The absence of important statistics from the United States and a decrease in panic about the spread of the virus contributed to corrective growth on Asian exchanges. Nevertheless, the general background remains neutral on Tuesday morning.

On the other hand, the demand in dollars is growing as a result of increasing uncertainty. The date of negotiations for the second phase of the US-China trade agreement has not yet been determined, the day of official registration of Brexit is approaching, and there are practically no positive signals of a macroeconomic nature. So today, the demand for protective assets is likely to increase.

NZD/USD

The RBNZ cut the rate three times in 2019 and steps to soften financial conditions were supposed to revive the economy. However, opinions on how these expectations are met are markedly different.

As an example, ANZ Bank is changing its rhetoric following a pessimistic scenario last year. According to them, forecast indicators have improved, the government has announced an increase in spending, the housing market has strengthened, and inflation looks as if it is approaching the target. As a result, there is no need to further reduce the rate, and if the market considers this position reasonable, then the kiwi will receive a strong impulse to continue growth.

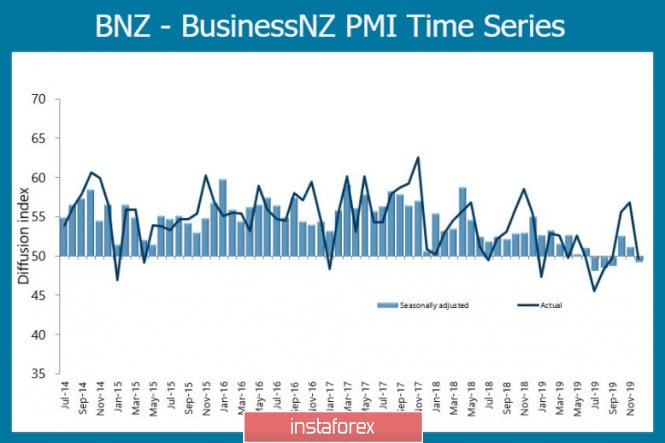

At the same time, recent business reports show that stabilization is still out of reach. Production PMI declined to 49.3p in December, and the average level in 2019 amounted to only 50.9p against 53.8p in 2018. Moreover, the trend is negative, despite a stable labor market. Accordingly, there are no signs that in the first half of 2020, but we can expect improvement will come.

In addition, PMI in the services sector sharply slowed down. It declined to 51.9p in December versus 53.3p a month earlier, and there were no signs of acceleration in the services sector either.

On the other hand, quarterly inflation report will be published on Friday, rising to 1.8% y / y, it is now one of the few factors holding back the decline. If the expectations are met, short-term growth is possible to 0.6625 / 35 or to 0.6650 / 60, where sales will begin again. It is more likely that NZD/USD will continue to decline, due to the fact that support 0.6570 / 75 is weak while support 0.6552 is slightly lower, which will not stand if inflation data turn out to be worse than expected.

AUD/USD

The Australian dollar looks somewhat more confident, since there are no obvious signals to slow down Australia's economy, but not everything is as good with the Aussie as we would like. Westpac consumer confidence index fell again in January, the trend is negative, and it is unclear what can stop it.

The main explanation is large-scale forest fires, as some subcomponents of the index look confident - optimism has grown regarding the state of global financial markets, the housing market is stable, and a decrease is observed only in the spectrum of economic components of the index.

The NAB retail sales index declined 0.1% in December, while the November indicator was revised from + 0.9% to + 0.5%, and even then, its growth is a result of Christmas sales, and not an increase in consumer activity. Judging by the survey, the mood is quite dull - unemployment is expected to increase, on the contrary, wages will grow slowly, and lower interest rates do not have any positive effect.

On Thursday, data on employment in December and January inflation expectations, forecasts are neutral with a slight margin of negativity.

AUD/USD dropped to important support 0.6837, where it may try to find a basis if panic in global markets due to coronavirus does not spread. There are no internal reasons for AUD growth. Growth is possible only due to the general revival of business activity and the apparent weakness of the US dollar.

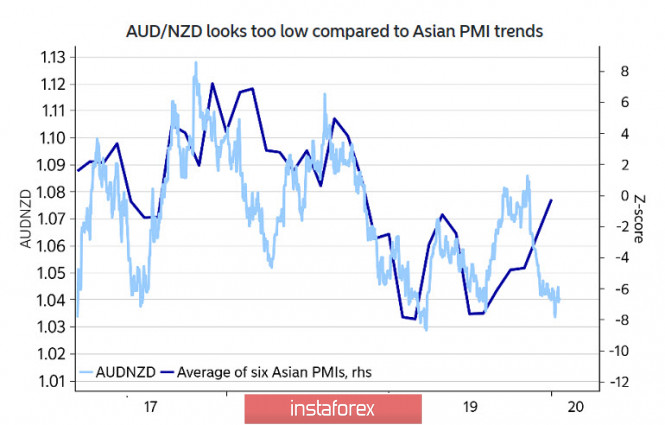

Additionally, you can pay attention to the fact that the AUD/NZD pair is too low relative to the average Asian PMI, with which it has a good correlation. Two ways out of this are possible: either an outstripping growth of AUD, if a general increase in optimism begins, or a sharp decline in PMI, if the panic develops and the threat of a global recession intensifies.