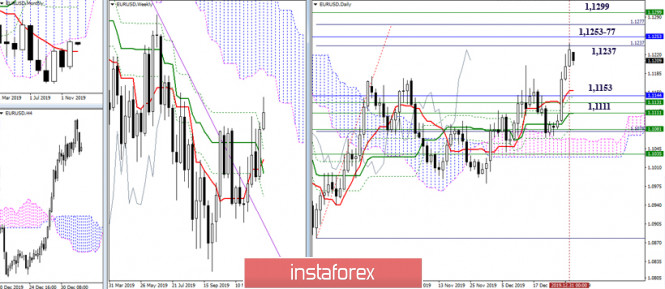

EUR / USD

Players on the upside managed to optimistically close the last month of the outgoing year. During the increase, the pair worked the first target of the daily target for the breakdown of the cloud (1.1237). This level was where we met the first resistance, which is a quite wide, zone of resistance (1.1237 - 1.1253 - 1.1277 - 1.1299). Now, passing these levels will allow the pair to penetrate the Ichimoku clouds at the most upper times (week - month), which will entail the formation of new upward prospects. At the same time, players on the upside can take a break having completed the tasks of closing the month and year. The nearest support zone is now in the area of 1.1153 - 1.1111 (daily cross + weekly cross + monthly Tenkan).

The development of the current correction has led the pair to lose support for the central pivot level (1.1222). At the moment, the first support of the classic Pivot levels (1.1205) is being tested for strength, and then the support is located at 1.1180 (S2) - 1.1163 (S3). Today, the closing and most important support is the weekly long-term trend which is located at 1.1148. To change the current balance of forces and the emergence of new opportunities for players to increase in this situation, you need to regain the central Pivot (1.1222) and leave the correction zone (1.1240).

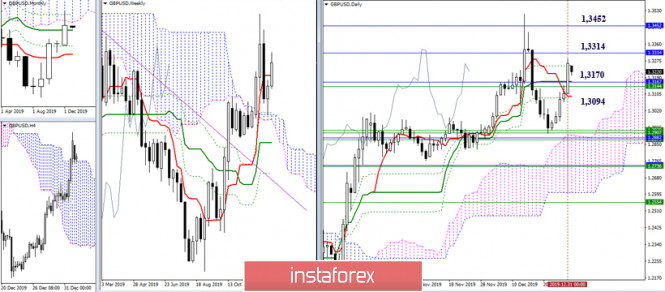

GBP / USD

Last December, the players on the upside managed to close above the monthly medium-term trend (1.3167), but the resistance met 1.3314 (the lower border of the monthly cloud) - 1.3452 (monthly Fibo Kijun) remained unfulfilled. Now, consolidation above will open up new horizons for players on the upside. At present, the pull is at the daily Fibo Kijun (1.3250), while nearest support is concentrated in the area of 1.3170-1.3094 (daily cross + weekly Tenkan + monthly Kijun).

Meanwhile, on the lower time-frames, the development of correction is observed. At the moment, the struggle is for the central Pivot level (1.3217). Further, the weekly long-term trend (1.3055), the nearest Pivot level S1 (1.3150) may act as intermediate support with the continuation of the decline on the way to the key reference point of the correction. Therefore, a conversation about the plans and opportunities for players on the upside will be possible after leaving the correction zone and consolidating above the maximum extremum (1.3284).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)

The material has been provided by InstaForex Company - www.instaforex.com