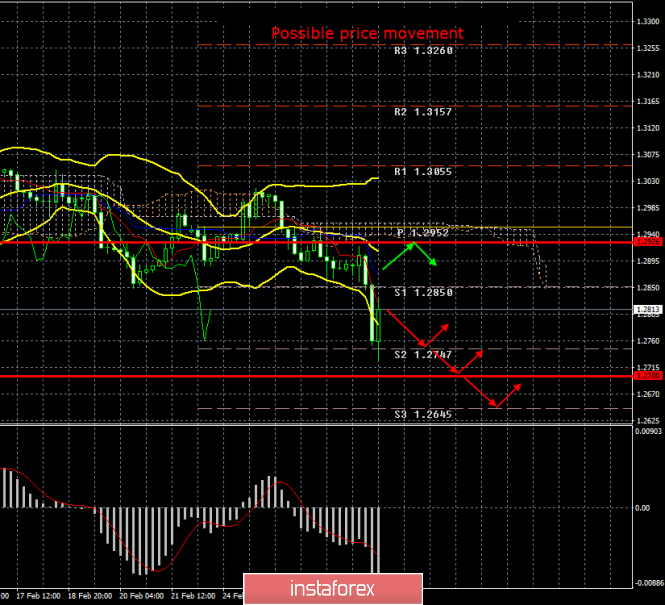

4-hour timeframe

Amplitude of the last 5 days (high-low): 68p - 104p - 108p - 87p - 194p.

Average volatility over the past 5 days: 113p (high).

The British pound, as we said in previous articles, did what it should have done a long time ago at the end of last week. Namely, resumed the downward trend. "I want to believe" - not because we want the pound to continue moving down, but because this is the most logical option for the development of events, given the entire macroeconomic and fundamental background. March begins, and for the UK and pound traders a new saga begins, which will keep them in suspense for a long time, called trade talks with the European Union. We have repeatedly reviewed this topic and talked about all the possible problems and pitfalls that the parties to the negotiation process may face. The conclusion is unchanged: if Boris Johnson fails to agree with the EU, the pound will fall under a sell-off. And since the information will come gradually and for at least six months, the British currency may remain prone to fall all this time. The current week for the British pound paired with the US dollar will also be very interesting. A little economic information will come from Great Britain, but extremely important reports will be published in the United States several, which, with a high degree of probability, will affect the EUR/USD pair.

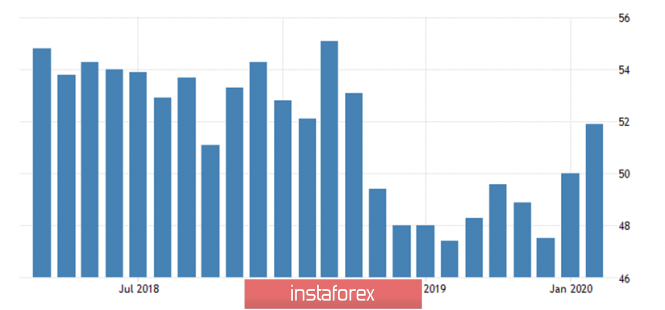

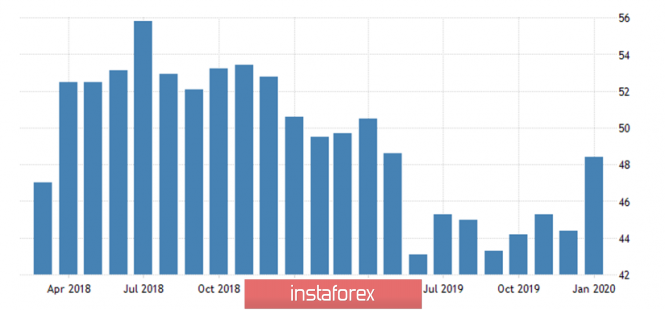

On Monday, Britain will receive data on the index of business activity in the manufacturing sector Markit, which last month was 50.0, and in February it could be 51.8-51.9. Thus, this index will not only get out of the recession zone, but it will be enough to move away from it, in contrast to the European and German indices. However, in spite of the seemingly emerging growth of the manufacturing sector, during 2020 it may again encounter serious problems, for example, due to a slowdown in business activity in China due to the pneumonia virus.

