A new trading week will begin for the forex market, and we have to figure out what to expect and what the macroeconomic background will be. Unfortunately, traders continue to ignore most macroeconomic events. We have already said that the reason for this could be the active actions of major players in the foreign exchange market, which in times of crisis and epidemic carry out transactions not based on statistics and news, as it happens in normal times. Given the fact that small traders do not have access to the international market itself, in any case, only large players work on it, which, accordingly, drive it. However, in moments of peace, about 80% of statistics and important news is processed. Therefore, this is not the most stable time. On the other hand, no one knows when it will end. We need to be ready. It is unlikely that this state of health will continue throughout the entire time of the epidemic on the planet.

The coronavirus, despite some slowdown in the growth of the disease in the United States and the European Union, continues to spread across the planet. The number of infected people is approaching 750,000 in the US. The numbers are even worse in the European Union, because the total number of patients is around 675,000 in Spain, Italy, France and Germany. Thus, the growth rate of the pandemic may be slowing down, but it is very early to talk about defeating the virus. Moreover, the slowdown in growth could stop. We would like to note that for approximately a month and a half of hard quarantine in the United States and the EU, these two failed to completely reduce the number of new diseases to zero, unlike China and South Korea (at least according to official information), but only to slow the spread of the virus COVID-2019. That is, from our point of view, countries have achieved only a small reduction in the number of new diseases through strict quarantines and almost completely dead economies. On the one hand, it means more time to create a vaccine and a little less burden on the health sector, which is good. On the other hand, the results of mankind's struggle with the coronavirus are not yet impressive.

The most significant news in the upcoming week will be released near the end of it. However, macroeconomic information will be available to traders on Tuesday. On this day, the European Union will publish an indicator of economic sentiment from the ZEW Institute for April, which, of course, has a negative forecast at -62. The previous value was -49.5. The ZEW Institute will also release data for Germany, the index of assessment of current economic conditions for April with a forecast of -82.3, and the index of sentiment in the business environment with a forecast of -42.8. In principle, these reports were not significant enough even in average times, but we can see that the mood in the euro area continues to deteriorate. If so, other, more important indicators may continue to decline in April and May.

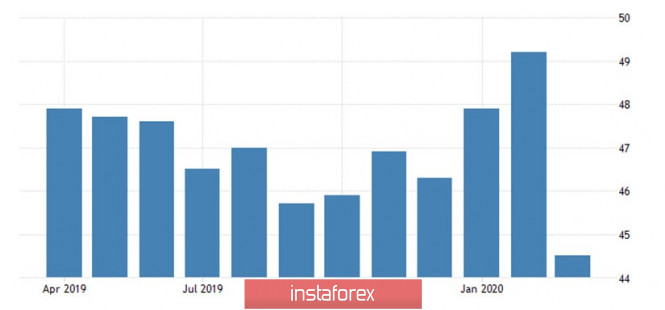

Important EU data will not be released on Wednesday, April 22, but there will be a plethora of different statistics and reports on Thursday. The day will start with business activity indices in the German services and manufacturing sectors. These are only preliminary values for April, but in most cases they are not too different from the final ones. According to experts ' forecasts, business activity in the manufacturing sector could decrease from 45.4 to 39.6.Recall that a month earlier, we said that 45.4 in the crisis is not such a bad value. However, now we see that the manufacturing sector has not just sharply fallen, like the service sector, but will also shrink. A reading of 28.9 is expected in the service sector, which means that there will be an even greater drop in business activity. Needless to say, neither the European Union nor Germany has seen such weak indicators of business activity in the past 20 years. This point indirectly proves the assumption that the crisis caused by the coronavirus will indeed be much more severe and destructive for the economy than the mortgage one.

Business activity indices for the EU will also be published on Thursday. A drop to 44.5 was recorded in the manufacturing sector in March, while a decline to 39.0 is expected in April.

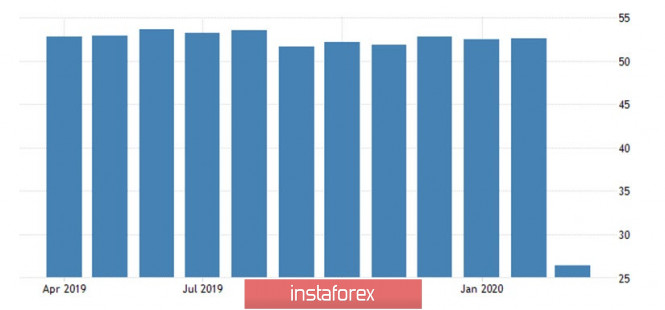

The service sector collapsed to 26.4 in March, it is also expected to fall to 23.0-25.0 in April. Thus, traders expect that all indicators of business activity in the euro area will present new significant declines. Publications and business activity in the United States are also set to be released on this day, but all statistics from overseas will be considered in the GBP/USD article.

The EU calendar of events will be empty on Friday. Therefore, quite interesting reports in Europe will be published next week. Traders will only be able to draw conclusions about how business activity in the EU countries and economic sentiment have changed in recent weeks. This data is unlikely to cause any reaction. Based on this, we again conclude that US macroeconomic data will be the only one able to attract the attention of market participants. Looking ahead, we can say that the next report on applications for unemployment benefits in the United States (released every week) could show an increase of another four million. Thus, the total number of Americans who lost their jobs will reach 26 million in five weeks. And such figures can lead traders out of the process of carefree purchases of the US currency and suspend the appreciation of the dollar. Data on orders for durable goods will also be released next week, which predicts a very strong decline. Since goods in this category are very expensive, their reduction also means a drop in the welfare of the US population, a drop in purchasing power, which obviously has a negative effect on the economy.

In addition to the planned publications, we recommend not to lose sight of the speeches of EU and US officials, including, of course, the main newsmaker – Donald Trump. There is no doubt that Trump will continue to give daily interviews and post messages on Twitter, which, as before, can cause a public outcry. Well, we also advise you not to lose sight of the oil market. After the OPEC+ countries came to an agreement to reduce production by almost 10 million barrels per day, oil continued to fall. Thus, it seems that oil is simply accelerating before a new price increase. Since the OPEC+ agreement will enter into force on May 1, afterwards, the price of a barrel of all grades is expected to increase.

The technical picture of the EUR/USD pair continues to predict the growth of the US currency. There is a new sell signal from Ichimoku, which is strong as the price is below the Ichimoku cloud. At this time, the pair is correcting, but it could resume the downward movement on Monday.

Trading recommendations for the EUR/USD pair:

We believe that the fundamental background's influence next week will not be too strong. The exception would be one or two reports. No important speeches or events are planned for the upcoming week. Thus, as before, more attention should be paid precisely to the technical picture. Low volatility may occur on Monday and Tuesday. In general, we expect the downward movement to resume, at least until Thursday and Friday, when important reports come out in the US.

The material has been provided by InstaForex Company - www.instaforex.com