On Friday, the US Congress passed a stimulus package of $ 2.2 trillion (10% / GDP), and Trump signed it. This is the largest economic assistance package in history, and now, the markets need some time to assess whether the measures taken are enough to stop the main economic shocks of recent weeks, or whether the crisis will deepen.

There is no consensus yet. Stock indices are trading mixed on Monday morning, the Shanghai Composite and Nikkei225 are losing 1 to 2%, while the Australian S & P / ASX 200 added 7%, multidirectional dynamics are also observed on the government bond market.

The week will be marked by gathering information to assess the impact of the pandemic. On Tuesday, China's PMI data for March will be released and on Wednesday and Friday, the ISM in the US, and, of course, non-Pharma, which, judging by the sharp increase in unemployment claims, will be a failure.

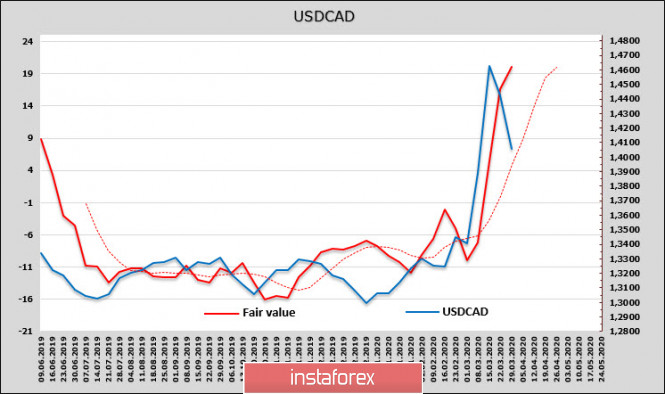

USD/CAD

The Canadian dollar recovered some of the losses last week, considering the decline of more than 4% excessive. The growth of the Canadian dollar was facilitated by temporary stabilization in the markets, which is still unlikely to be long, and another wave of decline awaits the Canadian currency.

The Bank of Canada on Friday eliminated the gap with other Central Banks at a rate that reduced it to 0.25%. This rate level looks consistent within the framework of the cartel and is designed to reduce the speculative component of the yield spread. BoC also announced a large-scale asset purchase program, which will amount to 5 billion CAD per week.

Apparently, the strengthening of the Canadian dollar is temporary and partially compensates for large-scale measures by the Fed, but the lack of dollars will continue to be the main dominant topic in the coming weeks. The CFTC report showed that a short position continues to grow in all commodity currencies, and the Canadian currency is no exception, which means that he will be under pressure in the medium term at least.

The corrective pullback to 1.3921 is 50% of the recent growth, and there is no reason to expect a further decline. Purchases at the current levels are justified and the long position can be increased with a decrease to 1.3760. The main scenario assumes a return to the growth of USD/CAD and a movement to 1.4660, which can only be prevented by the aggressive policy of the Central Bank, which seeks to keep currencies within the secretly approved ranges.

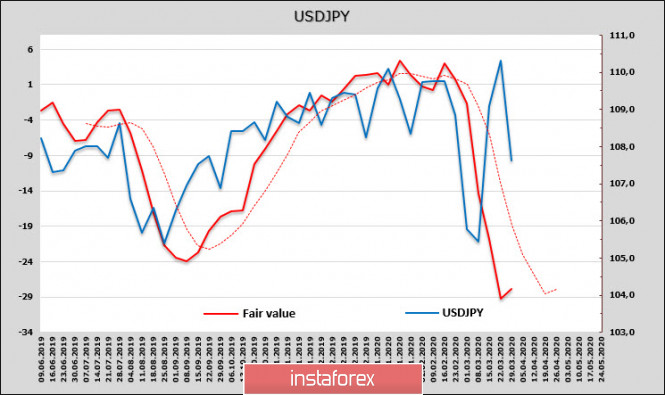

USD/JPY

The Japanese government is preparing to present an emergency stimulus package in April. This package will be presented in the form of an additional budget and achieved by increasing the issuance of bonds that are not needed by anyone except disciplined Japanese banks.

Not yet related to the coronavirus, the Japanese government had already adopted a package of measures for 26 trillion yen projects and 13.2 trillion last December. New spending expenses, including credit lines, will raise the volume of liabilities to 56 trillion, or 10% of GDP. The government is also considering measures such as distributing money to everyone, both adults and children, in order to encourage them to buy goods in stores and somehow support demand.

The CFTC report showed a reduction in the long position on the yen, but, nevertheless, along with the franc and the euro, the yen still has a positive balance against the dollar amid a total lack of the latter.

The estimated fair price of USD/JPY pair is still much lower than the current one, but the incoming movement has already begun. Estimated and spot prices may occur around 106, but given that the estimated price has started to unfold, pressure on USD/JPY may turn out to be weaker and trading will go sideways.

The material has been provided by InstaForex Company - www.instaforex.com