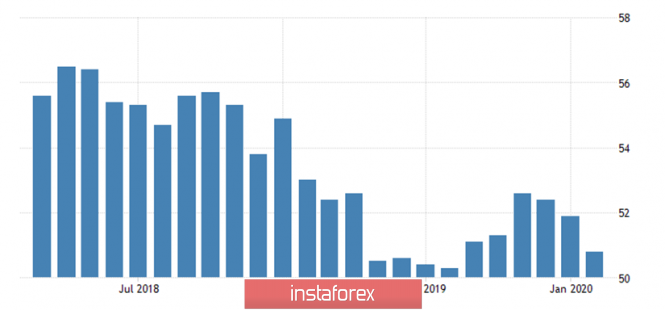

In the United States, the day is scheduled for the publication of the index of business activity in the manufacturing sector Markit, which may drop to 50.8.

As well as the index of business activity in the manufacturing sector ISM, which after a sharp increase to 50.9 may fall in the range of 50.4-50.2. If the forecasts for these two indices come true, the US manufacturing sector will begin to raise serious concerns, as industry growth has been negative for more than six months, and business activity continues to decline and comes close to the recession zone.

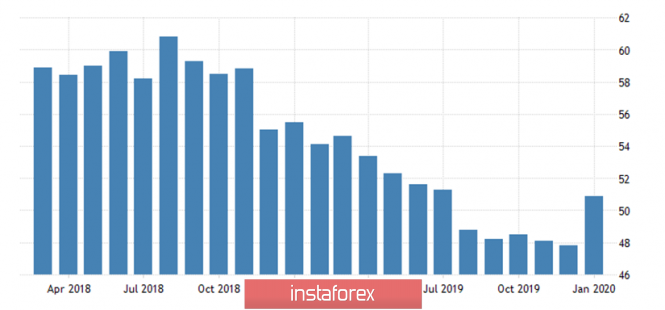

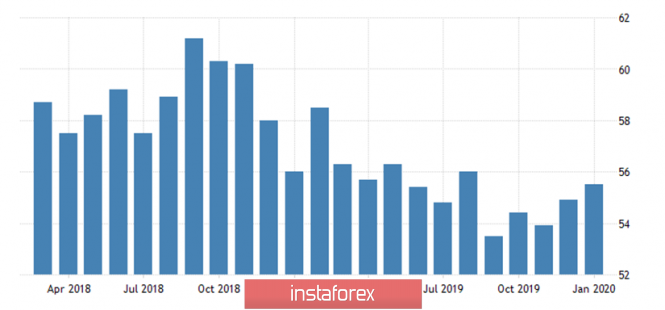

Britain will release PMI in the construction sector on Tuesday, which regularly affects exchange rate changes of the pound. By the end of February, a value in the range of 48.4-48.6 is expected. That is, no major changes compared to January are expected. The calendar of macroeconomic events of the US will be empty on this day.

