"Everyone chooses his own path. And the more obvious the goal, the easier the path."

Good morning, dear colleagues!

As always with you, here is the forecast for the likely movement of the EUR/USD currency instrument.

Let's start by summing up the results of the past week, after which we will smoothly move on to the current week and end with the report and basic definitions. So here we go!

The trading session of the previous week, January 13-17, 2020, presented an "unusual" surprise - the price rose in the first half of the trading week, and after which it formed a "false breakdown" (the price closed just a couple of points above the local maximum, and subsequent testing which is already the support level, turned out to be successful. After which, the price already tested it as a resistance level and could be sold at Fibo 50% -61 / 8%), began to decline, breaking the local weekly lows at 1.1105. The price is now located below which. Why did I write an "unusual surprise"? It is all because I believe that a false breakdown is formed again at the moment and ...

And now it is time to talk about the prospects of the EUR / USD currency instrument for the current trading week. Since I wrote a little earlier that, in my opinion, the price formed a "false breakdown" again, and we will proceed from the forecast for the current week:

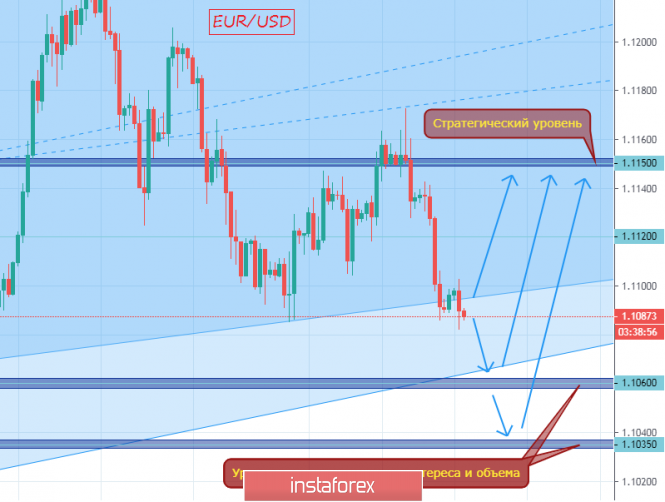

1. The strategic level is located in the region of 1.1150, which tells us about the likely growth of EUR / USD.

2. The medium-term trend is still upward.

3. A large cluster of levels with high open interest and high volumes is located at 1.1180 and above.

Well, dear colleagues, it would seem that you would not want to buy. But oh, if everything were so simple...

In fact, it is now necessary to determine the level-range to enter long positions. And here, there are 2 options:

1. The first option, as always, is the most common: entry when the price returns above the level of 1.1105. It is desirable that the return be on an increased volume, which will tell us that, the price will most likely knock down sellers' stops and they may well "roll over" in position.

2. The second option is not so obvious, since you can try to enter long positions only after a downward movement of prices in the area of high open interest and volumes. And such an area exists at 1.1035-1.1060, and you will not believe it - it also coincides with the line of the upward medium-term trend, and, as we well know, the classic signal to buy is testing the price of the line of the upward trend.

So, in fact, I explained my point of view on the issue of the likely "false breakdown" of the support level and the return of the price "for the pen with the bulls" to strategic goal 1.1150.

The previous forecast for EUR/USD on 01/10/2020 worked perfectly well!

"EUR/USD. BUY priority based on melon CME and classic VSA"

IMPORTANT! Remember that you should enter the market exclusively by patterns - by graphic patterns that are often repeated on the market. As a result of which, there is a certain pattern of price behavior in the future.

In my trading, I use patterns consisting of candlestick analysis and volume analysis. My favorite pattern is absorption on a sharply increasing volume, followed by testing up to 50% -61.8% Fibo.

The material has been provided by InstaForex Company - www.instaforex.com