The financial world continues to show panic. Almost all of Friday's trends were continued on Monday: the euro-dollar pair continued to grow during the Asian session, gaining a foothold in the 10th figure, and the yield on the treasuries continued to fall - for example, the yield on 10-year bonds hit a record low (1.062%). The dollar index also plunged, reflecting weak demand for US currency throughout the market. After Friday's statement by Jerome Powell, who had already made it possible in plain text to reduce the rate due to the negative consequences of the spread of coronavirus, this behavior of the currency looks quite logical. The greenback was also pressured by the PMI Caixin index for the manufacturing sector - today it slumped to a record low of 40.3 points (even in the fall of 2008 it was slightly higher). Nevertheless, the bulls of the EUR/USD pair need additional boost from macroeconomic reports. If upcoming releases disappoint dollar bulls, the price could go into the 11th figure.

It is worth noting that the current week is eventful. For example, today all the attention of the pair's traders will be focused on the US manufacturing ISM index, which can significantly spoil the positions of dollar bulls. Let me remind you that the US production indicators have recently left much to be desired, and this fact puts background pressure on the US currency. This pressure significantly increased in early January - the December production ISM US unexpectedly collapsed to 10-year lows, reaching 47.2 points. The index was below the key 50-point mark for five months, so this trend disappointed investors. But the January indicator turned out to be better than expected: the indicator unexpectedly climbed above the 50th level, reaching 50.9 points. It is noteworthy that according to general forecasts, the ISM index may show a slight decline in March - up to 50.5 points. Such dynamics is unlikely to affect the pair. But if, contrary to forecasts, it again falls below the key 50-point mark, the dollar will come under strong pressure.

The central event of Tuesday will be the publication of data on the growth of European inflation. The general consumer price index in the eurozone has been gradually growing since October, and in January reached its local high of 1.4% (the highest since April last year). Positive dynamics is also expected in February - according to analysts, the indicator will grow to the level of 1.5%. Core inflation should demonstrate a similar dynamics - experts believe that the core index will be released in the green zone, at around 1.2%. If the indicators come out at least at the forecast level, the EUR/USD pair will get a reason for its growth, as inflation dynamics is under the scrutiny of the European Central Bank. There are certain prerequisites for the growth of pan-European inflation - judging by the growth rate of German inflation. In February, inflation in Germany rose to 0.4% m/m and 1.7% y/y (with a forecast of growth to 0.3% and 1.6%, respectively). The harmonized consumer price index also ended up in the green zone: 0.6% m/m and 1.7% y/y. In annual terms, the indicator showed the strongest dynamics since April last year. In monthly terms, indicators also reached many-month highs, contrary to the neutral forecasts of most analysts. All this suggests that tomorrow's release may pleasantly surprise EUR/USD buyers.

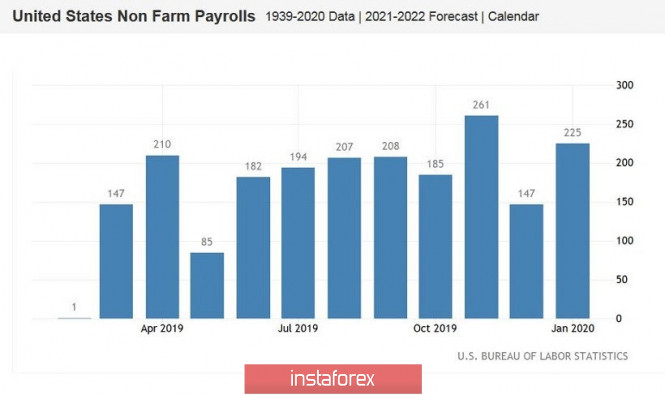

Nonetheless, Nonfarm will be the most important event of the week for the pair's traders. It is worth recalling that the previous release, which was published in early February, made an ambiguous impression. Many components came out better than expected, reflecting positive trends in the labor market. In particular, instead of an increase of 185 thousand (a consensus forecast), the employment growth rate jumped 225 thousand. At the same time, the inflationary component of Nonfarm was disappointing - the level of average hourly wages. This most important indicator for the Fed was at around 0.2% on a monthly basis and 3.1% at an annual rate. Unexpectedly, the unemployment rate rose (albeit minimally) to 3.6%.

According to the general forecast, the February Nonfarms will show a weaker result. The employment growth rate should drop to 180 thousand, and the average hourly wage may drop to a three percent mark. The growth rate of people employed in the manufacturing sector of the economy can again show a negative result, though not as significant as in January (the indicator should decrease by 4 thousand).

Thus, this week macroeconomic releases that are quite important for the pair will be published. But with all this, the role of the first violin will be played by the coronavirus, or rather the panic mood that is associated with the spread of COVID-19. For example, if the profitability of 10-year-old Treasuries declines to a one percent mark (and judging by the dynamics of the decline, this may happen today), the dollar will come under strong pressure - regardless of the dynamics of macroeconomic reports. The US stock market will also affect the health of the greenback, especially if it continues the trends of the past week. Fed's dovish comments may also increase pressure on the dollar: Loretta Mester, James Bullard, Charles Evans, Jones Williams, Eric Rosengren and Esther George are expected to perform this week.

From a technical point of view, EUR/USD bulls, firstly, it is necessary to overcome the resistance level of 1.1070 (the middle line of the Bollinger Bands indicator on D1), and secondly, to overcome the mark of 1.1110 (at this price point the upper and lower boundaries of the Kumo cloud on the same time frame): in this case, we can already speak with confidence about a trend reversal.

The material has been provided by InstaForex Company - www.instaforex.com