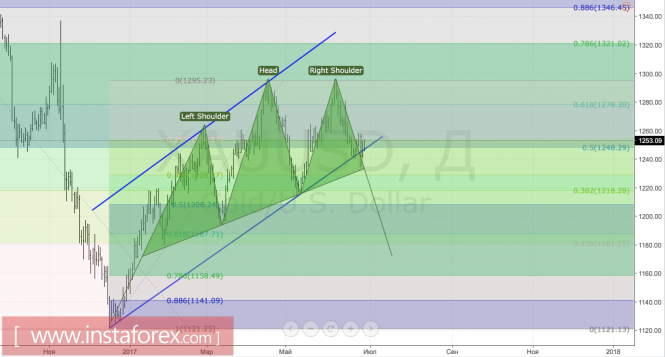

Dynamics of gold futures quotes

Source: Bloomberg.

In general, the situation on the precious metal market is in favor of consolidation. "Bears" argue that given the acceleration of global GDP growth, global stock indices near record highs, consistent high risk appetite and the Federal Reserve's desire to continue the cycle of normalizing monetary policy, XAU/USD quotes should continue to rise in the direction of $1,230 and $1,200 per ounce. On the other hand, "bulls" expect a recovery of the medium-term uptrend while citing persistent political risks in the United States, geopolitical tensions in the Middle East and the Korean Peninsula as well as continued terrorist attacks. All these factors increase the demand for safe-haven assets.

The condition of the physical metal market is characterized as moderately negative. Chinese gold imports from Hong Kong in May fell to 45 tons. It is nearly 40% lower than in April, and 60% less than the previous year. While retail investors are gradually increasing ETF stocks, institutional investors are pulling out from the specialized exchange-traded funds.

XAU/USD is supported by the fall in the dollar index, but the fact that Draghi's "hawkish" rhetoric sparked a rally not only in Europe but also in yields in US government bonds, casts doubt on the rapid recovery of the medium-term uptrend. Gold, which does not provide its owners the opportunity to receive dividends or interest, in calm conditions would not be able to compete with stocks or bonds.

At the same time, the fact that the IMF lowered its US GDP growth forecasts for 2017-2018 from 2.3% to 2.1% and from 2.5% to 2.1% and no longer expects Trump reforms to boost the economy towards the President's promised 3% growth, is a "bullish" factor for precious metals. If the situation in the United States is not as good as expected, perhaps the global economy as a whole will not be able to deliver expected results.

Technically, the rebound of XAU/USD from the support level resembles a false breakdown. If the "bulls" manage to push gold above the resistance by $1,254 per ounce and get a strong position there, the risks of a revival of an uptrend will increase.

Gold Daily Chart