4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - downward.

CCI: -154.7020

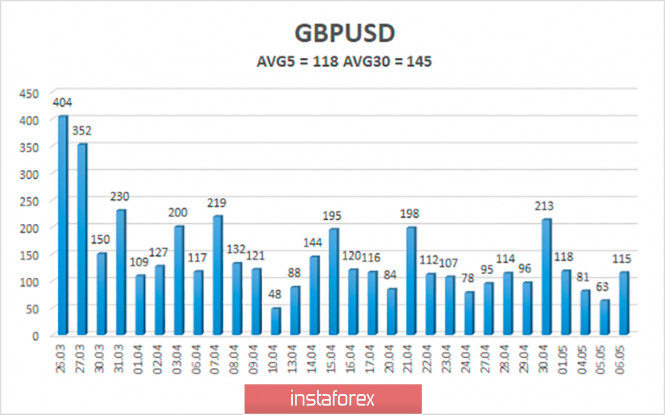

The British pound continues to trade lower this trading week, which fully corresponds to our vision of what is happening. The third trading day of the week ended with a volatility of 115 points, which corresponds to the average value of the indicator. Traders continue to trade calmly, although the news from the UK health sector continues to be disappointing. The total number of deaths from the epidemic in the Foggy Albion exceeded 32,000, which is more than in Italy, Spain, or France. Also, the number of new cases of infection does not decrease. Over the past day, 6,111 new cases of the disease were recorded, which is 2,000 more than the previous day. In total, more than 200,000 cases of the COVID-2019 virus have been recorded in Britain.

The main newsmaker in the world now remains American President Donald Trump. To be honest, we continue to wonder how Trump has enough time to hand out interviews every day and cover almost every possible topic. Although now Trump's rhetoric is just as clear and obvious as ever. The American President feels that his chances of re-election in November 2020 are "burning". Trump feels that all his trump cards, which he could boast of during the election campaign, are leveled by the "coronavirus", which he took lightly from the very beginning. You can then make as many statements as you like in the style of "I knew everything, but didn't want to deprive people of hope", however, if initially, the leader of the nation said that "Americans have nothing to fear" and "the coronavirus will not survive the April month", then when people start to get sick in tens of thousands and die in thousands, it's too late to make excuses. Also, Trump changes his forecasts about the possible number of deaths from the COVID-2019 virus with surprising frequency. Recall that the original version was that no one would die at all, then it was about 200,000 people, in April the American president talked about 60,000. During the last interview, Trump said: "We will lose from 75.8 to 100 thousand people. This is terrible." At the moment, more than 71 thousand deaths have already been recorded in the United States. Thus, the latest forecast of Trump can still be considered optimistic, which, however, does not prevent him from trying hard to open borders and restart the economy. Also, Trump has already made several contradictory statements regarding the COVID-2019 vaccine. It is known that many countries of the world are engaged in creating a vaccine, but its creation, according to scientists, will take at least a year. Thus, before 2021, the world should not wait for a vaccine. Trump himself has several times stated that the vaccine will appear before the end of this year, but recently retracted his words and said: "I can't be sure of anything, but I think we have a very good chance of having something very significant." The head of the National Institute of Allergy and Infectious Diseases, Anthony Fauci, has already refuted this statement of Donald Trump, saying that the development of any vaccine takes from a year to a year and a half.

In addition, Anthony Fauci also refuted statements by Mike Pompeo and Donald Trump that the "coronavirus" could have been created artificially in a Chinese laboratory. According to the country's chief epidemiologist, "The virus evolved in nature and then jumped the interspecies threshold." Also, Mr. Fauci believes that the version that the virus was discovered in the wild and only then moved the laboratory, where it subsequently escaped, is also untenable. And of course, this whole topic is overgrown with a huge number of rumors, opinions, and judgments. And no one knows why this or that expert is lobbying for this or that opinion. In any case, ordinary citizens and traders will not know the whole truth.

On the penultimate trading day of the week in the UK, it is planned to summarize the results of the Bank of England meeting. Recall that the Fed and ECB held their meetings last week and no particularly important decisions were made. In principle, all the developed countries of the world are now simultaneously expanding their programs of buying securities and bonds to finance the economy as needed. Most likely, at the meeting of the British regulator, no special changes in the parameters of monetary policy will be adopted. And traders have long been used to expanding incentive programs. One important point should be understood here. If the Bank of England (for example) decides to expand its quantitative easing program during normal quiet times, when the economy is growing all over the world or reduces rates, or simply its macroeconomic indicators begin to decline (no matter for what reason, for example, because of Brexit), then market participants can start to get rid of the British pound in large volumes, which will provoke a serious depreciation of the pound against other currencies. If all the key banks in the world reduce rates to zero and expand their programs to stimulate the economy to trillions, then traders have no reason to conclude that it is in the UK that "everything is bad" or "worse than in other countries", so there will probably be no sell-off of the British pound.

Also scheduled for today is a speech by the head of the Bank of England, Andrew Bailey, who, of course, as well as his colleagues from the Fed and ECB, will talk about the "economic shock", the need to stimulate the economy, and the huge values by which the British economy will decline in 2020. What else can the Chairman of the Central Bank talk about now? The more "dovish" his rhetoric will be, the higher the numbers he announced that the British economy may lose, the higher the probability of a fall in the British pound at today's trading. However, we believe that in general, this probability is not too high if we look exclusively at the fundamental factors.

But from a technical point of view, the probability of a further fall in the pound's quotes is quite high. First, the US dollar is now becoming more expensive against the euro, the pound, and other currencies. The reasons may be different, one of the options is the desire of market participants to protect themselves against a possible new conflict between the US and China. Secondly, the pound/dollar pair bounced from the Murray level of "7/8"-1.2634, as on April 14, thus forming a "double top" pattern, which implies a noticeable downward movement. Third, there is a probability that, like the euro currency, the pound will now consolidate in a wide side channel (about 400 points), if so, the decline will continue to its lower border – near the Murray level of "1/8"-1.2268. Fourth, none of the linear regression channels is directed down, and the price is fixed below the moving average line.

The average volatility of the GBP/USD pair has started to decline again and is currently 118 points. For the pound, this is not too much, the main thing is not to start a new trend of increasing volatility, which may mean a new panic in the market. On Thursday, May 7, we expect movement within the channel, limited by the levels of 1.2244 and 1.2480. A reversal of the Heiken Ashi indicator upward will indicate the beginning of correction against the downward trend.

Nearest support levels:

S1 – 1.2329

S2 – 1.2268

S3 – 1.2207

Nearest resistance levels:

R1 – 1.2390

R2 – 1.2451

R3 – 1.2512

Trading recommendations:

The GBP/USD pair continues to move down on the 4-hour timeframe. Thus, traders are now recommended to stay in the sales of the pound with the goals of 1.2329 and 1.2268 and keep the shorts open until the Heiken Ashi indicator turns up. It is recommended to buy the pound/dollar pair again not before fixing the price above the moving average with the first goals of 1.2512 and 1.2573.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com