Yesterday, the pound was able to strengthen quite well, and it even kept the gains made. The most interesting thing is that this happened thanks to British macroeconomic statistics, which in recent times has been extremely rare.

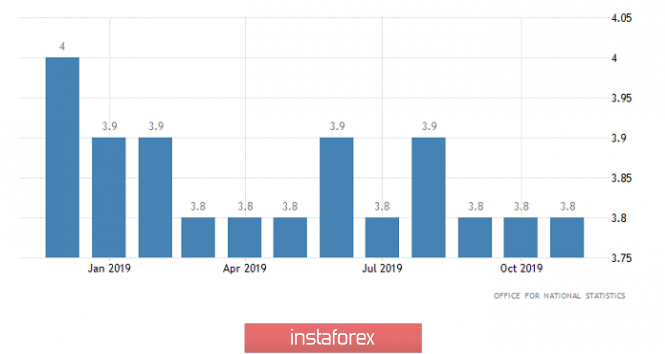

So, the reason for the pound's growth was the data on the labor market in the UK, which turned out to be significantly better than the most optimistic forecasts. Thus, the unemployment rate and the growth rate of average wages, taking into account premiums, remained unchanged. Also, at the previous value of 14.9 thousand, the number of applications for unemployment benefits remained. But the growth rate of the average wage, but without taking into account premiums, although it slowed down, but not from 3.5% to 3.3%, but to 3.4%. So the slowdown in wage growth is weaker than predicted. But what exactly inspired the market participants was employment, which grew by 208 thousand, while even the most daring forecasts predicted its growth by 104 thousand. As a result, we must admit that the data on the labor market were purely positive. This has already become a reason for talk that the Bank of England has no reason to lower the refinancing rate.

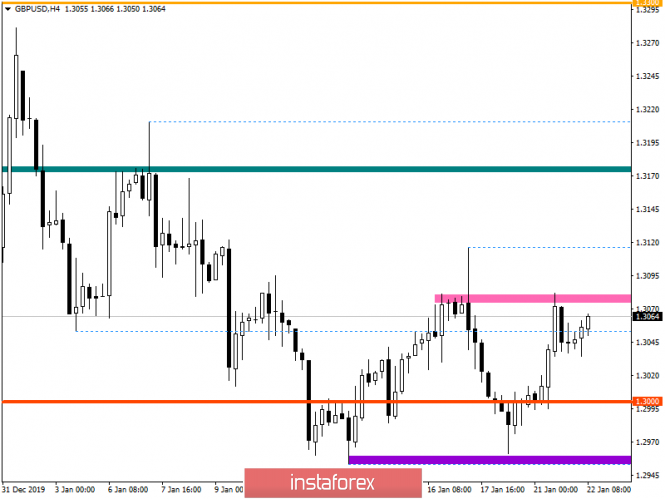

Unemployment Rate (UK):

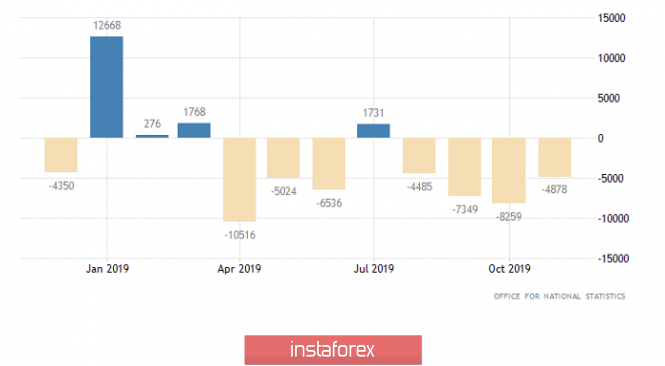

If you look at the single European currency, which first grew after the pound, and then returned, we can assume that the pound will face the same fate. However, during the European session, there was no reason to weaken the pound. Only data on public sector borrowing in the UK will be published, the total amount of which should be reduced by 4.6 billion pounds. A decrease in the debt burden will be perceived as a positive factor, which will support the pound.

Net public sector borrowing (UK):

But during the US session, the pound will still have to give up its positions. Data on the real estate market in the United States will add pressure. In particular, housing sales in the secondary market should increase by 1.1%. In addition, housing prices may rise by another 0.3%. That is, sales growth is expected, combined with rising prices, which is an extremely optimistic factor and will help strengthen the dollar.

Secondary Home Sales (United States):

In terms of technical analysis, we see another rebound from the psychological level of 1.3000, which leads to the area of variable resistance of 1.3080. In fact, we have a repeating series of patterns that took place at the previous measure. There were no cardinal changes; quotes still retain a downward interest, where the interacting level is 1.3000.

Considering the trading chart in general terms, we continue to consolidate a kind of compression of the quote, at the conditional peak of the medium-term upward trend [09/03/19-13.12.19].

It is likely to assume that the existing stagnation of 1.3035/1.3080 will not last long, where work should be carried out on the principle of breaking the borders. At the same time, if we focus on quotation fluctuations from the beginning of January, we will see that the probability of a return trip to the area of the psychological level of 1.3000 is still high.

Concretizing all of the above into trading signals:

- Long positions, we consider in case of price consolidation higher than 1.3085, local positions.

- Short positions, we consider in case of price consolidation lower than 1.3030, the main positions.

From the point of view of a comprehensive indicator analysis, we see that the indicators of technical instruments relative to minute and hour intervals have temporarily turned in the upward direction, having a local buy signal. The medium-term time span remains downward in the market.