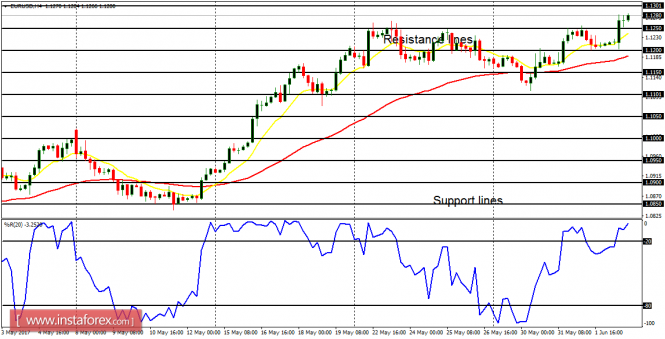

EUR/USD: The EUR/USD pair went upwards last week, closing above the support line at 1.1250 on June 2, and going towards the resistance line at 1.1300. The resistance line at 1.1300 may even be breached to the upside as price goes further upwards. However, a bearish reversal is likely to take place this week or next, owing to the bearish outlook on EUR pairs, which would probably materialize within the next several trading days.

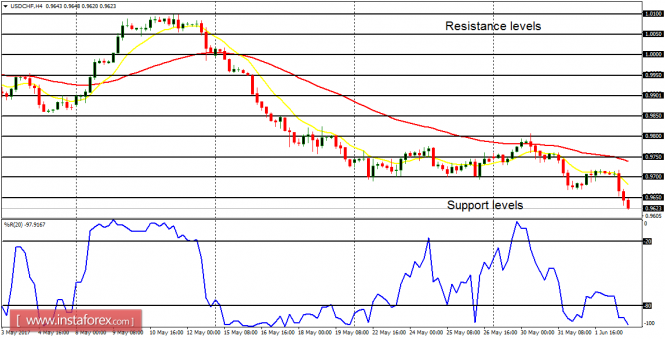

USD/CHF: This is a bear market. Price went south last week, following the initial consolidation that was witnessed in the first few days of the week. The market has lost about 460 pips since May 11, and this has caused a clean Bearish Confirmation Pattern on the chart. The market would continue going downwards until there is a bearish reversal on EUR/USD, a factor that may cause USD/CHF to spring upwards.

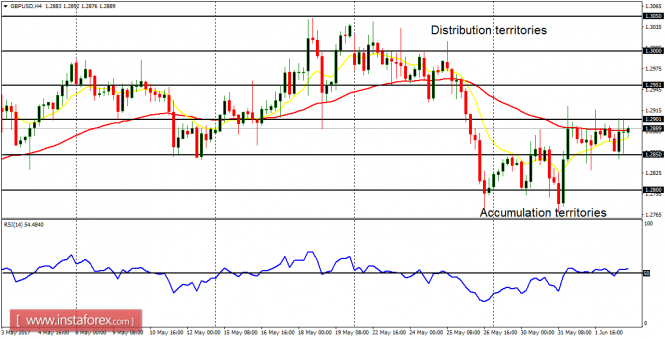

GBP/USD:

The GBP/USD pair is bullish in the long term but neutral in the short term. The price simply fluctuated last week, without assuming any directional movement. This week, the price would either go above the distribution territory at 1.3050 to strengthen the long-term bullish outlook; or go below the accumulation territory at 1.2700, to form a new bearish bias. This is expected to happen this week or next.

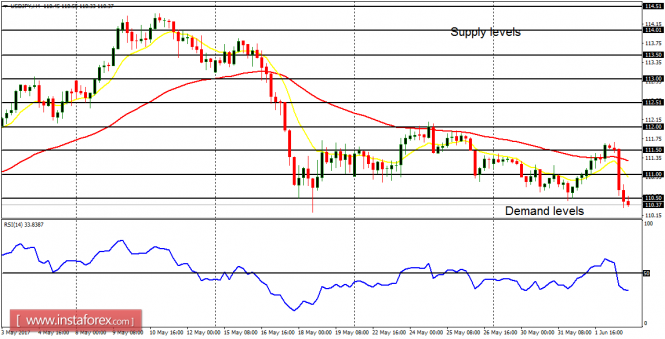

USD/JPY: This pair went sideways last week, but became vividly and conspicuously bearish on Friday. Price is expected to go more and more southwards this week, reaching the demand levels at 110.00, 109.50, and 109.00. The forecasted southwards movement goes hand in hand with the bearish expectation on JPY pairs for the month of June.

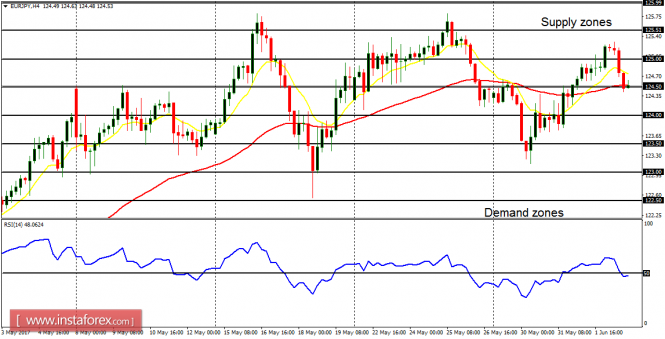

EUR/JPY: This cross pair is bullish in the long term, and neutral in the short term. Price tested the demand zone at 123.50 last week, and then went upwards by 180 pips, before closing below the supply zone at 125.00 on Friday. This week, a further bullish effort may be made, as long as EUR is strong in itself. A show of weakness in EUR may cause this cross pair to tumble.