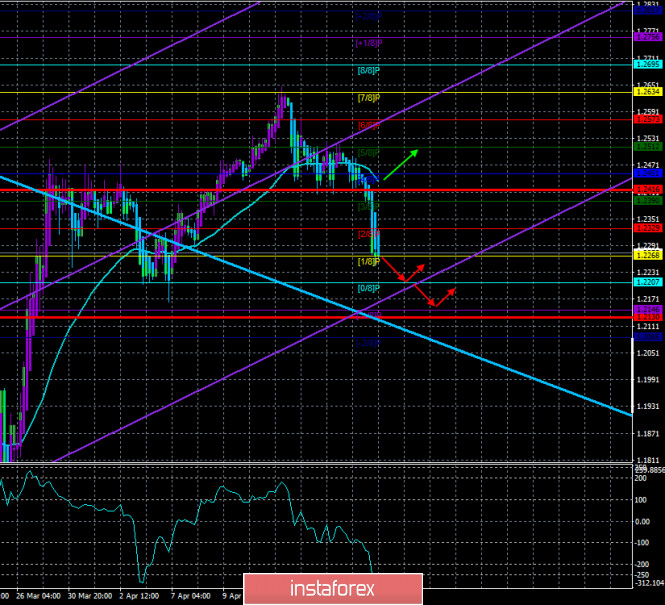

4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - downward.

CCI: -238.8254

The British pound continues to fall quite strongly against the US currency on April 22. Some experts believe that this fall was triggered by weak data on wages and unemployment for February in the UK. However, we believe that this package of statistical information has nothing to do with it. We remind you once again that market participants have been ignoring any macroeconomic statistics for a month and a half, and yesterday, according to the same British reports, the country recorded only 12,000 applications for unemployment benefits in March, while forecasts predicted at least 175,000. Thus, yesterday's package of statistics can be considered even positive for the British currency, however, this currency lost almost 200 points during the day. Based on this, we believe that the reasons for the fall in the pound are purely technical. After a downward movement of 1,700 points in 10 days, the pair has corrected by almost 70% and now it is time to either resume the downward trend (then the pair should go below 1.1500) or "correction against correction" (then we expect a decline to the level of 1.1900). In almost any case, except for the unexpected, the pair is now waiting for a drop in quotes.

Meanwhile, British Prime Minister Boris Johnson, who recently recovered from a "coronavirus" infection, according to unconfirmed information, is in favor of extending the quarantine measures. In chronological order, Johnson's statements on "coronavirus" are as follows. At first, Boris Johnson was not opposed to the fact that the majority of British people got sick with the virus and formed a "collective immunity". At this time, the Prime Minister made a mournful face and warned that "many families may lose relatives and friends." After that, the Prime Minister, with a delay of about 1 month, nevertheless imposed quarantine, however, according to many doctors, "light" quarantine is quite enough. Then Boris Johnson got sick himself with "coronavirus". And now, when he is undergoing rehabilitation and has assessed the danger of the pandemic, he believes that it is impossible to remove the quarantine on May 11. Otherwise, the "second wave" of the epidemic can not be avoided. Thus, until Johnson himself fell ill with the "Chinese infection", he adhered to the policy of Donald Trump on this issue. After that, the rhetoric changed dramatically. It is expected that the quarantine in the UK may even be extended until the end of 2020, or until a vaccine is found or the number of cases goes down. And the number of cases and deaths from the epidemic in the UK is not declining. Over the past 24 hours, another 4,300 new cases of the disease were recorded in Britain, and the number of deaths was 823, which is almost twice as much as the day before. The total number of deaths in Britain is already about 18,000, which gives one of the highest death rates in the world – well above 10%. It is also reported that real death rates in Britain are even higher. We have already said that the official statistics do not include deaths outside of hospitals, such as in nursing homes.

Meanwhile, in a video format, the second round of negotiations between Britain and the EU on post-Brexit relations has begun. Both sides claim that they intend to make serious progress by June 1, but experts say that there is very little chance of true progress in the negotiations in such a short period. Meanwhile, Scottish Prime Minister Nicola Sturgeon is calling on Boris Johnson to extend the "transition period" by two years. Earlier there was a threat of termination of all agreements between Brussels and London, which would not allow Britain to trade duty-free with the EU and, accordingly, would inflict another blow on the British economy. And this did not frighten Boris Johnson. Now, when the UK economy suffers global losses due to the crisis and epidemic, the absence of an agreement with the EU can simply finish it off. In any case, Boris Johnson is still out of business, and we do not know whether his opinion on the issue of the "transition period" has changed under the new conditions. Perhaps the Prime Minister will still listen to the voice of reason and will go to prolong the validity period, as the European Union calls for him to do.

On Wednesday, April 22, the UK is scheduled to publish inflation for March. According to experts' forecasts, the annual inflation rate will slow down to 1.3%-1.5%. However, from our point of view, this report will not have any impact on the currency pair again. We still believe that the main reasons for the fall in the pound are technical. At least for the time being.

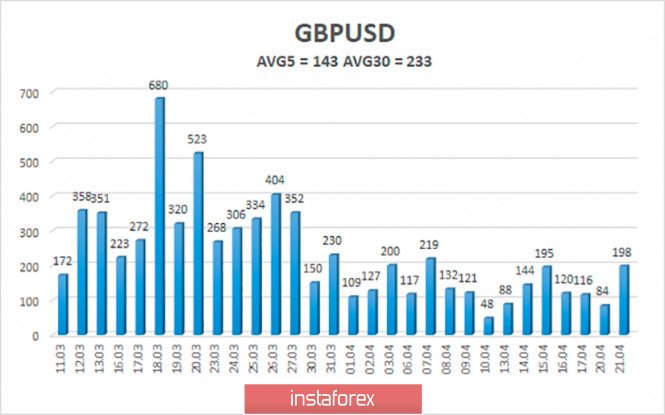

The average volatility of the pound/dollar pair has stopped decreasing and is currently 143 points. In the last 20 trading days, the pair almost every day passes from 100 to 200 points. Therefore, we can say that volatility is now stable. On Wednesday, April 22, we expect movement within the channel, limited by the levels of 1.2130 and 1.2416. A reversal of the Heiken Ashi indicator upward will indicate a round of upward correction within the new downward trend.

Nearest support levels:

S1 - 1.2268

S2 - 1.2207

S3 - 1.2146

Nearest resistance levels:

R1 - 1.2329

R2 - 1.2390

R3 - 1.2451

Trading recommendations:

The GBP/USD pair started a strong downward trend on the 4-hour timeframe. Thus, traders are now recommended to stay in the sales of the pound with the goals of 1,2207 and 1,2146 until the reversal of the Heiken Ashi indicator to the top. It is recommended to consider buying the British currency not before fixing traders above the moving average, which is not expected in the near future.

The material has been provided by InstaForex Company - www.instaforex.com