The US dollar continues to receive support before the publication of Payrolls, remaining a favorite across the entire spectrum of the market. Yesterday, the S&P 500 broke the record, reaching 3344p after China announced that it would reduce tariffs on US goods by about $ 75 billion, and Factset reported that 71% of corporations showed profits above the expectations of the market.

Positivity is supported by a decrease in panic regarding coronavirus. According to recent data, mortality is currently 2.0% compared to 2.3% a week earlier.

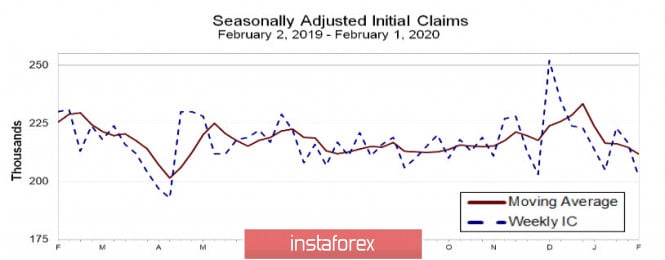

The number of applications for unemployment as of January 31 increased by 202 thousand, which was the best result since April 2019, and the head of the Federal Reserve Bank of Dallas, Robert Kaplan, said that he expects the US economy to grow by 2.25% this year, and this forecast would be even higher if not for the problems of Boeing and coronavirus.

On the other hand, the dollar index has good chances to strengthen at the end of the week, but gold and oil will remain in the consolidation zone. However, OPEC has not yet made any comments on upcoming decisions. Meanwhile, gold is under pressure due to a general decrease in tension.

USD/CAD

The Canadian dollar is slightly behind other commodity currencies, which made an attempt to recover amid rising oil and lowering tensions associated with the coronavirus, remaining hostage to the situation regarding the expectations of today's employment report.

The expected speech by Carolyn Wilkins, First Deputy Head of the Bank of Canada, did not bring anything new in terms of understanding BoC's intentions for the near future. In her comments, there was no room for hints of the next steps. In addition, Wilkins noted the threat of a slowdown in the Canadian economy, markets assess the threat of lowering the BoC rate as low - if the probability of such actions was estimated at 25% at the beginning of the month, then on Friday morning, it was only 12%.

As a result, CAD may leave the consolidation zone today depending on the reaction of the rank to the US and Canada employment report. If the Canadian report turns out to be worse, then USD/CAD will overcome the resistance zone 1.3330 / 50 and move to the zone 1.3365 / 82. This is a more likely scenario than the correction to 1.3190 / 3205.

USD/JPY

Japanese household spending declined by 4.8% in January which is an expected pullback amid a small jump after rising consumer tax. In turn, short-term prospects for consumer demand remain disappointing due to a fall in domestic demand, real GDP declined in Q4 2019, and only whether consumer spending can recover depends on whether GDP will grow in the 1st half of 2020.

To compensate for the weak domestic demand, the Japanese government launched a new round of fiscal stimulus, this time in the amount of 13.2 trillion yen which is approximately 2.4% of GDP. These measures concern the state expenses, that is, the government has planned a decrease in consumer demand and closes a growing hole in the budget in advance.

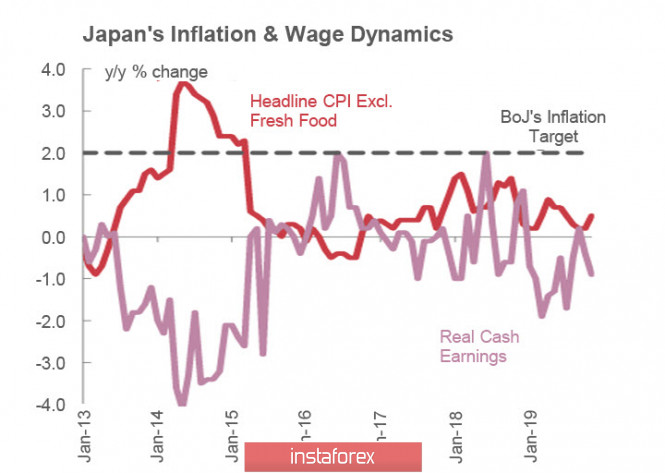

As a result, the dynamics of wages and inflation remain so weak that one can only dream of reaching a 2% target, since there are no chances for growth.

The recession is delaying in the industrial sector, especially in electronics, exports are declining, and GDP growth will balance at a level slightly above zero.

In such circumstances, the Bank of Japan has no choice but to support the current financial policy, since there is no reason to tighten it, and there is no place to weaken it further. Moreover, inflation will remain very low, weak demand will mean lower demand for raw materials, which for the yen in the end, as an asset that is in the opposite phase relative to commodity prices, will mean the threat of strengthening.

As a result, USD/JPY continues to trade in the range 107.63 - 110.29. The conditions for exiting from which will not mature in any way. Internal factors pull quotes down, as well as the threat of a slowdown in world trade, but a strong dollar, based on high US statistics, looks like a favorite, especially when the demand for defensive assets decreases. The chances of a breaking through the level of 110.29 are increasing. The goal is 110.91.

The material has been provided by InstaForex Company - www.instaforex.com