The data on the index of business activity in the manufacturing sector (PMI) of China published on Tuesday were unexpectedly strong, which served as the basis for positive dynamics in the stock markets in the Asia-Pacific region.

According to the data from China, the index of business activity in March unexpectedly rose to 52.0 points from the February value of 35.7 points and the expected growth forecast to 45.0 points. Moreover, it rose above an important level of 50 points, which indicates an objective increase in production in the country after the most severe quarantine measures that were taken at the beginning of the year in the wake of the coronavirus epidemic. It is important to note that the resumption of the pace of work of enterprises amounted to 98.6%, and the number of returned workers rose to 89.9%.

This is very encouraging news. This raises the question: Will China become the driver of global economic recovery from the consequences of COVID-19?

Of course, there are such hopes, but it should be recognized that the Chinese economy, while still being a global manufacturing workshop, will be able to fully function if demand starts to recover in Europe and North America, where the so-called "golden billion" of Chinese consumers are concentrated, and not only it. In this case, China will only be able to return to the usual economic growth rate of around 6.0%. But now it is predicted that it will be from 1% to 2% in the first half of the year, no more than that.

Again, as before, we believe that April will be a decisive month. If a pandemic can be curbed in Europe and the USA, and such signals have already begun to appear in Italy, the epicenter of this infection in the European part of Eurasia, then demand will begin to recover and apocalyptic forecasts of a future grave global crisis will not come true. The failure in the growth of the global economy can reach 10%, which can be overcome already this year.

Based on this, we believe that a gradual recovery in demand for risky assets will put pressure on the dollar, which will continue to decline smoothly against major currencies.

Given the positive on the background of Chinese statistics, we believe that the opening of trading in Europe in the "green" zone, and stock index futures so far demonstrate this, will lead to an increase in the exchange rates of major currencies against the dollar, as well as its growth against the yen and the Swiss franc.

Forecast of the day:

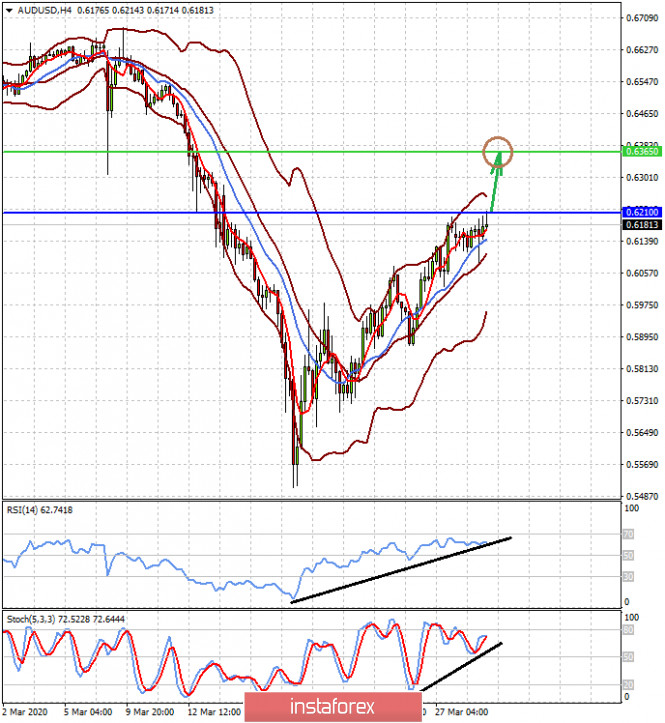

The AUD/USD pair has every chance to continue to grow to the level of 0.6365 after breaking through the level of 0.6210.

The USD/JPY pair can also grow to our previous target 109.00 after breaking through which the direction will open for it to the level of 109.30.