4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - up.

CCI: 169.0755

The second trading day of the week begins with the same strong upward movement that was observed on Monday and throughout the past week. It is difficult to even imagine what can stop buyers of the euro. As we have already seen in the final articles for March 2, the growth of the European currency can not be called special and logical now. And especially strong growth. Thus, we believe that the markets are just in a panic and only for some instruments. For example, the GBP/USD pair feels calm and trades quite logically. Thus, it is recommended that the euro remain in the longs until it receives a signal about the beginning of a downward correction, which is likely to be a signal about the end of the upward trend. All macroeconomic events that will be available to traders this week can be ignored. Such a strong movement could not be provoked by banal reports. Thus, any other reports may not provoke any market reaction. However, you should not lose sight of important statistics and important fundamental events. At the very least, they will help to predict the movement of the currency pair when the panic mood leaves the market.

For example, today, on March 3, there will be another speech by the Vice-President of the European Central Bank, Luis de Guindos, who yesterday hinted that the Regulator will do everything necessary to ensure that inflation continues to strive for its target level, which now remains at the level of 2.0%. The ECB has not been able to reach this level for 7 or 8 years, so de Guindos's words are likely to have a figurative meaning. First, the Vice President started talking about monetary policy at a time when the risks of a global economic slowdown due to the "coronavirus" have increased many times. Secondly, it was at the time when Jerome Powell and Mark Carney made similar statements. Third, if the ECB had been so important for inflation at 2%, the rate would have been cut again a long time ago. Thus, the conclusion is that the ECB is not afraid of weak inflation at this time, but of an even greater slowdown in the European economy, which is already on the verge of recession.

Also scheduled for today is the speech of the head of the Cleveland Fed, Loretta Meister, who can speak about the Fed's monetary policy next to Jerome Powell. Recall that the more members of the monetary committee will vote "for" easing the policy, the more likely it is to see a rate cut in March. Thus, each speech by a member of the Fed's monetary committee now receives an additional degree of significance.

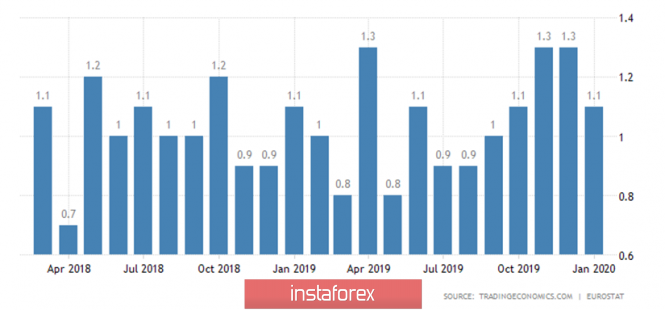

Well, in addition to the speeches of high-ranking officials, today the European Union will publish data on inflation. Although we believe that traders are highly likely to ignore any value of the consumer price index, it is impossible to avoid such a publication. Core inflation in the EU in February should be 1.1%-1.2% y/y. That is, according to experts, we should expect an acceleration of 0.1%. Recall that core inflation does not take into account changes in food and energy prices, so it is considered more accurate.

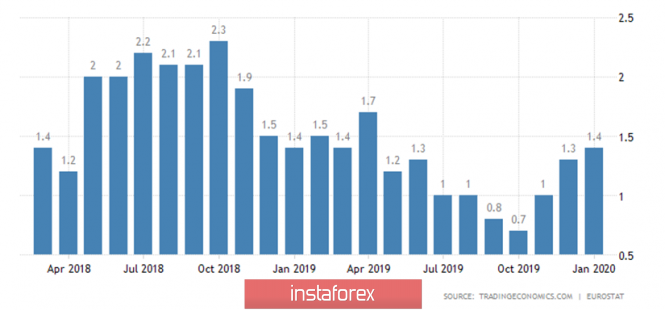

It will be followed by the main inflation indicator for February, which may fall to 1.2%-1.3% y/y from the current 1.4% y/y. Thus, it is highly likely that macroeconomic statistics will disappoint buyers of the euro. However, as we have already said, it is unlikely that such a strong movement will be broken by a single inflation report, whatever it may be. The most interesting thing is that it is almost impossible to predict when and why the euro/dollar pair will end its trip to the north. Most likely, the pair will start falling after reaching a certain level, where large pending sell orders or Take Profit orders are located. While the upward movement continues, as indicated by the Heiken Ashi indicator, we recommend that traders continue to stay "in the trend".

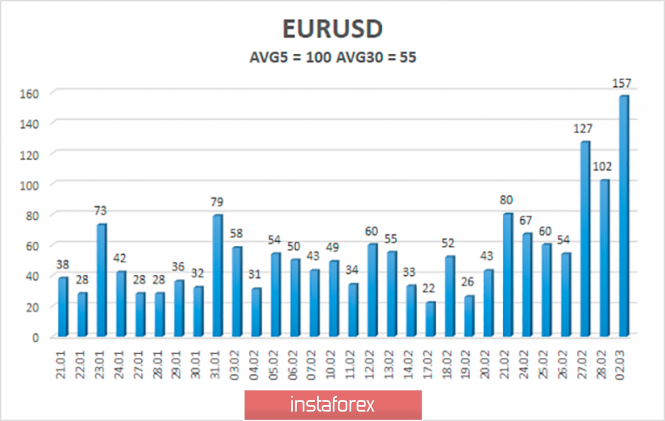

The average volatility of the euro/dollar currency pair rose to 100 points per day, which is a very high value for the euro. Thus, on the second trading day of the week, we again expect a decrease in volatility and movement within the channel, limited by the levels of 1.1056 and 1.1256. A downward turn of the Heiken Ashi indicator will indicate a turn of the long-awaited corrective movement.

Nearest support levels:

S1 - 1.1108

S2 - 1.1047

S3 - 1.0986

Nearest resistance levels:

R1 - 1.1169

R2 - 1.1230

R3 - 1.1292

Trading recommendations:

The euro/dollar pair continues its strongest upward movement so far. Thus, purchases of the European currency with the targets of 1.1230 and 1.1256 remain relevant now, until the Heiken Ashi indicator turns down. You will not be able to return to sell positions until the price is fixed below the moving average line with the first targets of 1.0925 and 1.0864, which is not expected in the near future, for obvious reasons.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com