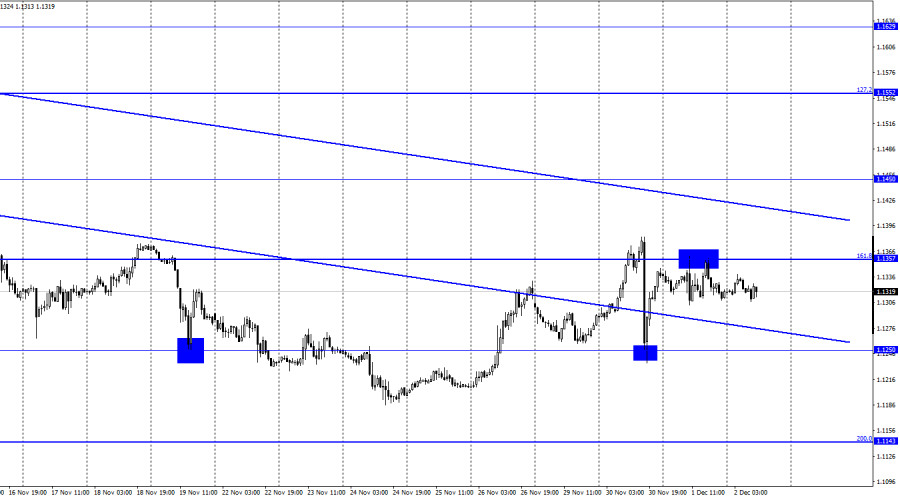

EUR/USD – 1H.

Hi dear traders! On Wednesday, EUR/USD grew to 1.1357, 161.8% Fibonacci level, and dropped twice off this level. Thus, the currency pair reversed downwards and began a bearish move towards 1.1250 which is still rather weak. Traders seem to hesitate between new long positions on EUR/USD and short ones. The ongoing downward trend channel still defined market sentiment as bearish. Yesterday, the economic calendar was full of economic data. Investors got to know a bunch of manufacturing PMIs for the US and the EU. All of them did not trigger big market moves as the PMIs broadly came in line with expectations. The most significant report was ADP national employment report. The actual employment growth in November of 534K was better than the consensus. Speaking for the Senate, Fed's Chairman Jerome Powell reiterated all those issues unveiled a day earlier that caused a serious slump in the EUR/USD pair.

So, the US dollar was able to rise a bit on Wednesday that was actually happened. On the while, traders had no preference for either buying or selling the pair. Apparently, the current state of affairs does not benefit risk sentiment. The world is still in the grips of the coronavirus. The new Omicron variant raises doubts about what to expect from it. Medical specialists say that it is more contagious than other previous strains. Jerome Powell stated in the Senate that the news variant poses a grave threat to the US economy. It could derail the economic output, slow down a recovery in the labor market, and propel further inflation acceleration. All in all, buying the euro as a riskier asset than the US dollar is not quite reasonable for the time being. On December 15, the Federal Reserve will wrap up its policy decisions at the final meeting this year. The official nonfarm payrolls are due on December 3. Today there is nothing interesting in the economic calendar. So, traders are taking a pause ahead of the crucial events.

