4-hour timeframe

Amplitude of the last 5 days (high-low): 57p - 148p - 83p - 179p - 135p.

Average volatility over the past 5 days: 121p (high).

The pound sterling lost almost two cents in the first two trading days of 2020 and this is far from the limit. The British currency will be prone to a new fall in the first and second months of 2020. Almost all factors testify to this. For example, technical. After the pound/dollar pair soared to the level of 1.3500 (completely unreasonable), there was a pullback, then a correction against this pullback, which amounted to 61.8%, so now traders are ready for the second wave of sales, which should be no less strong than the first wave. Thus, according to the most conservative estimates, the pound quotes should fall below 1.2900. The fundamental picture says roughly the same thing. The pound still simply does not have fundamental grounds for strengthening. Brexit looms on the horizon ... no, not that. The disordered Brexit looms again on the horizon and now the opposition forces of the British Parliament will not be able to stop it: all power is concentrated in the hands of Conservatives who will support any initiative of Boris Johnson. The "hard" Brexit, with which the absence of a trade deal with the European Union is now identified, is a catastrophic blow to the economy of Great Britain, which is already facing what is known as far from its best times. Recent data on business activity in the manufacturing sector confirms this. In addition to these two factors, there is another factor - speculative. Traders raised the pound quite high and, most likely, realizing the groundlessness of such growth, used those levels for large sales, which will now be fueled by other traders who will support the emerging trend. Thus, from our point of view, there is only one road for the pound - down.

Meanwhile, Johnson, who had previously blocked the possibility of extending the duration of the transition period, is beaming with the desire to continue trading with the European Union after Brexit. Next week, European Commissioner Ursula von der Leyen will arrive in London for the most likely preliminary negotiations. Johnson believes that 11 months is enough to agree on new trading conditions. However, the British prime minister seems to be the only one who thinks so. Throughout 2020, the UK will have uniform European trade standards. Until July 1, 2020 London has an official and legal opportunity to extend the transition period for another two years, after July 1 - it will end anyway on December 31, 2020, after which the trade rules for third countries will be applied to the UK. That is, London will lose all trade preferences and, if no agreement is reached by that time, will begin to incur losses due to high duties on non-EU goods.

Johnson himself is optimistic about the future. He said: "Saying goodbye to 2019, we can turn the page with the disagreement, hostility and uncertainty caused by Brexit. We are starting a new chapter in the history of our country, where we will unite and move forward, revealing the potential of the British people." Johnson also once again reminded that the country's main goal is to leave the EU, after which all government forces will be directed to the development of the health care system, education and improving security.

The Labour Party, having suffered a crushing defeat in the elections, proposes to extend the transition period until 2023, if it is not possible to reach an agreement with the EU before July 1, 2020. The report says that this is necessary to prevent the unsettled Brexit. However, as many experts say, this proposal is already doomed to failure, since the Conservatives have the "majority government" in their hands.

The technical picture now almost unambiguously indicates a continued downward movement. The sell signal from Ichimoku dead cross is weak at the moment, however, the price is located inside the cloud and its lower boundary is now the Senkou Span A line, which is not strong support or resistance. Thus, problems with overcoming this line should not arise. The volatility of the GBP/USD currency pair remains quite high.

Trading recommendations:

GBP/USD continues to move down. Thus, at the moment, traders are advised to sell the pair with targets at 1.0101 and 1.2950. These goals will be specified tomorrow morning. So far, you can sell the pair in small lots, since the dead cross is still weak. However, we believe that the probability of continued downward movement is 90%. It is recommended that purchases of British currency be returned no earlier than when the price is consolidated above the Kijun-sen line.

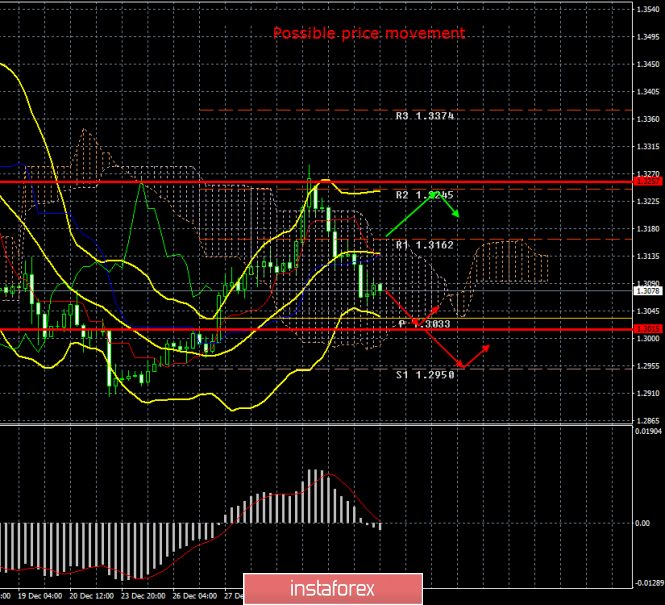

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

Support / Resistance Classic Levels:

Red and gray dotted lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movement options:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com