Gold is trading in the red after another rejection from a major dynamic resistance. It has opened with a gap up, but the sellers have forced the price to close it. The yellow metal is trading at $1,615 and most likely it will challenge the $1,600 psychological level again before it resumes the upside movement.

Gold maintains a bullish outlook as the COVID-19 epidemic grows and makes new victims, the global economy is under threat, that's why Gold remains an attractive safe-haven instrument, the price could pass above the $1,703 high soon.

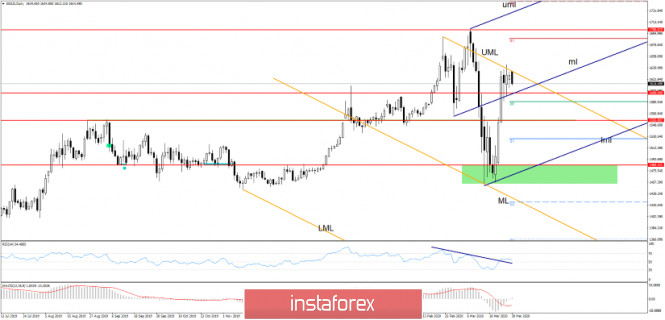

Gold has decreased aggressively after another rejection from the upper median line (UML) of the major orange descending pitchfork. I've said on Friday that maintains a bullish bias and it could resume the bullish movement as long as it stays above the $1,600 level and above the median line (ml) of the dark blue ascending pitchfork, a valid breakdown below these levels will validate a potential drop towards the $1,555 level.

I want to remind you that a further increase will be confirmed only after a valid breakout above the upper median line (UML) of the orange descending pitchfork and if the price stays above the $1,600 level and above the median line (ml).

- TRADING TIPS

Gold has decreased in the early of the week, but it is still bullish as long as it is traded above the $1,600 and above the median line (ml). A rejection from these levels, false breakdown, followed by a valid breakout above the upper median line (UML) will give us a chance to go long again on Gold, with potential targets at R1 ($1,686) level and at the $1,700 - 1,703 area. A valid breakout above the $1,703 high will validate a further increase on the medium to the long term.

As I've said higher, a breakdown and a consolidation below $1,600 could signal a drop on the short term, this scenario will take shape if Gold stays below the UML (orange descending line), the next downside targets are represented by the $1,555 level, S1 ($1,526) and by the lower median line (lml) of the dark blue ascending pitchfork. A potential drop could appear if the USDX starts another leg higher.

The material has been provided by InstaForex Company - www.instaforex.com