Forecast for May 20:

Analytical review of currency pairs on the scale of H1:

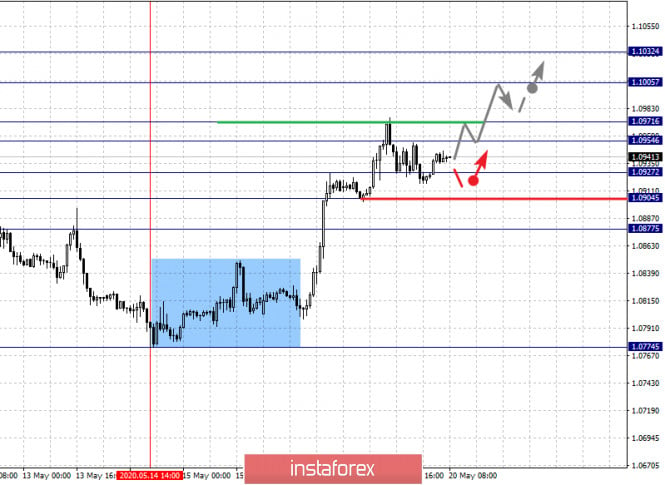

For the euro / dollar pair, the key levels on the H1 scale are: 1.1032, 1.1005, 1.0971, 1.0954, 1.0927, 1.0904 and 1.0877. Here, we are following the development of the ascending structure of May 14. The continuation of the upward movement is expected after the price passes the noise range 1.0954 - 1.0971. In this case, the target is 1.1005. For the potential value for the top, we consider the level of 1.1032. Upon reaching which, we expect consolidation, as well as a downward pullback.

A short-term downward movement is expected in the range of 1.0927 - 1.0904. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.0877. This level is a key support for the top.

The main trend is the upward structure of May 14

Trading recommendations:

Buy: 1.0971 Take profit: 1.1005

Buy: 1.1007 Take profit: 1.1030

Sell: 1.0925 Take profit: 1.0906

Sell: 1.0902 Take profit: 1.0878

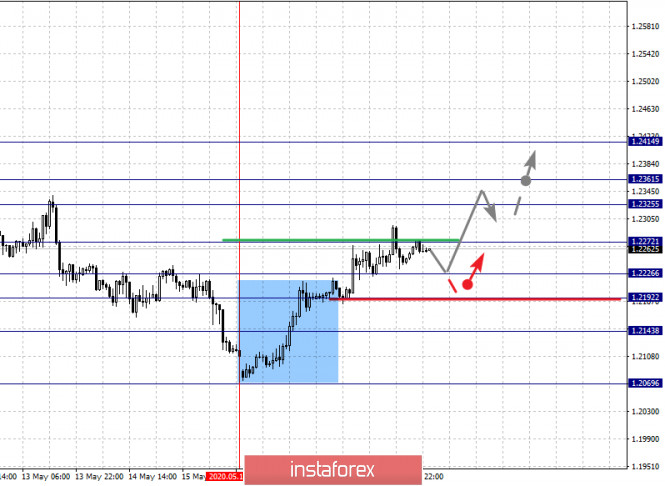

For the pound / dollar pair, the key levels on the H1 scale are: 1.2414, 1.2361, 1.2325, 1.2272, 1.2226, 1.2192 and 1.2143. Here, we are following the formation of the initial conditions for the upward cycle of May 15. The continuation of the upward movement is expected after the breakdown of the level of 1.2272. In this case, the target is 1.2325. Short-term upward movement, as well as consolidation are in the range of 1.2325 - 1.2361. For the potential value for the upward movement, we consider the level of 1.2414. Upon reaching this level, we expect a downward pullback.

A short-term downward movement is possible in the range of 1.2226 - 1.2192. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.2143. This level is a key support for the top.

The main trend is the upward structure of May 15

Trading recommendations:

Buy: 1.2274 Take profit: 1.2325

Buy: 1.2327 Take profit: 1.2360

Sell: 1.2226 Take profit: 1.2194

Sell: 1.2190 Take profit: 1.2145

For the dollar / franc pair, the key levels on the H1 scale are: 0.9754, 0.9727, 0.9710, 0.9683, 0.9675, 0.9653, 0.9639 and 0.9617. Here, we are following the descending structure of May 14. The continuation of the downward movement is expected after the price passes the noise range 0.9683 - 0.9675. In this case, the target is 0.9653. Short-term downward movement, as well as consolidation are in the range of 0.9653 - 0.9639. For the potential value for the bottom, we consider the level of 0.9617. Upon reaching which, we expect an upward pullback.

A short-term upward movement is possible in the range of 0.9710 - 0.9727; hence, there is a high probability of a reversal and the subsequent development of a downward trend. The breakdown of the level of 0.9730 will lead to the formation of an upward structure. In this case, the potential target is 0.9754.

