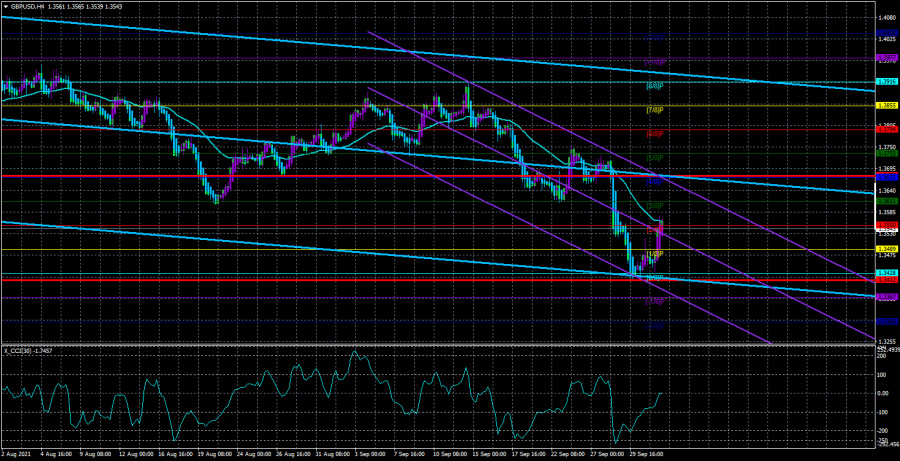

4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - sideways.

The British pound, paired with the US dollar, recovered to the moving average line at the end of last week. Therefore, the question is as follows: will the bulls be able to overcome the moving confidently? And if so, then the pound can easily resume its upward movement. Recall that the pound is very reluctant to adjust in the long term. It managed to adjust with difficulty by 23.6% against the entire upward trend, which has lasted for a year and a half, which is much less than the euro/dollar pair adjusted. Thus, the pound is now more likely to see the formation of a new upward trend.

Moreover, last week's fall in the pound's quotes was mostly provoked by the "fuel crisis," which is slowly beginning to be resolved. In principle, it would be difficult to imagine a situation in which the government would be inactive. Moreover, the markets are moving away very quickly from such unexpected news. Thus, it can be assumed that the fuel situation in the UK will improve, and at the same time, the British pound may continue to strengthen. At the same time, the price continues to be located below the moving average, and both linear regression channels continue to be directed downward. Therefore, now it is still more preferable to sell the pair. It should also be noted that last week the CCI indicator entered the oversold area (below -250), which indicates a very likely upward reversal. The reversal has already happened. Now it remains for traders to "take" the moving.

Meanwhile, the UK government has said that they have managed to resolve the fuel crisis, and the situation across the country is beginning to improve. It was stated by Kwasi Kwarteng, the Secretary of State at the Department of Business, Energy, and Industrial Strategy. "Gas stations now receive more fuel than they sell, and we are confident that this problem will be solved now," Kwarteng said. However, fuel retailers themselves do not share Kwarteng's optimism, stating that gasoline runs out faster than they have time to bring a new one. In some regions of the country, long queues at gas stations are still accumulating. It should also be noted that the Labor Party, which is in a state of constant hostility with the Conservatives, immediately became more active, criticized the government of Boris Johnson, and said that the Prime Minister should be given priority right to gasoline to all key services of the country.

It is also reported that the UK government has decided to extend the visas of 5,000 foreign truck drivers until 2022. Previously, these visas were supposed to expire by Christmas. "The level of fuel reserves at gas stations in the UK is growing, fuel supplies to gas stations exceed the normal level, and the demand for fuel is stabilizing. There is no shortage of fuel in the UK, and people should continue to buy fuel as usual," the official statement said. Boris Johnson himself said that the problem with fuel shortage could not be solved by inviting drivers from abroad. "I will not return to the old failed model of low wages, low qualifications, supported by uncontrolled immigration," Johnson said.

Thus, the fuel situation is improving a little, which may support the pound. There will be very few macroeconomic statistics this week, especially in the UK. Therefore, traders will have to wait until Friday to get really important data on the state of the American labor market. It should also be noted that no important speeches are scheduled for this week either.

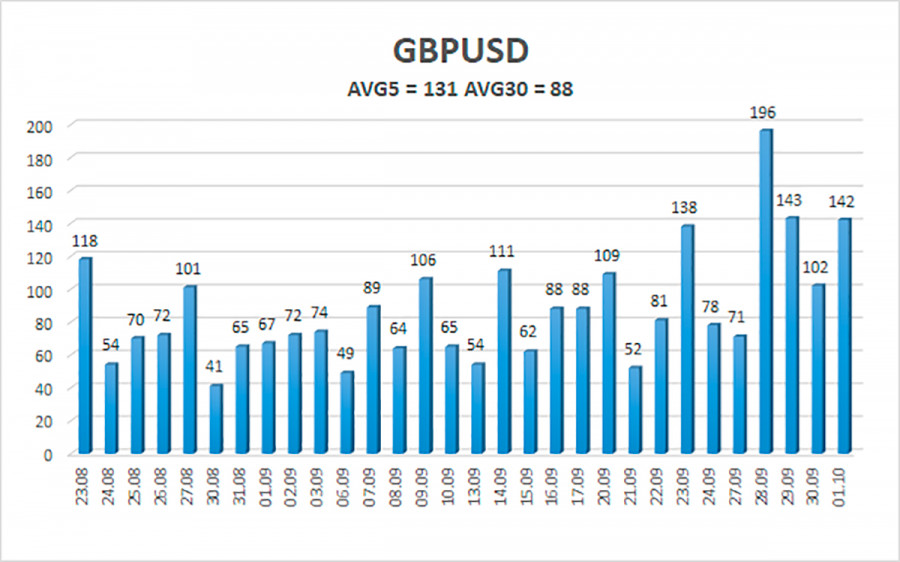

The average volatility of the GBP/USD pair is currently 131 points per day. For the pound/dollar pair, this value is "high." On Monday, October 4, we expect movement inside the channel, limited by the levels of 1.3412 and 1.3677. The upward reversal of the Heiken Ashi indicator signals a round of corrective movement.

Nearest support levels:

S1 – 1.3489

S2 – 1.3428

S3 – 1.3367

Nearest resistance levels:

R1 – 1.3550

R2 – 1.3611

R3 – 1.3672

Trading recommendations:

The GBP/USD pair has started a corrective movement on the 4-hour timeframe but has not yet overcome the moving average. Thus, at this time, it is still necessary to consider sell orders with targets of 1.3489 and 1.3428 levels in the event of a price rebound from the moving average line. Buy orders should be considered again if the price is fixed above the moving average with targets of 1.3611 and 1.3672 and keep them open until the Heiken Ashi turns down.

The material has been provided by InstaForex Company - www.instaforex.com