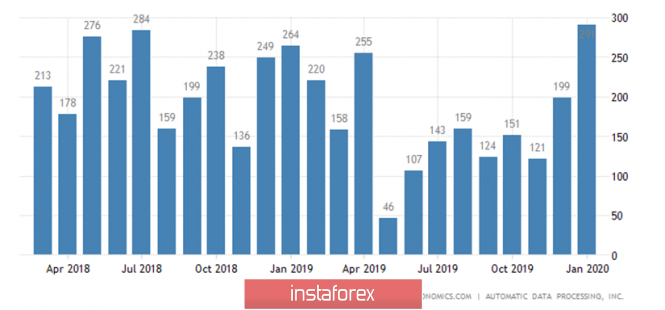

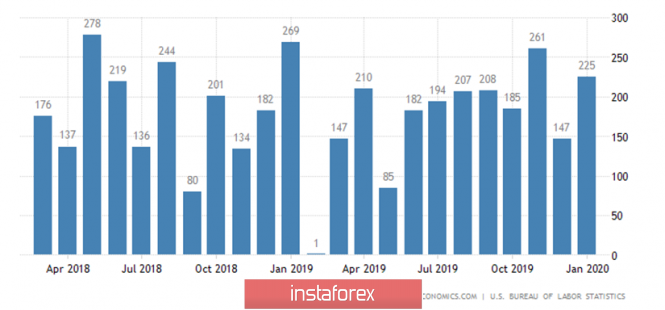

The rest of the week will be held under the American flag. On Wednesday, a fairly important report on the change in the number of workers in the private sector from ADP will be published, which last month showed an increase of almost 300,000 units of labor. Forecasts for February are much weaker, but still quite high, from 170,000 to 191,000.

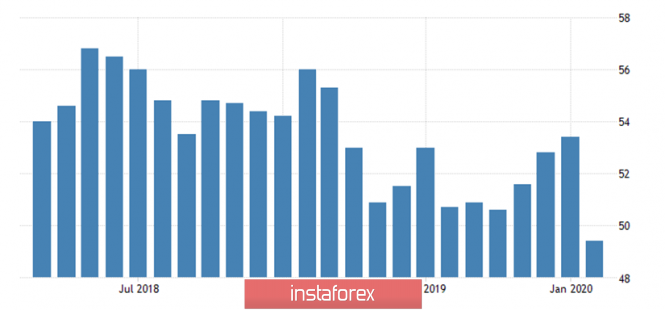

As for business activity in the US services sector, here, most likely, the preliminary values for February will be justified according to Markit, and the index will drop to 49.4.

In the case of the ISM index, it is from a fairly high value of 55.5, according to experts, it is likely to slow down to values of 54.2-54.5. The ISM index is more significant, so it should help the US dollar on Wednesday be in demand among traders in the foreign exchange market.

Nno important statistics will be received from across the ocean on Thursday. Finally, a key report of the entire week will be released on Friday - US NonFarm Payrolls. Six of the past seven months have shown very high growth rates in the number of newly created jobs outside the agricultural sector. In February, another +165,000 or even +175,000 new jobs are expected.

What can be said in general for the entire statistics package this week? There will be little news in the UK, at least planned and economic in nature. But a lot in the United States, however, the prospects for the euro, pound and the dollar will depend more on technical factors, less on statistics from the United States, since it is it that can push technical factors into the background. Reporting on ISM indices, as well as NonFarm Payrolls and ADP, will be extremely important. But do not forget that for the British pound, information on the course of negotiations between London and Brussels, which may already begin to come at the disposal of traders, will be extremely important, at least preliminary. Thus, there will be plenty of factors that will be able to influence the movement of major currency pairs this week. We would also like to draw attention to the speeches this week by representatives of the Fed, in particular James Bullard, Loretta Meister and others (almost all members of the monetary committee will speak). In recent weeks, there have been rumors in the markets that the Fed will accept one or two key rate cuts in 2020. The reason is called the slowdown in the global economy due to the Covid-2019 virus. It is the members of the monetary committee that will either dispel these rumors or confirm them. And finally: on Thursday, Bank of England Chairman Mark Carney will give a speech, who, although he will soon leave his post, can nevertheless make an important statement regarding monetary policy. Recall that the Bank of England has long been expected to lower rates, but this decision still supports only two members of the monetary committee of nine.

Trading recommendations:

We can say that the GBP/USD pair has already begun an upward correction. Thus, it will be possible to sell the British pound again with targets at 1.2747 and 1.2700 (to be revised tomorrow), after the completion of the current correction. We recommend considering the pair's purchases with a view to the Senkou Span B line in small lots if the bulls are able to gain a foothold above the Kijun-sen line. In any case, the fundamental background does not remain on the side of the pound. Till...

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

Support / Resistance Classic Levels:

Red and gray dashed lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movements:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com