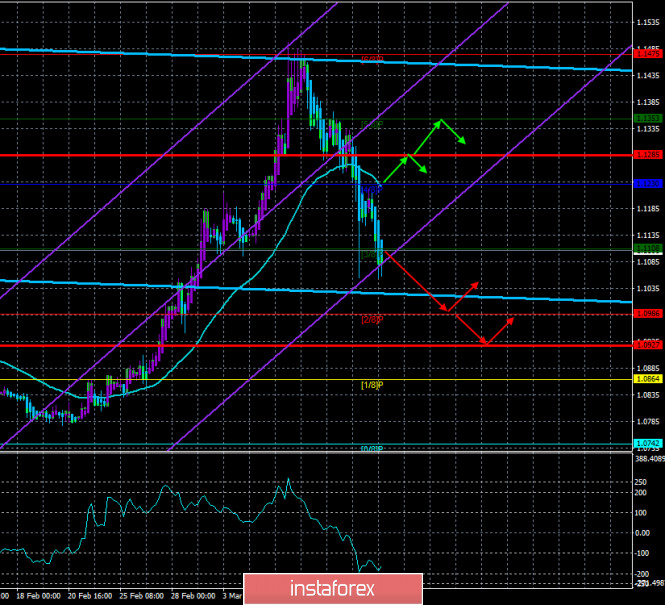

4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - downward.

CCI: -160.7397

The new trading week for the EUR/USD currency pair begins with the same downward movement, with the same record-high volatility. To be honest, we do not yet see any reason for traders to get out of a state of panic. The situation with "coronavirus" is still not resolved and, according to the latest data, the number of infected has increased to 156,000. Thus, the virus continues to spread across the planet, respectively, and the markets will continue to be in a very excited state. Based on this, any day there may be a new reversal of the quotes up. The downward movement may become even stronger. In general, we believe that the "storm" will continue. It is good that there are not too many macroeconomic publications planned for this week. To be honest, it is painful to see how important reports are ignored by market participants. However, important information not related to the "coronavirus" will also abound this week.

Monday could have been a half-day off if not for the panic in the currency and stock markets. There are no important publications scheduled for this day, but we all understand that at any moment, an important statement may be made by, for example, Donald Trump or someone from the EU government, or a speech by the head of Central banks. Thus, traders can get additional reasons to participate in trading even more actively at any time.

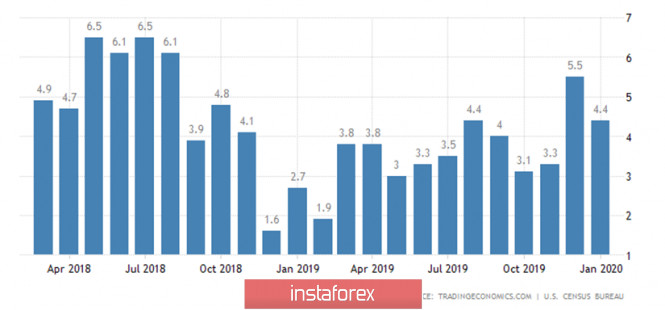

On Tuesday, the United States will publish an index of retail sales for February. It is expected that the indicator will grow by 0.2% on a monthly basis, but we believe that starting from February, a general slowdown in the economic indicators of almost every country in the world may begin due to the situation with the "coronavirus". Thus, the actual figures may differ significantly from the forecast. We would also like to note once again that traders pay very little attention to macroeconomic statistics now, so such an insignificant report will be ignored with a probability of almost 100%.

Also scheduled for this day is the publication of industrial production in the United States for February, which continued to slow down in the last year and a half and without any "coronavirus". It is expected that the annual decline will continue, and a small increase of about 0.4% will be recorded on a monthly basis. We believe that this indicator will not attract the proper attention of traders.

