The market has been in favor of the yellow market over the past few weeks. Its price has been steadily growing, but the joy of investors was short-lived. The precious metal began to rapidly become cheaper since the end of last Friday, February 28. Experts fear that it will be difficult for gold to recover in such a situation.

The end of last week brought a collapse of gold and silver quotes along with shares of major companies. The price of the yellow metal fell by 4% in just a day, which is the highest drop over the past seven years.

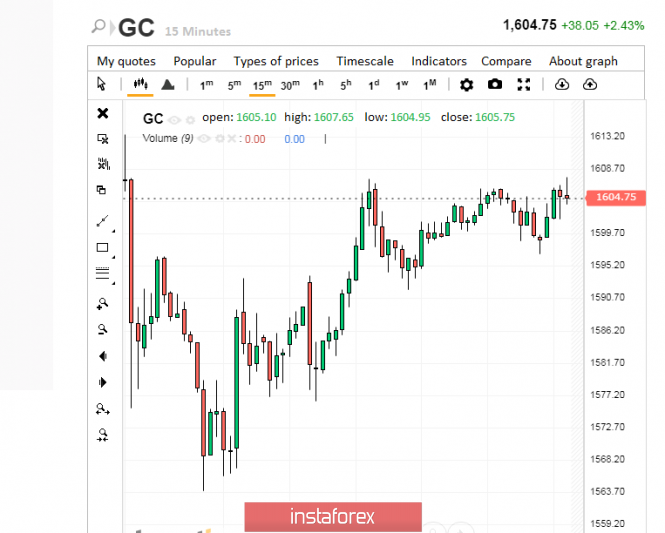

According to analysts, such a collapse has not been observed in the precious metals market since 2013. Gold fell to $1,586 per ounce, and in the futures market, the drop in precious metals traded in euros reached 5%. Nevertheless, the yellow metal began a new week on a positive side, having recouped its previous losses a bit. On Monday, March 2, gold futures are trading in the range of $1,604– $1,605 per ounce, trying to rise higher.

Subsequently, gold quotes managed to overcome this barrier, reaching $1,608 per ounce, but then it fell again.

Many experts were alarmed that the collapse of prices for precious metals occurred along with the fall of the stock market. Experts believe that if defensive assets are destabilized, the stock market may collapse. This happened during the global financial crisis of 2008, experts recall.

The reason for the rapid decline in the precious metals market and the stock market, analysts believe the intervention of a number of central banks. According to experts, regulators fear a rise in the price of gold, as this could lead to the devaluation of fiat currencies. As a result, banks had to intervene to urgently stop the yellow metal price rally.

An important role in the fall of the leading precious metal was played by a certain weakening of the US currency. Recall that the dollar lost ground due to market expectations regarding a further reduction in interest rates by the US Federal Reserve. A powerful correction recorded on the stock market provoked a liquidity shortage among hedge funds. As a result, traders decided to take profits from precious metals, which brought high profitability. However, the massive sale of gold and silver put a lot of pressure on their value, causing a collapse in quotes, analysts conclude.

According to experts, the current week in the gold and silver market will be very busy. Experts do not exclude an intensive outflow of funds from the gold ETF funds, as large institutional investors will need additional liquidity. This can cause profit taking on their part. The current drop in the precious metals market will be in the hands of long-term investors, analysts said. They will have a great chance to increase their investments. However, gold will be able to regain its position in the medium term, experts said.

The material has been provided by InstaForex Company - www.instaforex.com