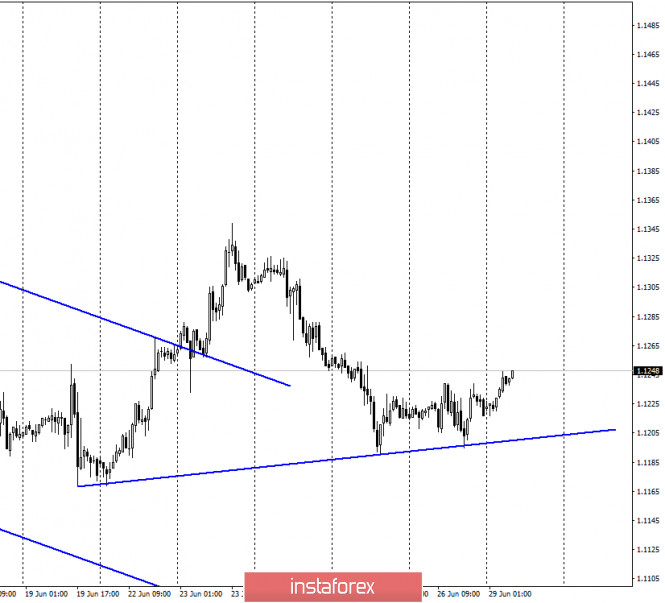

EUR/USD – 1H.

Hello, traders! On June 26, the euro/dollar pair started the recovery process after a two-day drop in quotes. Thus, the graphical picture allowed us to build an upward trend line, which again characterizes the current mood of traders as "bullish". At least as long as the quotes do not secure under this line, it is the purchases that will be more attractive. A bit of optimism was presented to traders on Friday by Christine Lagarde. The ECB Chairwoman said that perhaps the worst part of the crisis caused by the coronavirus epidemic is over. However, Lagarde also spoke of a slow and long recovery of the European Union's economy to pre-crisis levels. Thus, her words can be interpreted in different ways. But there was little information on the most important and interesting topics on Friday. Better to say, it wasn't even there at all. In America, rallies and protests continue, Donald Trump continues to prepare for the election and has already begun to travel to the cities of America with speeches to their voters, and the coronavirus in the country continues to spread, as rallies are just "what you need" to spread the infection.

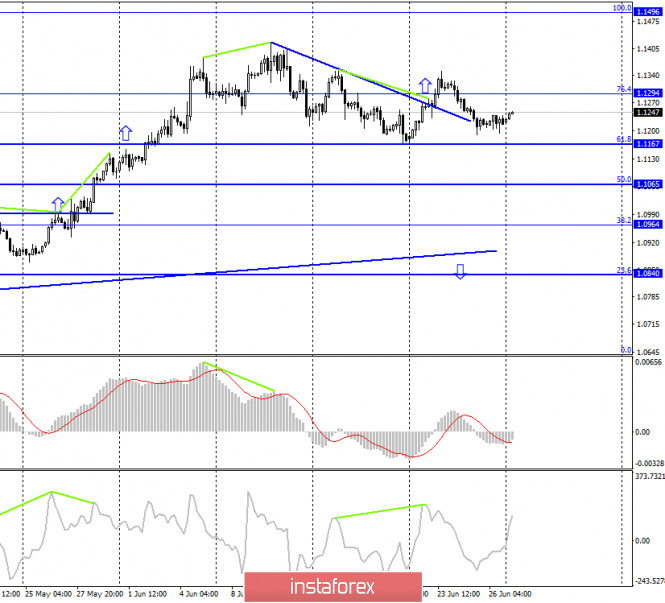

EUR/USD – 4H.

On the 4 hour chart, the quotes of the EUR/USD pair on Friday continued the process of falling, but today, Monday, thanks to a new rising trend line on the hourly chart has fulfilled turn in favor of the European currency and began the process of growth towards the corrective level of 76.4% (1,1294). Today, the divergence is not observed in any indicator. The rebound of the pair's exchange rate from the Fibo level of 76.4% will allow traders to expect a reversal in favor of the US currency and a resumption of the fall in the direction of the corrective level of 61.8% (1.1167).

EUR/USD – Daily.

On the daily chart, the euro/dollar pair again performed a reversal in favor of the US currency and closed under the corrective level of 127.2% (1.1261), which allows traders to expect a fall in the direction of the Fibo level of 100.0% (1.1147). However, the growing number of cases of coronavirus in the US may stop the growth of the dollar.

EUR/USD – Weekly.

On the weekly chart, the eurodollar pair rebounded from the lower line of the "narrowing triangle", which still allows traders to expect growth in the direction of the 1.1600 level (the upper line of the triangle"). However, the lower charts are now in a more bearish mood, so working out this goal is being postponed for now.

Overview of fundamentals:

On June 26, the European Union hosted a speech by Christine Lagarde, about which I wrote above, and in America – reports on changes in the volume of personal income and spending of Americans in may were released. However, none of these events is not sufficiently interesting to traders.

News calendar for the United States and the European Union:

Germany - consumer price index (12:00 GMT).

June 29 news on the European Union and America in the calendar is not listed. Only the German consumer price index will be released, but it is unlikely to interest traders. Thus, we can assume that today the information background will be empty.

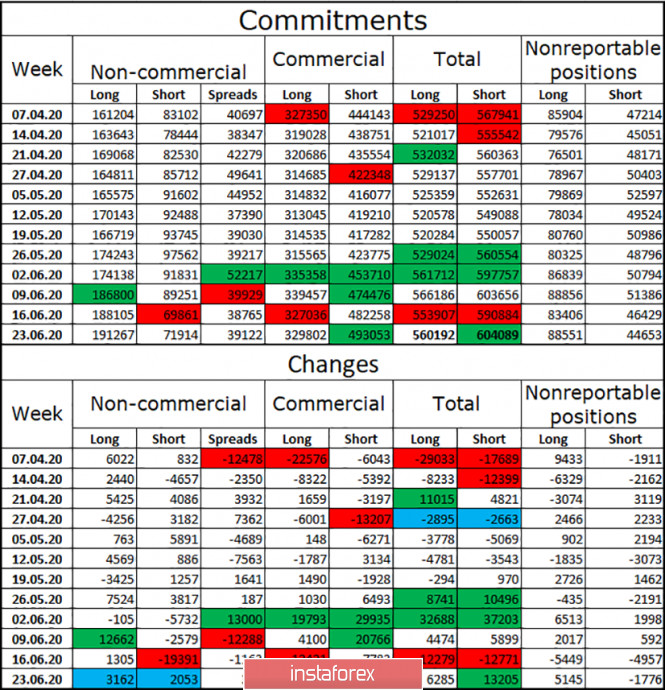

COT (Commitments of Traders) report:

The latest COT report, released last Friday, showed almost nothing. The "Non-commercial" group, which is the most important group and is considered to be the one that drives the market, has opened a total of only 5,000 contracts, of which 3,000 are long and 2,000 are short. The "Commercial" group (hedgers) were more active and opened almost 11,000 short-contracts, however, as we can see, in the period from June 17 to 23, the euro/dollar pair was trading first down, then up, then down again. In other words, it is impossible to conclude that the mood of traders during this period of time was the same and did not change. And the changes in the balance of forces that the latest COT report showed do not allow us to draw any conclusions for the long term.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend buying the euro currency with the goal of 1.1294 and 1.1350 (the last peak), since an upward trend line was built, above which the pair is currently trading. I recommend opening new sales of the pair today with the target level of 50.0% (1.1065), if the closing is performed under the trend line on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

The material has been provided by InstaForex Company - www.instaforex.com