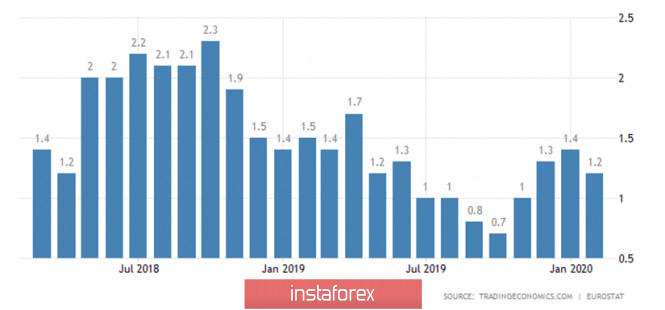

Wednesday will rightly be considered the most important day of the week since on this day the final inflation in the European Union for February will be published. According to experts' forecasts, the consumer price index will slow down to 1.2% y/y, as indicated by preliminary values. And late in the evening, the planned meeting of the Federal Reserve will take place, during which the key rate may be lowered once again. No important news is scheduled for Thursday or Friday.

Thus, the key event of the week will be the new meeting of the Federal Reserve. It is difficult to say what to expect from Jerome Powell, who only recently lowered the rate by 50 basis points. Trump is demanding that Powell has lowered interest rates to zero. However, the Fed still continues to show that it is independent of the US President and is unlikely to meet Trump's requests. Experts are inclined to believe that the Federal Reserve may well go for a new easing of monetary policy by 50 basis points. Thus, the key intrigue of the week will be the Fed's decision on the rate, as well as market reaction to this decision. After all, in the last week, the US currency has strengthened against both the pound and the euro. Will the winning pace in the dollar continue if the Fed will once again take a "dovish" stance?

We still believe that it is not particularly important which Central Bank takes what measures. If the majority of traders, major players, and speculators believe that it is safest to keep money in dollars, then the dollar will become more expensive. It doesn't matter how much the Fed eases the rate. However, this opinion may change. Also important will be the Fed's press conference, during which new judgments may be made about the fight against the "coronavirus" and its impact on the US economy and the world.

From a technical point of view, most indicators indicate a downward trend. The fastest Heiken Ashi indicator is directed downward and there is no sign of its upward reversal yet.

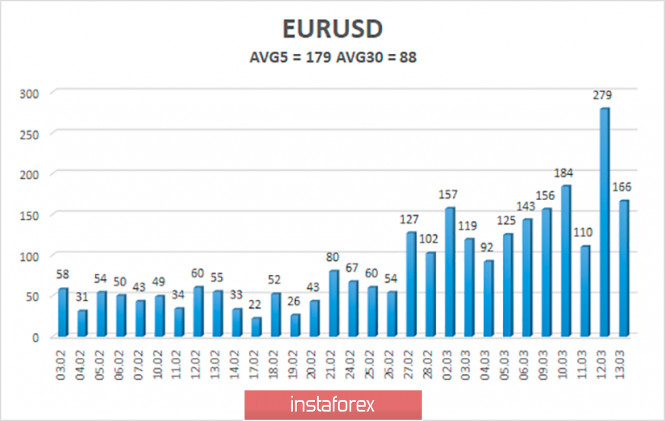

The average volatility of the euro/dollar currency pair remains at record values and continues to grow. At the moment, the average volatility for 5 days is already 179 points. This value once again confirms the fact that the markets remain in a very excited state and can move in any direction with a new force at almost any moment. Thus, on Monday, we again expect a decrease in volatility and movement within the channel, limited to the levels of 1.0927 and 1.1285.

Nearest support levels:

S1 - 1.1108

S2 - 1.0986

S3 - 1.0864

Nearest resistance levels:

R1 - 1.1230

R2 - 1.1353

R3 - 1.1475

Trading recommendations:

The euro/dollar pair continues a strong downward movement. Thus, it is now recommended to continue to consider the sale of the euro with the targets of 1.0986 and 1.0927, before the reversal of the Heiken Ashi indicator to the top, which will indicate a possible correction. It will be possible to return to the pair's purchases no earlier than the price-fixing above the moving average line with the first target of 1.1353.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com