The euro-dollar pair fell into the zone of price turbulence on Friday: demand for the US currency significantly increased in the morning, amid the assassination of a senior Iranian military leader. However, then the bulls of the pair began to gradually win back their positions, and even updated the high of the day. However, at the close of the trading week, the bears seized the initiative again, not allowing buyers to return to the 12th figure. As a result, the pair ended the trading day in almost the same positions where it started (open - 1.1172; close - 1.1160). And apparently, the next week will be no less volatile, given the possible consequences of the elimination of the Iranian general.

But first of all, we'll figure out why the euro-dollar pair unexpectedly unfolded on Friday, despite the dominance of anti-risk sentiment in the foreign exchange market. Oddly enough, macroeconomic releases still managed to attract the attention of traders. Although, as a rule, during periods of geopolitical tensions, economic reports fade into the background, waiting "in the wings". But we saw an exception to the rule on Friday: the European currency received support thanks to German statistical data, while the dollar collapsed throughout the market due to the extremely weak ISM report. This combination of fundamental factors helped the EUR/USD bulls to stay afloat, leveling the pressure of dollar bulls.

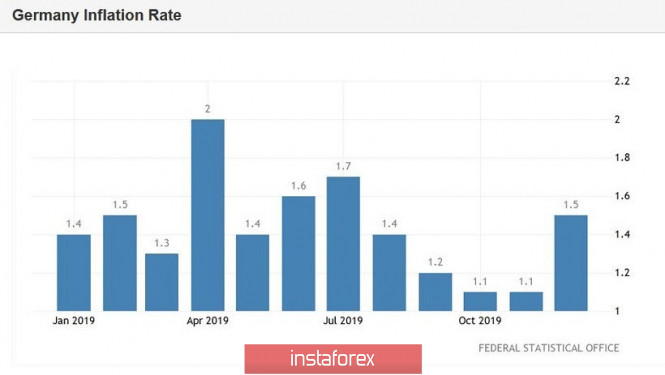

German inflation really pleased investors. This report is especially important now, in anticipation of the release of data on the growth of pan-European inflation (these data will be published on Tuesday, January 7). According to the consensus forecast, the general consumer price index in the eurozone will rise to 1.3%, after the previous increase to a one percent mark. Core inflation should also show a positive trend, rising to 1.4% (multi-year high). Such a result will provide strong support for the euro, therefore, the traders' special attention was riveted to the dynamics of German inflation.

The result exceeded expectations: in December inflation in Germany rose to 0.5% MOM and 1.5% YOY (with a forecast of growth to 0.4% and 1.4% respectively). The harmonized consumer price index also ended up in the green zone: 0.6% MOM and 1.5% YOY. In monthly terms, the indicators showed the strongest dynamics since April last year. In annual terms, indicators also reached multi-month highs. All this suggests that pan-European inflation may exceed forecast values, although the forecast for December itself looks quite strong.

But US statistics again disappointed. Production indicators have recently left much to be desired, and this fact puts background pressure on dollar bulls. Yesterday, this pressure significantly increased. The fact is that the US manufacturing ISM unexpectedly collapsed to 10-year lows in December, reaching 47.2 points. The index is below the key 50-point mark since August, and a consistent downward trend has been observed since April last year. According to forecasts, the indicator should have grown a little - from 48.1 to 49 points, but de facto fell to multi-year lows (the weakest result since June 2009). Such a significant decline in the overall index was due primarily to a decrease in production - the corresponding index collapsed to 43.2 points, after rising to 49.1 in November. After this release, the dollar index slowed down, allowing the EUR/USD bulls to regain lost ground. And although the price component of the ISM index has significantly grown (to the 51st point), this fact did not affect the reaction of dollar bulls.

Thus, both long and short positions on the EUR/USD pair looked risky on Friday. The dollar balances between the pressure of negative macroeconomic reports and the influence of anti-risk sentiment. Which factor will prevail next week is unknown. Much will depend on Tehran's further actions.

Iran's Permanent Representative to the UN, Majid Taht-Ravanchi, in an interview with CNN, has already said that the United States have actually declared war on his country, while emphasizing that "a military action will be the answer to a military action." Meanwhile, many analysts doubt that the liquidation of General Kassem Suleimani will lead to a direct clash of Iranians with the Americans or to large-scale hostilities in the Middle East. Most likely, according to political analysts, militarized organizations associated with Iran can attack infrastructure and/or diplomatic facilities in Saudi Arabia or Israel. If Tehran will resort to larger-scale (deadly) actions in relation to American citizens, then the anti-risk sentiment in the market will noticeably increase, as traders in this case will expect a response from Washington already.

From a technical point of view, last week the EUR/USD pair was able to stay between the middle and upper lines of the Bollinger Bands indicator, as well as above all the lines of the Ichimoku indicator, which continues to demonstrate the bullish Parade of Lines signal. This suggests that the pair maintains the growth potential to the nearest upward target - 1.1240 (the high of the current year and a 4-month price high). This scenario will acquire real features in the event of a decrease in anti-risk sentiment amid rising European inflation (the corresponding release, I remind you, is scheduled for January 7).

The material has been provided by InstaForex Company - www.instaforex.com