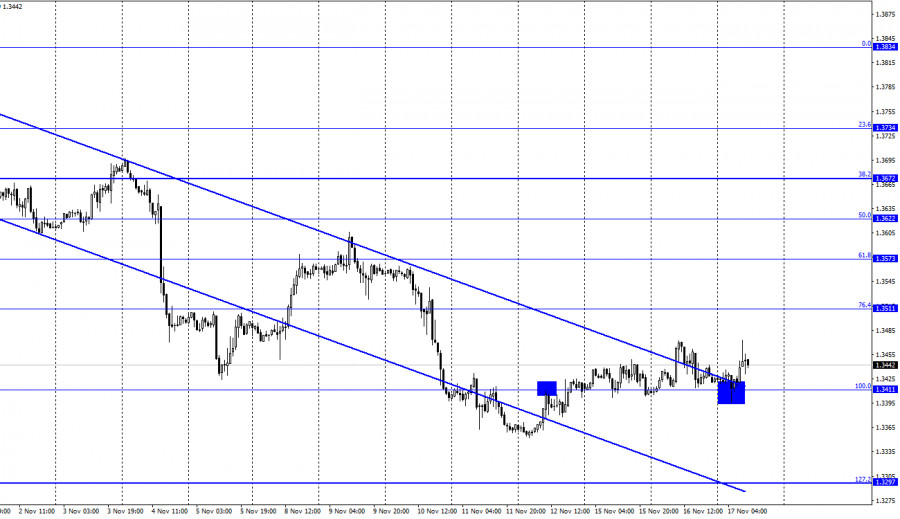

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair on Tuesday performed a slight increase in the direction of the corrective level of 76.4% (1.3511), after which it returned to the level of 100.0% (1.3411) and performed a rebound from it (already tonight). A new round of growth followed, but it did not last long, and the pair can once again return to the Fibo level of 100.0%. The pound has been trying to grow with the Americans for the fourth day in a row, but so far without much success. Yesterday, reports on unemployment and wages in the UK allowed the British dollar to grow slightly, but in the afternoon strong reports came out already in the US, so the dollar also rose. Retail trade volumes in America increased by 1.7% m/m in October and industrial production - by 1.6% m/m. Traders expected lower values. In addition, representatives of the FOMC speak almost every day, who make statements about the need to speed up the curtailment of the stimulus program, and some are even already talking about raising the rate.

Thus, paired with the euro, the dollar continues to grow steadily, but the pound is holding on with the last of its strength so as not to fall again. It seems that the policy of the Bank of England is saving it from this fate, whose members are also considering a possible rate hike in the coming months and curtailing the stimulus program. This morning, the UK has already released a report on inflation, which rose to 4.2% y/y in October, surpassing European inflation. The main consumer price index, the purchasing price index, and the selling price index have also grown. And all exceeded traders' expectations. Earlier, when US inflation rose significantly more than expected, the dollar significantly strengthened its position. But the pound today is practically not. Traders are preparing new sales of the pound/dollar pair and do not want to buy the pound, even when there is a strong information background.