The main trend is the descending structure of May 14

Trading recommendations:

Buy : 0.9710 Take profit: 0.9725

Buy : 0.9730 Take profit: 0.9750

Sell: 0.9675 Take profit: 0.9655

Sell: 0.9650 Take profit: 0.9642

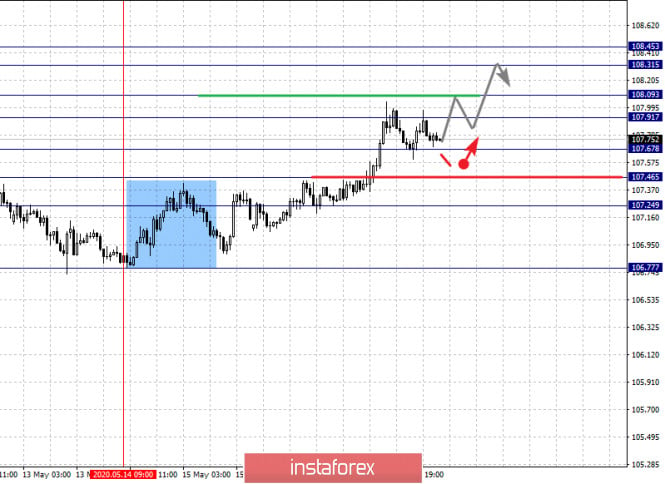

For the dollar / yen pair, the key levels on the scale are : 108.43, 108.31, 108.09, 107.91, 107.67, 107.46 and 107.24. Here, we are following the development of the ascending structure of May 14. Short-term upward movement is expected in the range of 107.91 - 108.09. The breakdown of the last value should be accompanied by a pronounced upward movement. In this case, the target is 108.31. For the potential value for the top, we consider the level of 108.45. Upon reaching which, we expect consolidation, as well as a downward pullback.

A short-term downward movement is possible in the range of 107.67 - 107.46. The breakdown of the latter level will lead to an in-depth correction. Here, the potential target is 107.24. This level is key support for the top.

The main trend: the upward structure of May 14

Trading recommendations:

Buy: 107.91 Take profit: 108.07

Buy : 108.11 Take profit: 108.30

Sell: 107.65 Take profit: 107.48

Sell: 107.44 Take profit: 107.25

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.4044, 1.4004, 1.3976, 1.3898, 1.3855, 1.3828, 1.3774 and 1.3732. Here, we are following the development of the descending structure of May 14. The continuation of the upward movement is expected after the breakdown of the level of 1.3898. In this case, the target is 1.3855. The price passing the noise range of 1.3855 - 1.3828 will lead to the development of pronounced movement. Here, the goal is 1.3774. For the potential value for the bottom, we consider the level of 1.3732, upon reaching which, we expect an upward pullback.

A short-term upward movement is possible in the range of 1.3976 - 1.4004. The breakdown of the latter level will lead to an in-depth correction. In this case, the target is 1.4044. This level is a key support for the downward structure.

The main trend is the downward cycle of May 14

Trading recommendations:

Buy: 1.3976 Take profit: 1.4002

Buy : 1.4006 Take profit: 1.4042

Sell: 1.3898 Take profit: 1.3855

Sell: 1.3828 Take profit: 1.3775

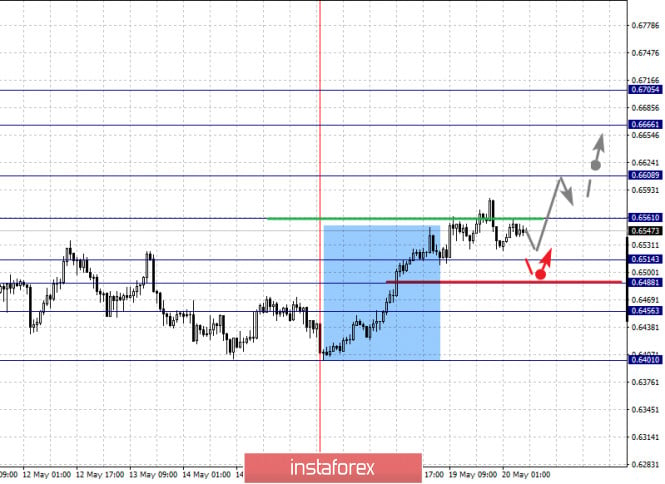

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6705, 0.6666, 0.6608, 0.6561, 0.6494, 0.6472, 0.6434 and 0.6401. Here, we are following the formation of the initial conditions for the upward cycle of May 15. The continuation of the upward movement is expected after the breakdown of the level of 0.6561. In this case, the target is 0.6608. Price consolidation is near this level. The breakdown of the level of 0.6608 will lead to the development of pronounced movement. Here, the goal is 0.6666. For the potential value for the top, we consider the level of 0.6705. Upon reaching which, we expect a downward pullback.

