4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - upward.

CCI: 55.1549

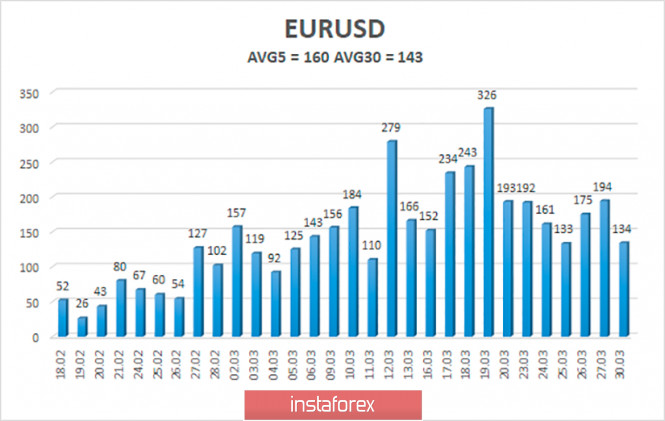

The second trading day of the week begins with a downward correction, which is signaled by the Heiken Ashi indicator. The blue bars of the indicator allows us to assume a decrease in the quotes of the EUR/USD pair. Since the current trend is characterized as an upward trend, a price rebound from the moving average is highly likely to trigger a resumption of the upward trend. We still can't say that market participants have calmed down. The volatility of the euro/dollar pair remains quite high, so although the fundamental background can not be called "causing panic or contributing to panic", nevertheless, how else can you call the state of the market when the volatility exceeds the average values by 3-4 times? Thus, even if this is not a panic in the literal sense of the word, it is still an overly excited state of the market. We are not saying that it is impossible to trade in such conditions. Just keep in mind that in normal times, the euro/dollar pair passes 40-60 points per day. Now, it is 150-250 points. Thus, if you do not forget about stop-loss orders, you can earn a very decent profit. The main thing to remember about money management is not to take unnecessary risks. Based on the current picture of things, we expect the upward trend to resume. Thus, the buy signals will be a rebound from the moving average or a reversal of the Heiken Ashi indicator up.

We have repeatedly said that macroeconomic statistics do not have any impact on the markets. However, this judgment was primarily concerned with statistics for February. After all, it was in March that the epidemic became global, and who gave it the definition of "pandemic". Thus, it was in March that everything in the world changed, turned "upside-down". It is reasonable that traders are interested in reports for this month, and not for February, which the current rate of almost any pair simply does not match. First, we have seen reports on business activity in the countries of the European Union and the United States. A little later - data on applications for unemployment benefits in the weeks when the epidemic has already gained momentum in the States. If the data on business activity were approximately the same for both the US and the European Union (the manufacturing sectors simultaneously fell by several points, and the services sector – collapsed to multi-year lows), the data on unemployment in the States caused huge surprise and disappointment among traders and investors. But the month of March ends and April begins, so it's time to sum up the results of the third month of 2020. This week, traders will start receiving a large amount of data on the state of the US and EU economies.

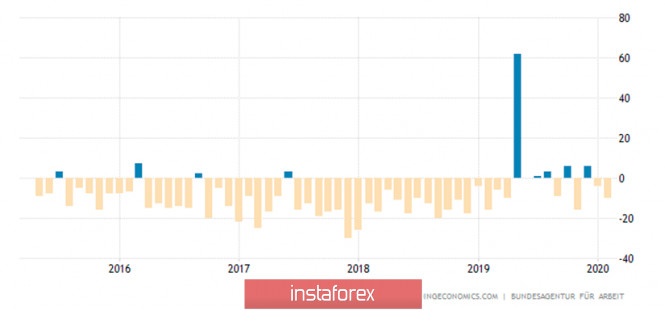

As often happens, everything starts with a "swing". Today, March 31, data will be published in Germany on the unemployment rate for March, as well as on the change in the number of unemployed in March. It is difficult for us to make a forecast of how these two indicators will change. After all, in the States, no one expected that within one week there would be 3.3 million applications for benefits at once. About the same can be true in Germany. Official forecasts are 5.1%-5.2% unemployment, which is not so bad at the current 5.0%. The change in the number of applications for unemployment benefits should be from 29,000 to 34,000. Here you should immediately note that if the forecasts of experts come true, these figures can be considered great in the current conditions and the number of applications will be the second largest in the last 5 years (see the graph above). Anyway, this is news only for Germany, one country from the entire European Union. Therefore, it is unlikely that they will cause any serious market reaction, however, we will be able to understand from these reports what to expect from the pan-European unemployment figures.

A little later, the European Union will publish the basic consumer price index for March and the main indicator of inflation. These values are only preliminary, but they can also have a high value for traders. It is naive to assume that in times of quarantine when the absolute majority of consumers spend money only on medicines and products, prices will increase. Thus, the forecasts speak in favor of slowing inflation in the EU to 0.7%-0.8% in annual terms. The core consumer price index will slow to 1.1%. Again, this is not bad. Despite the rather serious "signs" of reports, industrial production, GDP, unemployment, and labor market data are now more important. Thus, the EU's inflation indicators can be ignored.

What is waiting for the euro currency today? We believe that the pair will continue to trade with high volatility, as there are no prerequisites and reasons for calming the markets right now. "Coronavirus" continues to spread across the European Union and the States. The governments of these countries have already done everything they could, both financially and in monetary terms. Now it takes some time to evaluate the results of the measures taken. Thus, the markets will now again focus on official data on the spread of the epidemic. Unfortunately, so far there is nothing to brag about for humanity. According to the latest data, the number of cases of "coronavirus" in the world is almost 750,000. As we have said many times, the real numbers are even higher. Neither the States nor the most infected countries in Europe (Spain, Germany, Italy, France) show a decline in the rate of growth of the disease. Only in Germany can we note that the number of deaths is relatively low compared to other countries. However, this is unlikely to calm the markets. Donald Trump believes that the peak of mortality and morbidity will come in two weeks. If he's right, it takes about that long to find out if it's true. Well, all this time you need to believe and hope that the American President, who has never been famous for the accuracy of his forecasts, is right this time. The faster the rate of infection declines, the faster the global economy will begin to recover. And with it, oil prices and stock indices.

The average volatility of the euro/dollar currency pair remains at record high values but still continues to gradually decrease. The current average is 160 points and in the past seven days has shown volatility consistently below 200 points per day. On Tuesday, March 31, we expect a further decrease in volatility and movement within the channel, limited to the levels of 1.0871 and 1.1192.

Nearest support levels:

S1 - 1.0986

S2 - 1.0864

S3 - 1.0742

Nearest resistance levels:

R1 - 1.1108

R2 - 1.1230

R3 - 1.1353

Trading recommendations:

The euro/dollar pair started to adjust. Thus, market participants are now advised to wait for the correction to complete and resume buying euros with the goals of 1.1108 and 1.1192. It is recommended to sell the EUR/USD pair not before fixing the price below the moving average line with the first goal of 1.0871. When you open any position, it is still recommended to be more cautious as the situation on the market remains turbulent.

The material has been provided by InstaForex Company - www.instaforex.com