The euro reacted negatively to a report from Ifo Institute, which indicated that the German business sentiment index had declined, reflecting problems and is a warning to those investors and economists who spoke about the restoration of the German economy in the near future at the end of 2019. As the first reports show, it will hardly be possible to count on a serious breakthrough in growth rates in the first quarter of 2020. Back in November-December, when a trade agreement was reached between the US and China, or rather its first phase, traders perked up, expecting that the problems in the manufacturing sector of the eurozone countries would disappear on their own. Britain was also optimistic about its orderly exit from the EU. However, the report of some experts says that these global changes only reduce downward risks, but in no way create new incentives for growth, since both the trade agreement and the resolution of the Brexit situation are only partially resolved.

According to recent data, the activity of the manufacturing sector in Germany only slightly increased, but the decline continues. Equally important, both the service sector and the construction sector also showed weaker growth rates earlier this year.

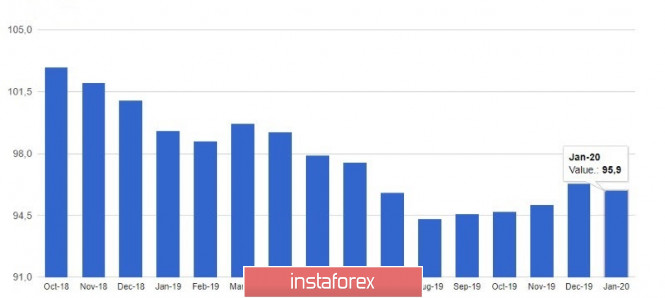

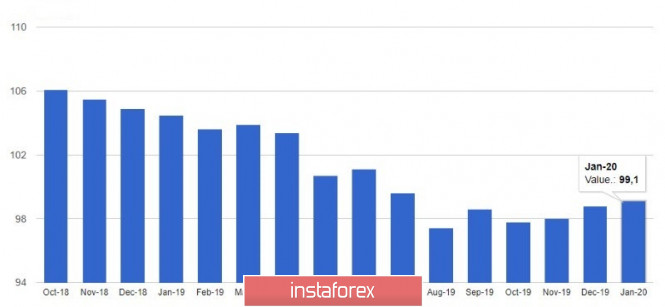

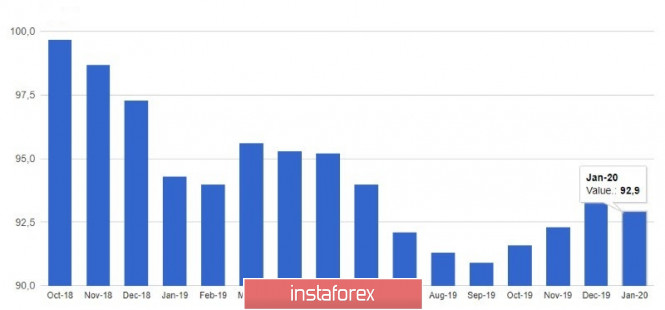

As I noted above, sentiment in German business circles deteriorated in January. This is evidenced today by published data from the Ifo Institute. Thus, the mood index in German business circles fell to 95.9 points in January from 96.3 points in December 2019. Economists had expected the index to rise to 97.0 points. It is clear that companies' expectations regarding their prospects worsened at the end of the year, which is unlikely to have a favorable effect on the country's economic indicators. The current conditions index in January 2020 rose to 99.1 points from 98.8 points in December 2019, but the expectations index also fell to 92.9 points from 93.9 points. Economists had expected index growth to 99.3 and 94.9, respectively.

The service sector, which is so far emphasized, also shows the first signs of weakening. Thus, the indicator of sentiment in the service sector in January of this year significantly dropped after reaching its six-month high in December. However, this did not put strong pressure on risky assets, and the EURUSD pair remained trading at around its morning levels, showing very low activity. The prospects for the recovery of the euro will continue to depend directly on the data on the US real estate market and on the level of 1.1040, since only through the return of this range will buyers of risky assets be allowed to return to 1.1070 and update 1.1110. If the pressure remains and there is no activity among major players in the area of 1.1040, we can expect a bearish trend to continue to the lows of 1.1000 and 1.10960.

Oil

Oil quotes slightly rebounded from their daily WTI lows near $52 per barrel after news of intense negotiations within OPEC and Russia on cutting production levels by the end of 2020 appeared. Let me remind you that at the end of the year the OPEC+ coalition, consisting of a cartel, Russia and other oil-producing countries, agreed to further reduce production by 500,000 barrels per day to 1.7 million barrels per day. The next meeting was scheduled for March, but, apparently, will take place earlier. A serious drop in oil quotes from $59 to $52 last week is due to the deadly virus that hit China. We are talking about the spread of Coronavirus, which may affect the consumption of oil by the Chinese side in the future. According to representatives of the cartel, they are already discussing response anti-crisis measures that could lead to a larger reduction in production, or to extend the term of restrictions until the end of 2020.

The material has been provided by InstaForex Company - www.instaforex.com