4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

CCI: 32.0601

For the euro/dollar currency pair, the third trading day of the week was held in a corrective movement against the background of a complete lack of any fundamental information and macroeconomic reports. During the day, traders simply had nothing to react to, nothing to pay attention to. Thus, the euro/dollar pair began to adjust. At the same time, the technical picture looks quite interesting now and allows us to make some assumptions about the future movements of the currency pair. For example, during the past day, traders managed to work out the Murray level of "5/8"-1.1353 and rebounded from it. This is the second time that traders have failed to overcome this level in the past two weeks. Thus, this rebound can send the pair down again to the previous local low of about $ 1.12. However, traders are now clearly interested in the prospects of an upward trend, which seems to have resumed this trading week. We believe that from a fundamental point of view, the prospects for the European currency are quite ambiguous, however, it has certain chances for continued growth. The problem is that in recent weeks, the euro currency has already grown significantly, rising by about three cents against the dollar. For comparison, for the entire previous year, the dollar rose by 2 cents. Thus, three cents of advantage on a virtually flat spot is a lot. As for the reasons, they are still ambiguous. The growth of the euro can be associated with the political crisis in the United States (we continue to insist on this interpretation), and with a high probability of termination of the trade deal between China and the United States and, as a result, the beginning of a new trade war or even the "cold" war. It is completely unclear what will happen to the country after the elections and who will win these elections. It is completely unclear what to do with the "coronavirus", which continues to spread calmly across the United States, claiming more and more American lives. In general, now the number of these "incomprehensible" is so large that it is almost impossible to apply fundamental analysis in the general analysis of the currency market. By the way, we would like to remind you that during the 18-month trade war between Washington and Beijing, the dollar did not feel particularly strong pressure on itself. Thus, even now, the risks of an escalation of the conflict are just risks. But no one knows how these risks are interpreted by major market players. Perhaps there is more secret information in higher circles about the future relationship between Beijing and Washington. Perhaps in the highest circles and more accurately known about the prospects of Donald Trump as President of the United States. In general, there may be much more potentially important information, however, it is not available to ordinary traders.

But the information that is available to ordinary traders says now that Trump continues to suffer defeat after defeat in 2020. He has been repeatedly criticized by high-ranking officials and members of the Republican party (it is not worth talking about the Democrats). Now an open war has been declared against him by his former adviser, John Bolton, who wrote a book that reveals many aspects of the president's work, stating that "there has never been a more incompetent president in the United States". Trump, of course, immediately threatened Bolton with legal proceedings, however, what difference does it make? The key aspects of the book have already become known to everyone. And this is another blow to Trump's political ratings, which are already bursting at the seams in 2020. The most important thing is that Trump is no longer believed. No one believes him. His Twitter posts are increasingly becoming fake. Many media outlets and experts note that Trump constantly makes contradictory statements, the essence of which is completely untrue. Some of them can not be verified, some of them can be and that's where the US President begins to have problems. Just the other day, Donald Trump publicly and, as usual, unsubstantiated accused former US President Barack Obama of treason. The head of the White House believes that employees of the Obama administration spied on his election campaign in 2016. Trump accused Obama of doing everything possible in 2016 to prevent him from becoming president and hinted that democrats might try to crank something like that in 2020. "This is high treason. When I spoke a long time ago, I said that they were spying on our campaign. It turns out I was right. We'll see what happens to them now," Trump said in an interview. Well, most political analysts immediately agreed that through "Obamagate", Trump is trying to cast a shadow on his current rival for the presidential seat in the election, Joe Biden, who was Vice President under Barack Obama. What is this if not a political crisis?

On Thursday, June 25, a large number of important macroeconomic reports are planned in the United States, including orders for durable goods, GDP for the first quarter, and applications for unemployment benefits. The last report can be safely discarded, however, you need to focus on the first two. The most important, of course, is the GDP report, which has a forecast of -5%. Recall that in previous readings, US GDP losses were expected to be 4.8% in the first quarter. Therefore, this time the real losses may also be higher than the forecast. And if this happens, the US currency may again be under market pressure. The same applies to the first report on orders for durable goods. This category of goods is characterized by its high cost and long service life, respectively, which has a high impact on the economy and GDP. All four derivatives are expected to increase in comparison with the previous month. If the forecasts do not come true, the US dollar may again be under pressure from traders.

But from a technical point of view, everything is simple. If the pair overcomes the moving average, the downward movement will continue to approximately 1.1200. If it bounces, then the price will return to the Murray level of "5/8"-1.1353, at least.

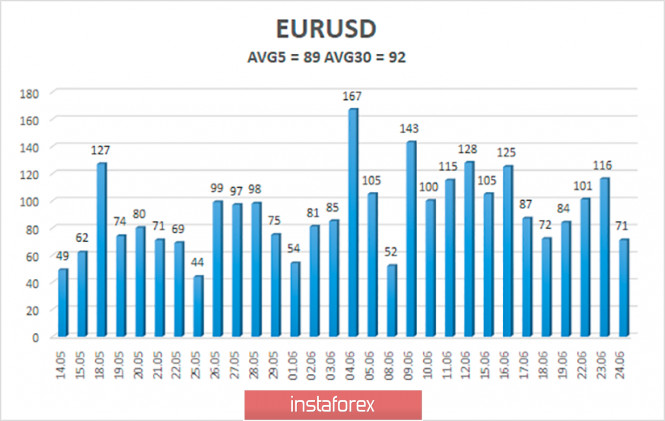

The average volatility of the euro/dollar currency pair as of June 25 is 89 points and now the value of the indicator is characterized as "average", in general, the volatility continues to decrease. We expect the pair to move between the levels of 1.1170 and 1.1348 today. A reversal of the Heiken Ashi indicator to the top will signal a possible resumption of the upward movement.

Nearest support levels:

S1 – 1.1230

S2 – 1.1108

S3 – 1.0986

Nearest resistance levels:

R1 – 1.1353

R2 – 1.1475

R3 – 1.1597

Trading recommendations:

The euro/dollar pair settled above the moving average, but could not overcome the Murray level of "5/8". Thus, long positions with targets of 1.1348 and 1.1475 remain relevant at this time, but only if the price rebounds from the moving average line. It is recommended to return to selling the pair not before fixing the price below the moving average with the first goals of 1.1170 and 1.1108.

The material has been provided by InstaForex Company - www.instaforex.com