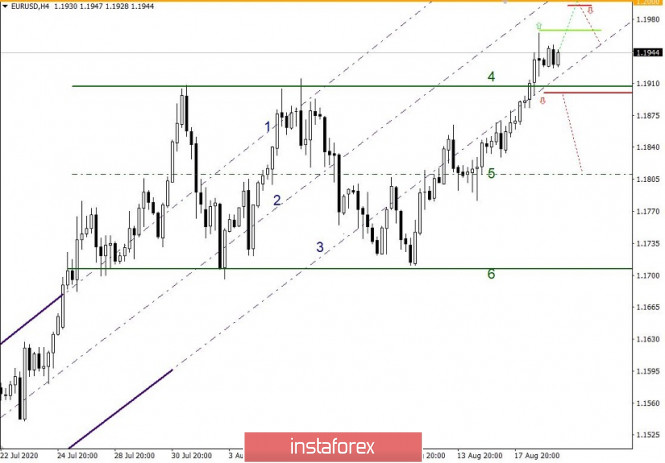

The EUR/USD currency pair has been moving within the borders of the side channel 1.1700 // 1.1810 // 1.1910, (6 + 5 + 4, lines) for almost a month, where, as a result, the upper border still decline under the pressure of buyers, and the quote managed to consolidate above 1.1910. The tactics of working on the breakout of the established boundaries, which we adhered to in previous reviews, brought us a profit, but this is just the beginning.

If we consider the side channel (lines 4, 5 and 6) as a platform for regrouping trading forces in the course of an upward trend, then the previously set channel from trend lines 1, 2 and 3 may become relevant again.

Following from the analysis of trend lines and the general insistence of the market, it can be assumed that if the price consolidates above the high of the previous day - 1.1965, the upward movement will resume towards the trend line No. 2 (area 1.2000), where it is possible to stop with the subsequent price pullback.

Alternative scenarios of market development consider the current slowdown in the values of 1.1930/1.1965 as an opportunity to return to the previous sideways movement if the price consolidates below 1.1910, trend line No. 4.

The GBP/USD currency pair followed the path of the European currency, breaking the upper border of the side channel 1.2985 // 1.3085 // 1.3185 (No. 6; 5; 4) and having a strong price movement towards the local maximum of 1.3263, where a small stagnation of 1.3230/1.3263 was formed.

Based on the dynamics and the breakdown of the upper border of the side channel, it can be assumed that the market participants are still relevant positions to buy the pound sterling against the dollar, where if the price consolidates above 1.3270, a further move towards resistance level 1.3300 is not excluded.

Alternative scenarios of market development consider the current deceleration in the values of 1.3230/1.3263 as an opportunity to return to the previous sideways movement if the price consolidates below 1.3230.