4-hour timeframe

Technical data:

The upper channel of linear regression: direction - upward.

The lower channel of linear regression: direction - sideways.

The moving average (20; smoothed) - sideways.

CCI: 37.3376

The British pound resumed its corrective movement and worked out the moving average line during the last trading day. Thus, the future of the pound-dollar pair will be decided today. If traders manage to overcome the moving average line, the strengthening of the British currency may continue although statistics from the UK continue to upset all market participants. If the bears hold the initiative in their hands, then a more attractive downward trend will resume. On Thursday, January 16, there will be no important macroeconomic publications in the UK. Thus, the attention of traders will be focused only on the most important report on retail sales in the United States.

We have already listed several times the reasons why the British pound may continue to fall in price in 2020, despite the seemingly end of the Brexit epic. Now the issue of a trade agreement with the European Union is on the agenda. Most of the world's experts say almost in unison that it is simply impossible to agree and ratify such a large agreement in 11 months, or it will be extremely superficial. Only Boris Johnson remained optimistic about this issue. However, today, it was reported that the British Prime Minister himself doubts that London will be able to reach an agreement with Brussels in 2020. During the November-December election campaign, Boris Johnson said that "a deal with the EU will be concluded in almost any case." Now his rhetoric is slowly beginning to change. The Prime Minister began to have doubts. Well, if even Boris Johnson is in doubt, then it's time for UK business, which is already going through its worst times, to start worrying even more. After all, if the UK does not agree with the EU, then from January 2021, Britain will trade with the Alliance under WTO rules, that is, with duties, checks, and paperwork. However, Boris Johnson continues to stand by his position, which does not imply an extension of the "transition period". He said this last week to the head of the European Commission, Ursula von der Leyen. In turn, Ms. von der Leyen said that the probability of a deal being concluded in 11 months is extremely low and that both sides need to consider extending the period during which negotiations will be conducted. Later, the head of the European Commission also repeated that the UK's access to the single European market will depend on how London is ready to comply with EU rules and regulations. Earlier, Brussels also said that London cannot rely on the same terms of trade as the other EU Member States.

Is it necessary to say that such information is only a source of new potential problems for the UK and the British pound? We have already said what problems the UK business is experiencing now, many large international corporations are moving their production outside the Kingdom. If there is no trade deal, there will be even more problems in the economy of Albion. The Bank of England, which is due to lower its key rate soon, will then have a very meager set of tools to influence monetary policy in the future. In general, as we have stated more than once, Brexit has not started yet, and the UK economy is already experiencing serious problems. Yesterday, for example, the inflation report showed another drop in this indicator, and retail sales for December will be published tomorrow.

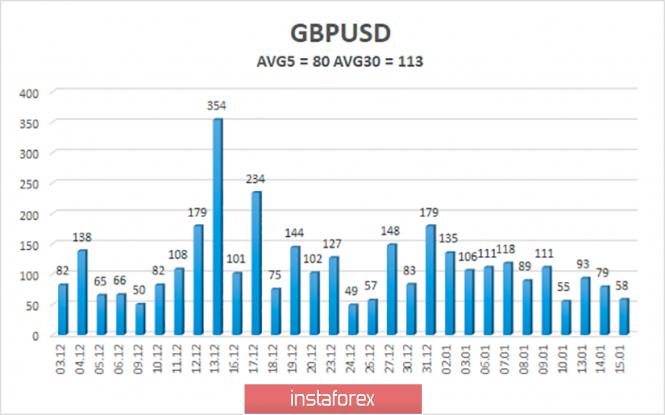

The average volatility of the pound-dollar pair over the past 5 days is 80 points and continues to decline. According to the current volatility level, the working channel on January 16 is limited to the levels of 1.2955 and 1.3115, and we still believe that the pair will seek to work out the lower limit of the volatility channel. The Heiken Ashi indicator can signal the end of the current correction by turning down.

Nearest support levels:

S1 - 1.3000

S2 - 1.2939

S3 - 1.2878

Nearest resistance levels:

R1 - 1.3062

R2 - 1.3123

R3 - 1.3184

Trading recommendations:

The GBP/USD pair continues to be adjusted. Thus, traders are advised to wait until the correction is completed and sell the pound again with the goals of 1.3000 and 1.2955, provided the price is located below the moving average line. It is recommended to buy the British currency not before the pair returns above the moving average with the first goal of 1.3115, but even in this case, it should be remembered that the fundamental background is not on the side of the pound.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator regression window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com