A short-term downward movement is possible in the range of 0.6514 - 0.6488. The breakdown of the latter level will lead to an in-depth correction. Here, the target is 0.6456. This level is a key support for the upward structure.

The main trend is the formation of initial conditions for the top of May 15

Trading recommendations:

Buy: 0.6561 Take profit: 0.6606

Buy: 0.6610 Take profit: 0.6666

Sell : 0.6514 Take profit : 0.6490

Sell: 0.6488 Take profit: 0.6456

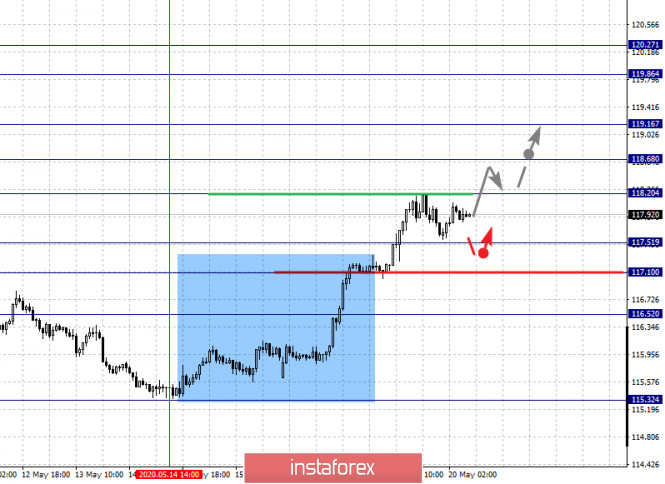

For the euro / yen pair, the key levels on the H1 scale are: 120.27, 119.86, 119.16, 118.68, 118.20, 117.51, 117.10 and 116.52. Here, we are following the development of the ascending structure of May 14. The continuation of the upward movement is expected after the breakdown of the level of 118.20. In this case, the goal is 118.68. The breakdown of which, in turn, will allow you to count on the movement to 119.16. Price consolidation is near this level. A pronounced upward movement is expected after the breakdown of 119.16. Here, the goal is 119.86. For the potential value for the top, we consider the level of 120.27. After which, we expect consolidation in the range of 119.86 - 120.27.

A short-term downward movement is possible in the range of 117.51 - 117.10. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 116.52. This level is a key support for the top.

The main trend is the formation of medium-term initial conditions for the top of May 14

Trading recommendations:

Buy: 118.20 Take profit: 118.66

Buy: 118.70 Take profit: 119.14

Sell: 117.50 Take profit: 117.15

Sell: 117.05 Take profit: 116.62

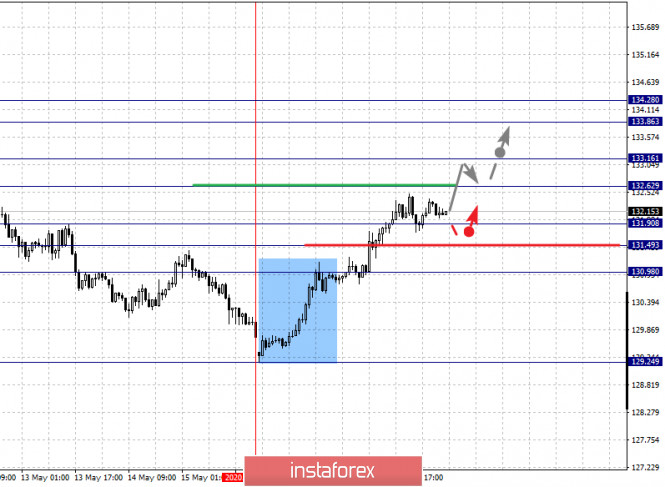

For the pound / yen pair, the key levels on the H1 scale are : 134.28, 133.86, 133.16, 132.62, 131.90, 131.49 and 130.98. Here, we are following the development of the ascending structure of May 15. The continuation of the upward movement is expected after the breakdown of the level of 132.62. In this case, the target is 133.16. Price consolidation is near this level. The breakdown of the level of 133.16 should be accompanied by a pronounced upward movement. Here, the goal is 133.86. For the potential value for the top, we consider the level of 134.28, upon reaching which, we expect a downward pullback.

A short-term downward movement is possible in the range of 131.90 - 131.49. The breakdown of the latter value will lead to in-depth correction. Here, the target is 130.98. This level is a key support for the top.

The main trend is the upward structure of May 15

Trading recommendations:

Buy: 132.62 Take profit: 133.16

Buy: 133.18 Take profit: 133.86

Sell: 131.90 Take profit: 131.50

Sell: 131.47 Take profit: 131.00

The material has been provided by InstaForex Company - www.instaforex.com