The Euro-Dollar pair jumped by almost 100 points following the December ECB meeting and US releases, updating the two-day high at 1.2160. But buyers of the pair could not enter the area of the 22nd figure. Having retreated from the price highs, traders, however, did not leave the framework of the 21st level. This suggests that the upward trend is still in force. The bulls of the pair fought for every point gained.

The European Central Bank, at its last meeting this year, left base interest rates unchanged but also increased the size of the bond purchase program (PEPP) by 500 billion Euros (up to 1 trillion 850 billion). In addition, the ECB extended the effect of net purchases under the above-mentioned program for 9 months (until March 2022).

Traders were fully prepared for this scenario so the Central Bank members did not manage to sink the Euro. Market participants expected even milder decisions. For example, according to previous forecasts of analysts, the PEPP should have been extended immediately for a year until mid-2022 ( in reality it was extended for 9 months). The difference is small but it still played in favor of the Euro.

On the eve of the December meeting, many experts warned that the European Central Bank could criticize the current Euro exchange rate which has risen by more than 500 points against the Dollar since the October ECB meeting and even announce currency intervention. However, this did not happen. Moreover, during her press conference, Lagarde stressed that the Central Bank did not set a target for the Euro, though the current value of the currency puts downward pressure on prices. The updated ECB forecasts also provided indirect support for the European currency. For example, Central Bank economists now forecast a 7.3% drop in Eurozone GDP this year while in September, the forecast for a decline was 8%. At the same time, the European economy should grow by 3.9% next year (the September forecast is 5%), and by 4.2% in 2022 (the previous forecast is 3.2%). Most experts surveyed by Bloomberg expected to see more pessimistic figures today.

At the end of the December meeting, the EUR/USD pair jumped to 1.2160 but a few hours after the meeting, buyers were forced to retreat from the heights they had gained. After the price impulsively failed to get close to the borders of the 22nd figure, market participants began to fix profits en masse, fearing a downward pullback. The price pullback did occur due to traders who left purchases. In addition, it became known that the decision to expand the PEPP was not unanimous. Any hint of a split in the ECB camp puts pressure on the Euro.

On the other hand, the corrective pullback of the price is limited: the pair continues to be within the 21st figure. The pair reacted not only to the ECB meeting but also to American macroeconomic reports. First of all, the data on the labor market was disappointing. The number of initial applications for unemployment benefits did not fall below 700 thousand though in early autumn, this indicator showed a stable downward movement. Today, it jumped to the level of 853 thousand, reflecting unhealthy trends. It is worth recalling that according to the latest Nonfarm, the number of people employed in the non-agricultural sector in November increased by only 245 thousand. Experts expected to see this indicator much higher-a a higher level, almost at the level of half a million (480 thousand). The growth rate in the number of people employed in the manufacturing sector was also disappointing. Instead of the projected increase of 53 thousand, it rose by only 27 thousand. If the rate of initial applications for unemployment benefits continues to grow (approaching a million) the next nonfarms may come out much worse than the November ones.

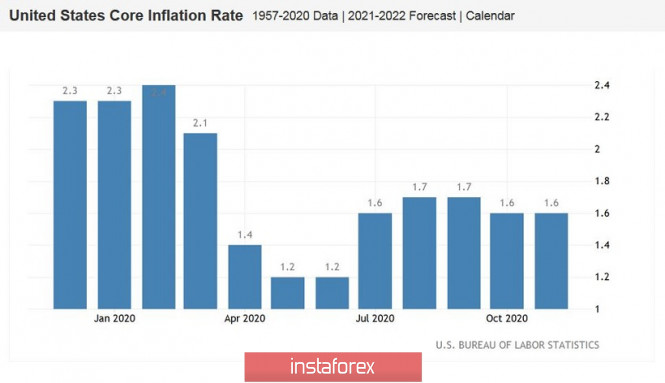

Data on the growth of American inflation was released today. The indicators showed contradictory dynamics. The overall consumer price index on a monthly basis in November rose to 0.2%, while in annual terms, the indicator remained at the level of October. As for the core inflation index, which does not take into account volatile food and energy prices, we see a similar trend here– a small (+0.2%) increase on a monthly basis and stagnation in annual terms. In other words, inflation is still showing weak growth.

Today's events confirmed the viability of the upward trend for the EUR/USD pair. The technical picture also shows the priority of longs. First, on the D1 and W1 timeframes, the pair is above all the lines of the Ichimoku indicator (including the Kumo cloud). Second, on the weekly chart, the price is located on the upper line of the Bollinger Bands trend indicator (on the daily chart, it is located between the middle and upper lines of this indicator). The first goal of the upward movement is the mark of 1.2177 (a 2.5-year high reached last week). The main target is still the psychological mark of 1.2200 which also coincides with the upper line of the Bollinger Bands on the daily chart.

The material has been provided by InstaForex Company - www.instaforex.com