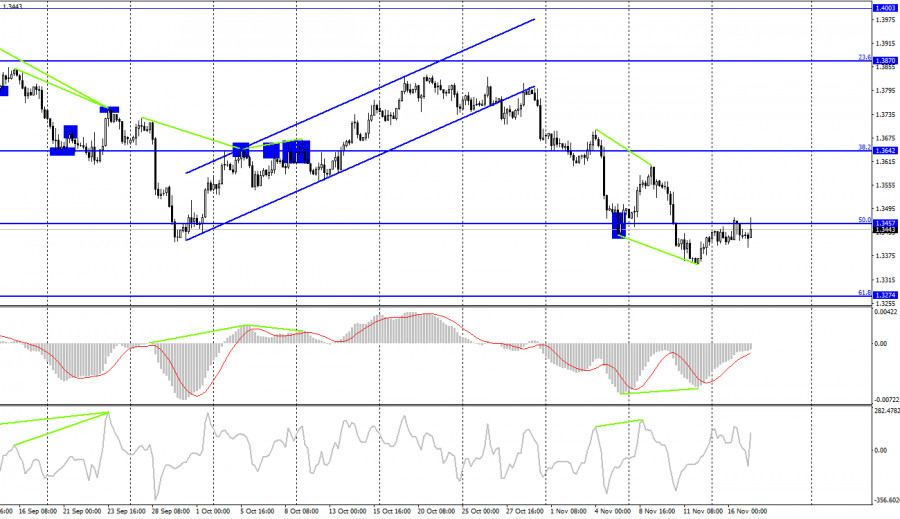

GBP/USD – 4H.

On the 4-hour chart, the British quotes made a second return to the corrective level of 50.0% (1.3457). The rebound of the pair's exchange rate from this level will allow traders to count on a reversal in favor of the US currency and a resumption of the fall in the direction of the Fibo level of 61.8% (1.3274). Closing quotes above the 50.0% level will increase the probability of further growth towards the next corrective level of 38.2% (1.3642). Emerging divergences are not observed in any indicator today.

News calendar for the USA and the UK:

UK - consumer price index (07:00 UTC).

On Wednesday, all the reports that were planned have already been released in the UK. And in the US today, no important reports are listed in the calendar. But there are endless speeches by FOMC representatives, who can even more strongly assure traders that the Fed is ready to tighten monetary policy.

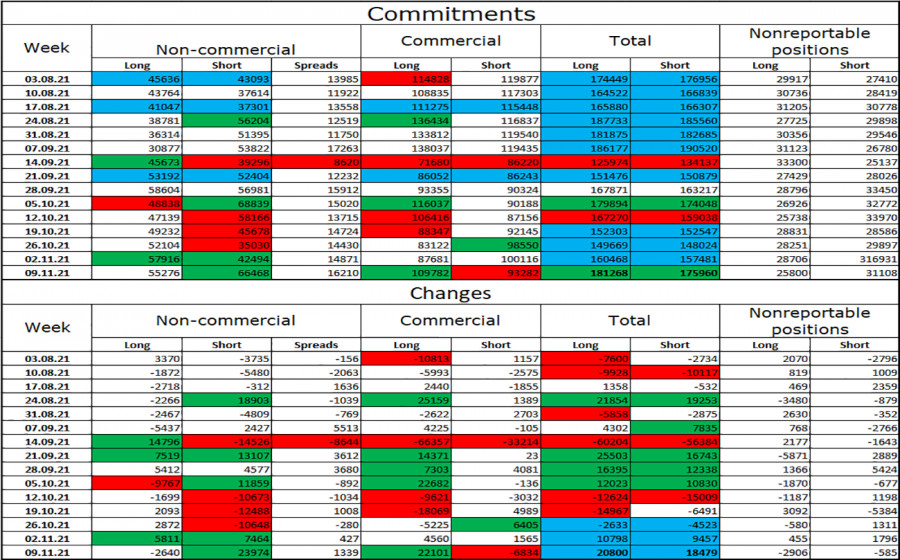

COT (Commitments of Traders) report:

The latest COT report from November 9 on the pound showed that the mood of the major players has become much more "bearish". In the reporting week, speculators closed 2,640 long contracts and opened 23,974 short contracts. Thus, the number of long contracts in the hands of major players in just one week has become more than the number of short contracts by 11 thousand. But a week ago, the advantage was reversed by 17 thousand. However, in recent weeks, speculators do not have any clear mood and then increase purchases, then increase sales, and the total number of long and short contracts for all categories of traders remains approximately the same (181K - 175K). Thus, after several weeks of an active buildup of shorts, a period of increasing longs may come.

GBP/USD forecast and recommendations to traders:

I recommend selling the pound if a close is made under the level of 100.0% (1.3411) on the hourly chart with a target of 1.3297. I recommended buying the British when closing above the descending corridor on the hourly chart with targets of 1.3511 and 1.3573. Now, these deals can be kept open, but they can also be closed since the pound refuses to grow.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.

The material has been provided by InstaForex Company - www.instaforex.com