The US labor market report was disappointing - 145 thousand new jobs were created, which was below the forecast of 160 thousand. The data for the previous 2 months were revised by 14 thousand downward. At the same time, the data on average wages look even weaker, an increase in December by 0.1% with a forecast of 0.3% and a decrease in annual growth from 3.1% to 2.9% worsen expectations for consumer inflation and increase the chances of another cut in the Fed rate in March 2020.

Therefore, leading indicators indicate that the slowdown is likely to develop. The number of new NFIB vacancies is falling and the number of worked overtime hours is noticeably reduced.

So far, the situation looks completely manageable for the Fed. There is no need for sudden movements, but some steps will be taken. This week, decisions will be made on new rates for the purchase of T-bills, as well as a new schedule of operations in the repo market.

Perhaps, the main driver for this week will be the trade negotiations between the US and China again since the probability of signing the document on Wednesday, January 15, looks high. Due to the fact that the specific terms of the agreement were not disclosed, directly opposite opinions are expressed about the possible reaction of the market to official signing.

The dollar looks weak at the beginning of the week and is likely to decline against most G10 currencies.

USD/CAD

The employment report in Canada in December turned out to be mixed, but it looks noticeably better against the backdrop of American non-farms and in fact is bullish for the Canadian. The number of employed increased in December more than forecasts. The unemployment rate declined from 5.9% to 5.6%, the negative is the decrease in average wages from 4.26% yoy to 3.84% yoy, which is still higher than in the USA.

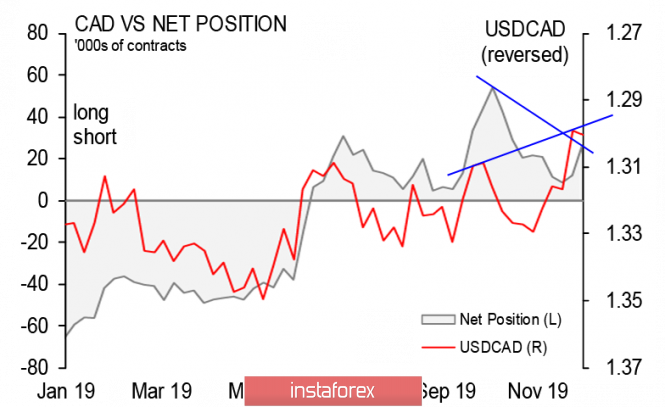

Meanwhile, the CFTC report released on Friday turned out to be unexpectedly positive for the Canadian dollar. The growth of geopolitical tensions did not lead to an increase in purchases of the dollar, and the demand for which, expressed through the positioning of major currencies, more than doubled compared to December 31, while there was no increase in the Swiss franc, as is usually the case in such cases. The total shortage for the yen declined, while the demand for the British pound increased, and for the Canadian dollar, there was a significant increase in bullish positions.

Given the quite strong correlation of the USD/CAD rate and the net speculative position, one cannot but notice a pronounced divergence - the total bullish position in CAD updated the one-year maximum, and the USD/CAD rate lags behind, so moving to 1.29 and further to 1.28 becomes quite logical.

The pullback from the local minimum of 1.2954 occurred against the backdrop of a sharp decrease in geopolitical tensions - the United States and Iran, apparently, will refrain from steps aimed at further escalation, which led to a sharp decrease in oil quotes.

Now, the loonie is unlikely to be configured for strong movements, given the "empty" calendar for CAD this week. Today, the Bank of Canada will publish its first study of consumer expectations, which will include data on consumer inflation, the labor market and financial conditions of households. The results of the survey will allow to adjust expectations following the meeting of the Bank of Canada on January 22.

BoC CEO Stephen Poloz said last week that the Central Bank will carefully examine labor market data to see if growth retardation is a trend or a temporary phenomenon.

In this regard, USD/CAD remains under bearish pressure. The threat of corrective growth to 1.3110 / 30 is not high, but the chances of updating the minimum of 1.2950 are growing. If the US inflation report on Tuesday will be worse than expected, then the movement of USD/CAD to 1.2830 may increase in the coming days.

USD/JPY

Deflationary factors continue to put pressure on the Japanese economy. The consumer confidence index continues to be around 8-year lows, the level of wages is below the 9-year average, and the expected rebound in household spending after the introduction of the new consumption tax rate in November did not happen - a decrease of 2% against the forecast of + 2.5% indicates that the Bank of Japan's problems are only growing with inflation.

As a result, USD/JPY rose to the boundary of the 109.7 channel again, and given the reduction in tension, growth could be expected, but the weakness of the dollar is too obvious to count on strong growth. Now, in the case of a breakdown of resistance, growth may stop at 110.2 or 110.5, but the chances of a return to the middle of the range of 109.05 / 15 look a little preferable so far.

The material has been provided by InstaForex Company - www.instaforex.com