Investors and all kinds of stock traders are extremely greedy creatures. On a daily basis, they must satisfy their hunger by absorbing information. Be it some kind of macroeconomic statistics or wise and thoughtful decisions and statements by various politicians. And only, having enjoyed the taste of these dishes, they are able to make a decision about the direction in which stock quotes will move today. However, when they are unable to satisfy their hunger, simply because nothing happens, a technical analysis comes to rescue, which allows investors to achieve the same state of catharsis. That is exactly what happened yesterday. One glance at the charts is enough to understand that it could not do without technical analysis. For two days in a row, the dollar was only concerned with losing its position. But yesterday was a day of forced information, therefore, hunger strikes or so called fasting day, since it is necessary to keep yourself in shape. And in the end, the dollar is incredibly elegant and literally according to all the laws of technology played almost exactly half of the losses of the first two days of the week. Beauty, that's all.

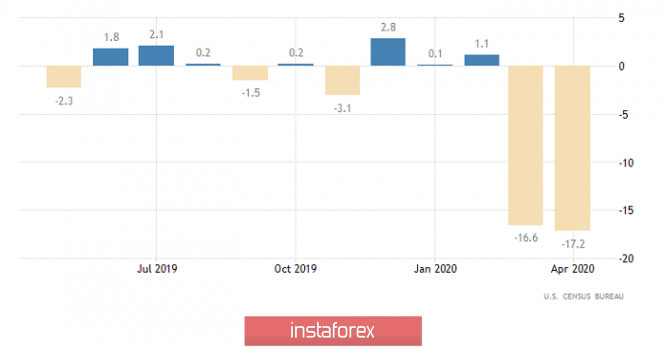

Today, market participants are offered a real feast of the most exquisite delicacies. The highlight of the program is the first quarter GDP data of the United States. However, do not think that investors are waiting for some kind of emotional explosion. After all, they have tasted this dish three times already. But these were only samples of some small pieces. Today, the dish will be presented in all its glory. And its taste may differ slightly, since if the preliminary estimate showed a decline in GDP of 4.8%, the final data will show a decline of 5.0%. Of course, there are some differences, but they are insignificant, so it is unlikely that these differences will encourage investors to sell off the dollar. But other dishes may well make them actively buy portraits of dead American presidents. Now, orders for durable goods look the most attractive and most interesting. After all, if the previous two innings of this delicacy were clearly unsuccessful due to the spoilage of products, today, a real firework of delight is expected. For example, in March, orders declined by 16.6%, and by another 17.2% in April. So in May, these same orders should grow as much as 8.5%. You must admit that such a striking contrast of taste sensations can even drive you crazy. Moreover, this taste promises a fantastic improvement in the quality of such main dishes as retail sales and industrial production. But it's also Thursday, which means it's fish day. However, over the past few months, it is customary to serve only rotten fish, today it can be slightly better salted, and the feed should improve a little. Thus, the number of initial applications for unemployment benefits should be reduced from 1,508 thousand to 1,380 thousand. The number of repeated requests may decrease from 20 544 thousand to 20 100 thousand. So, there are dishes on the menu today that will make investors love the portraits of dead American presidents.

Durable Goods Orders (United States):

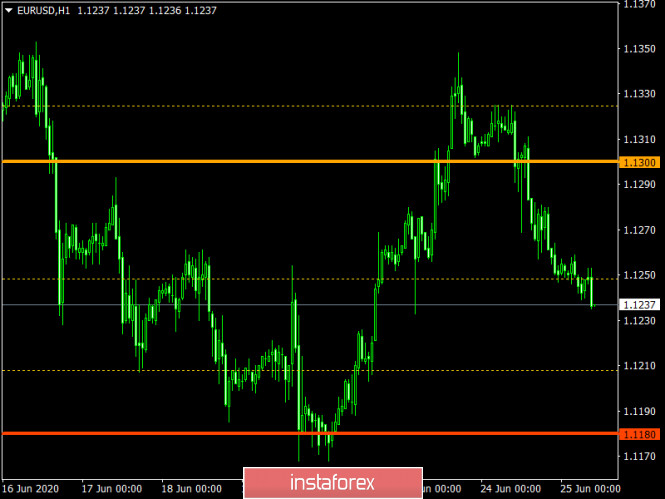

The euro/dollar currency pair managed to switch to the recovery process, during which the majority of the correctional movement was won back. It can be assumed that the downward trend will remain in the market, which will ultimately lead to a return to the values of 1.1200-1.1180.

The pound/dollar currency pair managed to rebound from the range of 1.2500-1.2540, recovering about half relative to the correctional move from the level of 1.2350. It can be assumed that if the price consolidates below the level of 1.2400, a downward movement will bring the quote to a support level of 1.2350.