The market was quiet and calm, while the United States was resting on the occasion of Martin Luther King's Day. No one wants to take risks and take early steps during the absence of American traders, who control most of the money circulating in the market. Moreover, there weren't any reasons that could set markets in motion. Thus, yesterday can safely be called a day off.

Today, there is something to work on, since the United Kingdom publishes labor market data for the release of the rested and amassed Americans. However, they are unlikely to be able to impress market participants, as the unemployment rate should remain unchanged. At the same time, other indicators of the state of the labor market will show some changes. In particular, employment can increase by 95 thousand, against 24 thousand in the previous month. In addition, the number of applications for unemployment benefits is likely to decline from 28.8 thousand to 26.0 thousand. So in general, the expectations are relatively positive. However, the growth rate of average wages, excluding premiums, should slow down from 3.5% to 3.3%, which will level the positive nature of employment data and applications for unemployment benefits. So in general, expectations on the data can be described as neutral.

Unemployment Rate (UK):

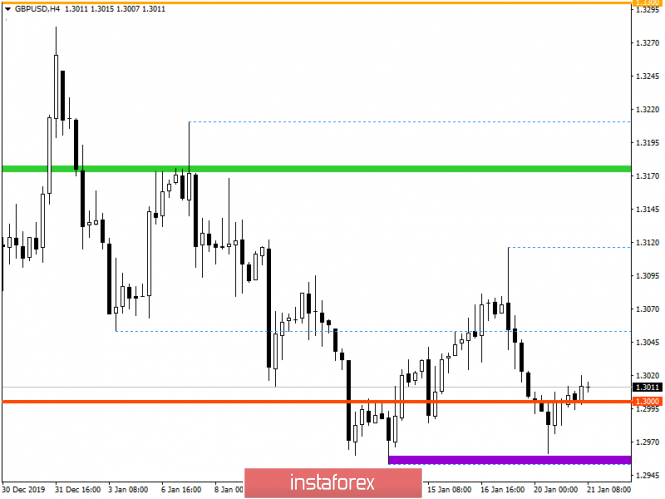

In terms of technical analysis, we see that the quote found a foothold in the region of the psychological level of 1.3000 after a significant inertial move, forming a pullback. In fact, we have already seen a similar development a week earlier, where the control level was not broken, but served as a deceleration range. Thus, the initial return of the price above the psychological level confirms the pattern.

Looking at the trading chart in general terms, we see a kind of compression of the quote, where the amplitude becomes narrower with each subsequent convergence with the range-psychological level.

It is likely to assume that the oscillation along the control level will continue, with a local move in the direction of 1.3050-1.3060, where subsequently the reverse move is not excluded.

Concretizing all of the above into trading signals:

- Long positions are considered in the form of local operations in the direction of 1.3050-1.3060.

- Short positions are considered in case of price fixing lower than 1.2955-1.2950.

From the point of view of complex indicator analysis, we see that the main signal flow is descending, but neutral interest appears due to ambiguous fluctuations along the psychological level.