Investors continue to closely monitor the development of the situation around the spread of coronavirus around the world. Reports in the media already fully resemble military reports, and the market reaction to all this is also extremely nervous and, in our opinion, excessively inadequate.

On Wednesday, the markets experienced the usual collapse of stock indices again. The reason for all this event is also the same - the fears of investors that COVID-19's influence on business and production activity primarily in the US and Europe, and in China, this attack has gone into decline. Again, if you look at everything that happens in the markets, especially in the States, you can clearly see that a collapse in the local stock market is natural and is a collapse of the so-gently and "lovingly" inflated financial bubbles after the mortgage crisis 2008-09, when, to save everything, the Federal Reserve launched unprecedented measures to provide cheap and unsecured dollar liquidity.

If you pay attention to how much the American economy has grown over the past 10 years and how much the S&P 500 index has jumped up, simple and very rough estimates show that the US GDP has added less than 20% over the years, and the index has grown by 100%. The question is, where did these 80% come from? And from there, from quantitative easing programs, the so-called QE, of which there were three. Even then, ten years ago, the author said and wrote in the media that this economic policy would lead to a collapse in the future. And just one serious problem was enough and a catastrophic situation is observed on the American market - the collapse of bubbles.

We believe that, despite all the tragedy – this will only improve the American financial system in the future, and rid the economy of inefficient and" empty " port business. However, despite this cleansing, there is a risk of the US falling into a financial heresy again. The market has not yet responded to large-scale announcements of measures to support the economy and financial stability from the Fed and the Ministry of Finance, but as soon as the situation with the coronavirus stabilizes, inflation will begin again, and the demand ffor risky assets will increase with another collapse expected in the future.

Meanwhile, the market continues to live its own life, not paying attention to any statistics coming out, in conditions of extremely high volatility, when speculators accelerate the value of assets using panic moods. So on Wednesday, the price of oil declined, but today, before the opening of trading in Europe, it is noticeably adding. This helps to restore commodity and commodity currencies. Therefore, AUD/USD, NZD/USD and USD/CAD pairs changed to an opposite direction in the morning to those that were the day before. At the same time, the US dollar is falling after a strong strengthening in the Asian trading session. Gold also cautiously rises in price while the franc and the yen decline.

Observing everything that happens, we note that the nervousness in the markets will noticeably decrease only if the situation with the pandemic in Europe and America stabilizes. Until then, there will be sharp ups in local demand for risky assets, accompanied by a weakening dollar, which will be followed by similar collapse in demand for risk as well as strengthening of the US dollar.

Forecast of the day:

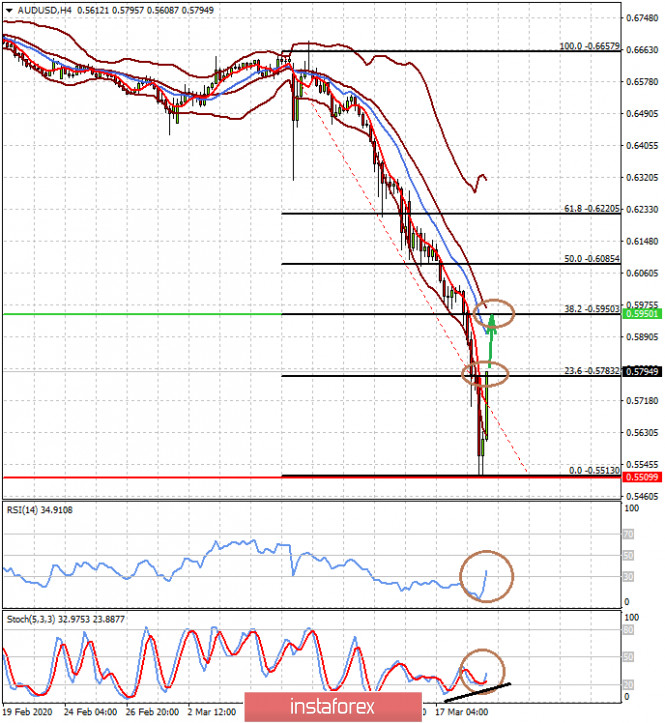

The AUD/USD pair is correcting up by 23% Fibonacci. We believe that fixing the price above the level of 0.5795 will lead to a local price increase to 0.5950.

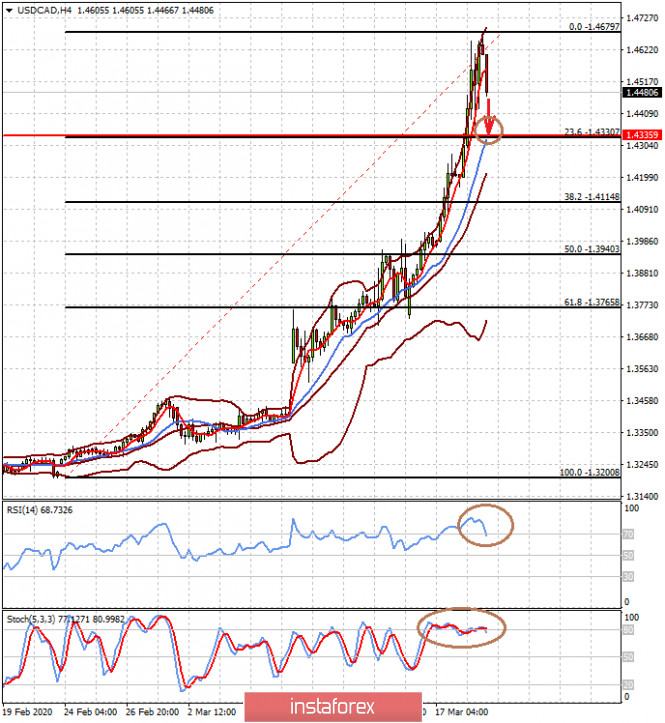

The USD/CAD pair is correcting down on a wave of growth in crude oil prices. We believe that it can pull back by 23% Fibonacci to 1.4335.