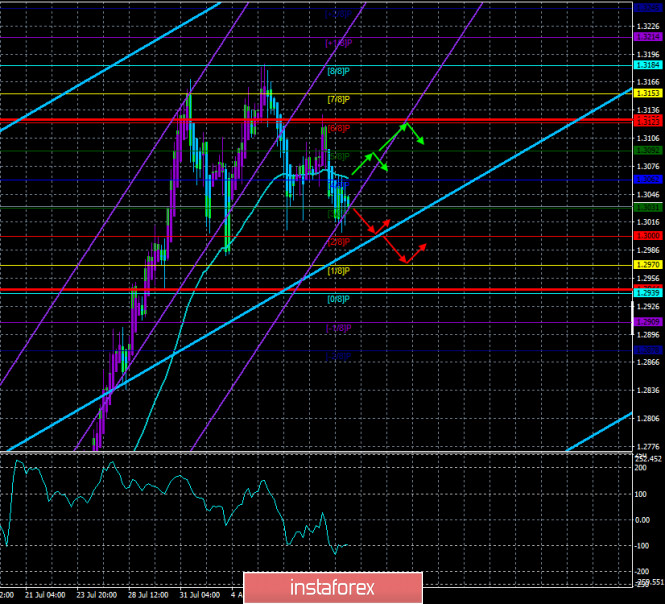

4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

CCI: -97.9586

If the European currency was trading indistinctly during the third trading day of the week, the British pound resumed its downward movement. For several days, the British currency has not been able to determine the direction of movement. There is a classic situation when "some can't, others don't want to". Bears can't now, but bulls don't want to. Moreover, the latter can be understood. All epidemiological factors have been worked out, and the epidemic is beginning to recede slowly in the United States, so it is no longer possible to sell the dollar based on this factor. Further, the political crisis remains, however, it does not have a direct impact on the economy, unlike the epidemiological crisis. The social crisis has also eased somewhat, although riots and clashes with the police continue in some American cities. And traders have already worked out the economic downturn with a vengeance. Since March 15, the pound has risen by 16-17 cents, which is quite a lot. As in the case of the euro currency, a correction is needed. However, it turns out that no one wants to buy the US dollar. Although all the factors that pushed the dollar down have already been worked out, traders are still afraid of investing in the US currency. No one knows when a particular crisis will make itself felt again. Moreover, most experts call the future presidential elections almost the most important in the history of the United States. To put it as simply as possible, the political and foreign economic course of the country for the next four years depends on who will remain in power, Donald Trump or Joe Biden. Under Trump, the US has worsened relations with everyone it could. In particular, with China and Russia, as well as withdrew from several international organizations (for example, WHO). In addition, Washington has already imposed sanctions and duties as part of trade wars against a good dozen countries. The course of Joe Biden, if he comes to power, is expected to be much more lenient, aimed not at constant confrontations, accusations, conflicts with other international players. And most importantly, Biden is expected to mend relations with China. It is clear that no full truce is in question, but Biden can at least bring the trade deal to a conclusion. Thus, until the election, the US currency may continue to remain under market pressure, despite the fact that technical factors speak in favor of its strengthening. Strengthening of the dollar = falling of the pound. And the fall of the pound now would also be very logical, since there is no positive news about the progress of negotiations between London and Brussels.

On Wednesday, August 12, UK GDP for the second quarter was published. We spoke about this report about a week and a half ago, calling it extremely important. It turned out that the British economy collapsed in the second quarter by 20.4%, which is just 0.1%, which does not match the forecasts of experts. At the end of June, GDP growth was slightly higher than expected, +8.7% m/m. Industrial production also rose slightly more than expected by traders, amounting to + 9.3% m/m. However, the very fact of losing 20.4% of GDP could not but cause a sell-off of the British currency. The question is, how strong will be the fall in the pound?

Meanwhile, the American newspaper The New York Times believes that Donald Trump will seek permission to use any vaccine in the United States. Recall that just a few days ago, Russian President Vladimir Putin announced the creation of the world's first vaccine against "coronavirus", which will now be used in Russia. The Russian vaccine was immediately criticized by the leaders of European countries and by Donald Trump himself, as well as by many virologists and epidemiologists. The essence of the criticism is simple: the vaccine has not passed all the necessary clinical trials and can not be considered completely safe and 100% effective. However, for Donald Trump, according to The New York Times, it does not matter. The important thing is that one of the main competitors has a vaccine, but America does not. Thus, Trump can seek to accelerate work in the invention of the American vaccine, which can also lead to unfair, defective research and testing. Researchers in America are concerned that trials of some vaccines may be completed ahead of schedule, just in time for the November 3 election. We have already said that almost the only chance of Trump winning the election is to develop a vaccine against COVID-2019 in the United States. If the vaccine can be obtained, then Trump will certainly take credit for it and can significantly increase his political ratings.

In the UK and America, no important macroeconomic publications are scheduled for Thursday, August 13. Thus, the influence of the fundamental background will be absent, and the influence of the fundamental background is unlikely to be strong. In recent weeks, there has been a situation in which the pair can neither continue the upward trend nor start a downward trend. Usually, if the bears do not take the initiative for some time, then the bulls return to the market. However, this also requires technical signals and confirmations. The fact that sellers are now extremely weak does not require any proof. The pair cannot go below the 1.3000 level. Lower timeframes also show that the price is now more in a sideways movement than in a trend one. Thus, technical factors are again in the first place. And the pound/dollar pair is now squeezed between the Murray levels of "8/8"-1.3184 and "2/8"-1.3000. Thus, it is better to use lower timeframes for trading this pair now.

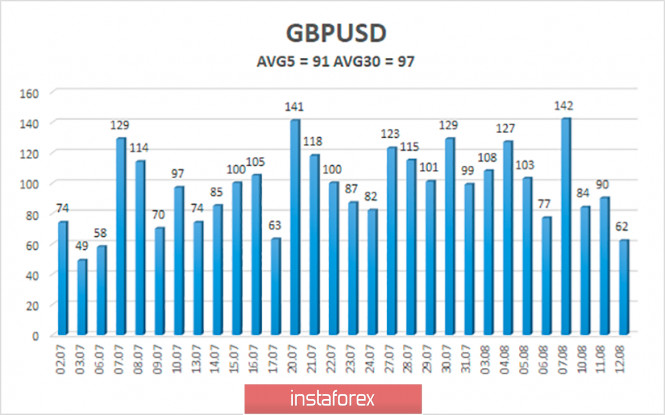

The average volatility of the GBP/USD pair is currently 91 points per day. For the pound/dollar pair, this value is "average". On Thursday, August 13, thus, we expect movement within the channel, limited by the levels of 1.2944 and 1.3126. Turning the Heiken Ashi indicator upward will indicate a round of upward movement inside the side channel of 1.3000 – 1.3180.

Nearest support levels:

S1 – 1.3031

S2 – 1.3000

S3 – 1.2970

Nearest resistance levels:

R1 – 1.3062

R2 – 1.3123

R3 – 1.3153

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe is located inside the side channel and is currently moving down. Thus, at this time, it is recommended to either trade the pair between the boundaries of the 1.3000 – 1.3180 side channel, or wait for the end of the flat.

The material has been provided by InstaForex Company - www.instaforex.com