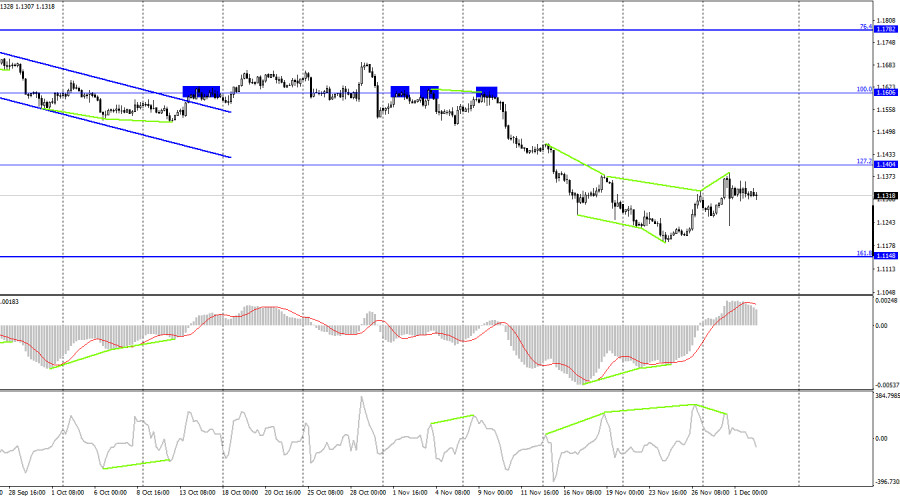

EUR/USD – 4H

On the 4-hour chart, EUR/USD reversed downwards in favor of the US dollar after the bearish divergence appeared. Later on, the currency pair began a decline towards 1.1148, 161.8% Fibonacci correction. Meanwhile, the pair is drifting downwards. None of the indicators is showing divergences in progress. If the pair settles above 1.1494, or 127.2% Fibonacci level, this will benefit the euro. So, EUR/USD will be able to resume growth towards 1.1606 that is 100.0% Fibonacci correction.

Economic calendar for US and EU

EU: unemployment rate (10-00 UTC)

US: Initial Unemployment Claims (13-30 UTC)

US: Treasury Secretary Janet Yellen speaks (14-00 UTC)

On December 2, the Eurostat posted a report on the EU unemployment rate that did not make any impact on trading sentiment. Later today, the US labor Department will report on unemployment claims. Janet Yellen is due to speak tonight as well. Her previous speech did not serve as a market catalyst. All in all, the information background is weak today.

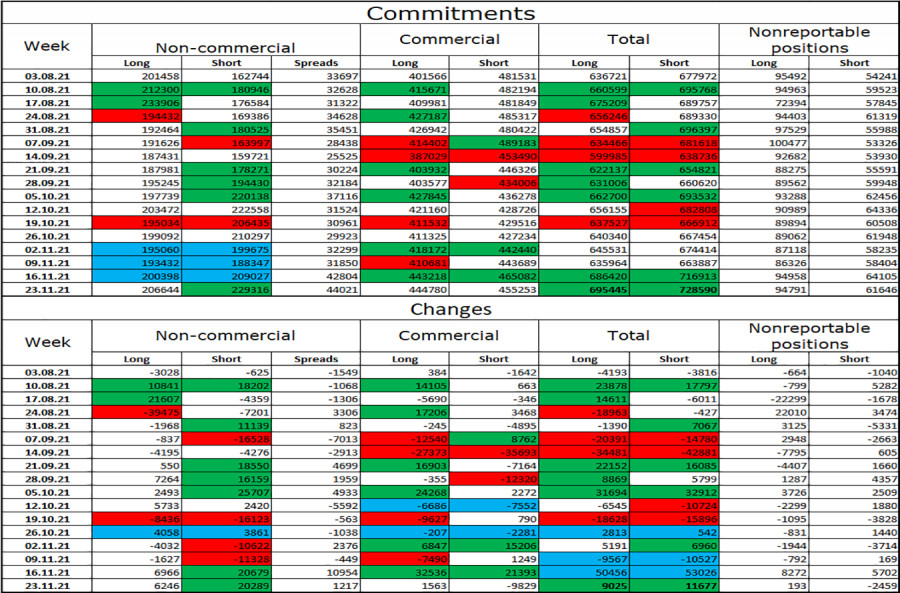

COT (Commitments of traders):

A new COT report logged that market sentiment of non-commercial traders turned bearish last week. Speculators opened 6,246 long contracts on EUR/USD and 20,289 short contracts. Thus, the overall number of long contracts kept by speculators increased to 206,000 and the total number of short contracts grew to 229,000. Besides, non-commercial traders opened more than 40,000 short contracts. It means that the bearish sentiment is escalating among the most important category of traders. Therefore, EUR could resume its fall in the nearest time. According to COT reports, there are no signs that EUR could develop long-lasting growth.

Outlook for EUR/USD and trading tips

EUR/USD gave an opportunity to open short positions during a breakout of 1.1357 in the 1-hour chart with the target at 1.1250. Alternatively, I would recommend opening long positions during a new breakout of 1.1250 on the 1-hour chart with the target at 1.1357. Another option is to go long when the pair closes above 1.1357 with the target 50-60 pips above.

The material has been provided by InstaForex Company - www.instaforex.com