4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

CCI: -5.0455

The EUR/USD currency pair was trading very indistinctly on Tuesday and Wednesday. After the traders managed to overcome the moving average line, we counted on the formation of a new downward trend or at least a significant downward correction. We have already listed the technical reasons for this option several times. The most important of them is the banal need for correction (traders fix profits on previously opened positions, which leads to a movement in the opposite direction). However, so far, the euro/dollar pair has managed to pass down "cosmic" 200 points. It seems to be not a little, however, we remind you that over the past three months, the euro currency has risen in price against the dollar by 11-12 cents. So 2 cents down is very little. We expect to move at least 400-500 points. However, in order for this movement to begin at all, it requires that traders start reducing long positions or start opening short ones. It seems that everything is extremely difficult for market participants with shorts now. It is still very difficult to find reasons to buy US currency. We have already repeatedly talked about the "four American crises" and it seems that they continue to hold the US dollar back even from technical growth. Thus, in the near future, the bulls may become more active, which may provoke the resumption of the upward trend.

On Wednesday, August 12, the most interesting publications were in the Foggy Albion. However, there was something in the European Union and America. Industrial production in the Eurozone in June fell by 12.3% year-on-year and grew by 9.1% month-on-month. Both values were worse than the forecasts. However, instead of continuing to decline, the European currency quotes again turned to growth. In the United States, the consumer price index for July was published, which also unexpectedly exceeded the forecast values. The monthly indicator increased by 0.6%, the annual rate - by 1%, and core inflation was 1.6% y/y, thus approaching the Fed's target level. However, this is a double-edged sword. On the one hand, the US economy can really recover at a fairly rapid pace, since it has been pouring a lot of money. On the other hand, this recovery was preceded by a severe fall. And it is precisely because of the scale of this decline that growth can be relatively strong.

To the great regret of all supporters of investing in the US dollar, the fundamental situation in the US is not changing for the better. In cities such as Portland and Seattle, mass rallies and protests continue, which Trump is again going to suppress with the help of the National Guard. The number of daily recorded cases of "coronavirus" has started to decrease, but remains at very high levels (40-50 thousand). The political crisis cannot be described in two words, but it continues to rage. Democrats and Republicans have not been able to agree on the size of a new stimulus package for the economy. Donald Trump signed several executive orders bypassing Congress to provide assistance to Americans affected by the pandemic and crisis and now may face new unpleasant consequences for himself. Well, the economy, although it started to recover, fell too much in the second quarter. In general, wherever you throw - a wedge is everywhere. But the most important thing is that news continues to come from America, which at best is very difficult to interpret as positive or negative, at worst - they are negative.

For example, yesterday it became known that the Democratic presidential candidate Joe Biden has chosen his deputy. It was Senator Kamala Harris from California. All would be fine, but if Biden wins the election, then Harris will become the first female vice president in US history. Moreover, Harris is of Jamaican and Indian descent and dark skin color, which adds to the piquancy of the whole situation, given the recent racist scandal, thanks to which rallies and protests have continued in some cities in America for three months. We believe that in this way, Joe Biden made the wisest "knight's move". Now he can count on additional votes in elections from the black population, as well as from American women. "These are very difficult times. For the first time in history, we are facing three historical crises simultaneously. We are facing the worst pandemic in 100 years, the worst economic crisis since the Great Depression, and racial injustice. And we have a President who failed to defeat a virus that continues to take the lives of Americans, destroyed our economy, and fanned the flames of hatred and division," Joe Biden said after Harris was appointed. It is noteworthy that just a year ago, Harris was fighting for the Democratic presidential nomination and accused Biden of racism.

Meanwhile, in the US, another poll was conducted, which showed that former Vice President Joe Biden is still ahead of Trump in the ratings by 10%. It is noted that Biden retains the lead not only in the total number of votes, but also in key American States. Thus, less than three months before the election, Donald Trump's political ratings continue to be poor. Donald Trump himself continues to criticize Biden, as he should before the election. After the appointment of Harris, Trump said that "Biden, with the arrival of Harris, cedes control of the country to the radical mafia". Trump believes that this tandem will lead to increased taxes, reduced police funding, and a drop in the number of jobs in the energy sector. In general, the situation before the elections is becoming more interesting.

On the penultimate trading day of the week, no publications are planned in the European Union. In Germany - the consumer price index for July will be released, which is unlikely to cause any reaction from traders, and in the United States - a report on applications for unemployment benefits that is insignificant at this time. Thus, today, traders are likely to be deprived of a macroeconomic background. However, judging by yesterday's reports, the euro/dollar pair does not really need this background, market participants still do not pay attention to it, and are also very afraid to buy the dollar. From a technical point of view, a return of quotes to the area above the moving average line will again return the pair to an upward trend. In this case, we can expect the continuation of the upward movement to the previous two local highs around the level of 1.1911.

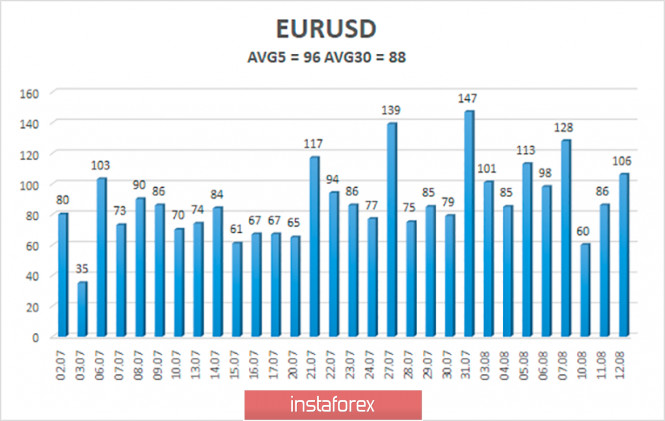

The volatility of the euro/dollar currency pair as of August 13 is 96 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.1694 and 1.1886. The reversal of the Heiken Ashi indicator downwards signals a turn of the downward movement within the side channel of 1.1719 – 1.1911.

Nearest support levels:

S1 – 1.1719

S2 – 1.1597

S3 – 1.1475

Nearest resistance levels:

R1 – 1.1841

R2 – 1.1963

Trading recommendations:

The EUR/USD pair continues to trade near the sideways moving average, which indicates a flat. Thus, at this time, it is recommended to either trade between the borders of the side channel based on the signal of the Heiken Ashi indicator, or wait for the end of the flat and the resumption of the trend movement.

The material has been provided by InstaForex Company - www.instaforex.com