Forecast for January 8:

Analytical review of currency pairs on the scale of H1:

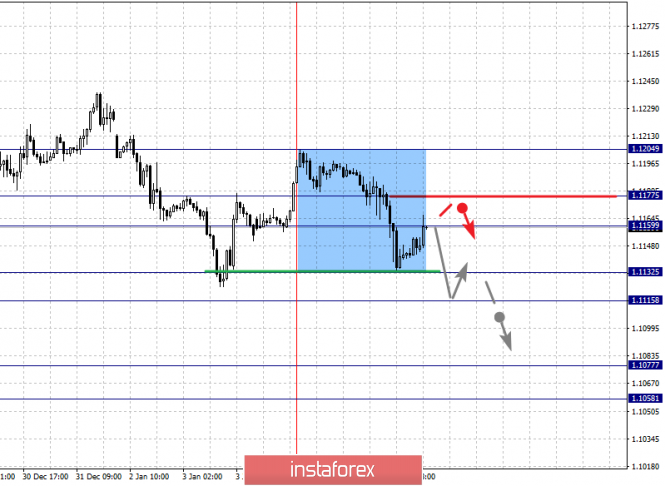

For the euro / dollar pair, the key levels on the H1 scale are: 1.1204, 1.1177, 1.1159, 1.1132, 1.1115, 1.1077 and 1.1058. Here, the price canceled the development of the upward structure from January 3 and at the moment, we are following the local downward structure from January 6. Short-term movement to the bottom is expected in the range of 1.1132 - 1.1115. The breakdown of the last value should be accompanied by a pronounced movement to the level of 1.1077. For the potential value for the bottom, we consider the level of 1.1058. After which, we expect consolidation as well as a pullback to the top.

Short-term upward movement is possibly in the range of 1.1159 - 1.1177. The breakdown of the latter value will have the potential to develop an upward structure. In this case, the first goal is 1.1204.

The main trend is the local descending structure of January 6

Trading recommendations:

Buy: 1.1160 Take profit: 1.1174

Buy: 1.1180 Take profit: 1.1204

Sell: 1.1132 Take profit: 1.1117

Sell: 1.1113 Take profit: 1.1080

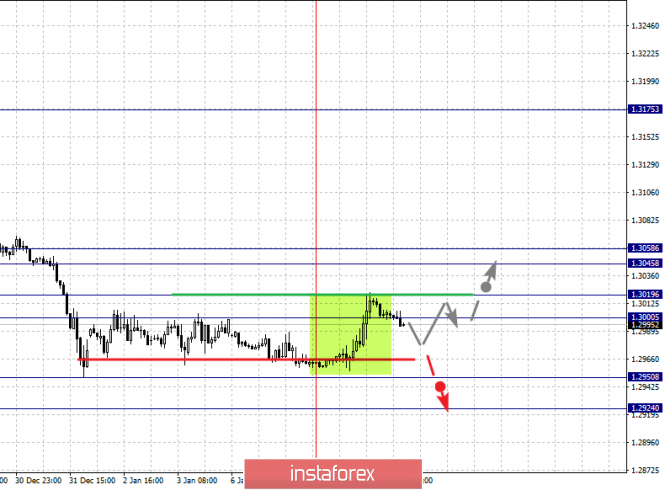

For the pound / dollar pair, the key levels on the H1 scale are: 1.3417, 1.3338, 1.3282, 1.3199, 1.3097, 1.3061 and 1.3006. Here, we are following the development of the ascending structure of December 23. At the moment, the price is in the zone of initial conditions. The continuation of the movement to the top is expected after the breakdown of the level of 1.3200. In this case, the target is 1.3282. Short-term upward movement, as well as consolidation is in the range of 1.3282 - 1.3338. For the potential value for the top, we consider the level of 1.3417. Upon reaching which, we expect a pullback to the bottom.

Consolidated movement is possibly in the range of 1.3097 - 1.3061. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3006. This level is a key support for the top.

The main trend is the upward structure of December 23

Trading recommendations:

Buy: 1.3200 Take profit: 1.3280

Buy: 1.3283 Take profit: 1.3336

Sell: 1.3097 Take profit: 1.3061

Sell: 1.3058 Take profit: 1.3008

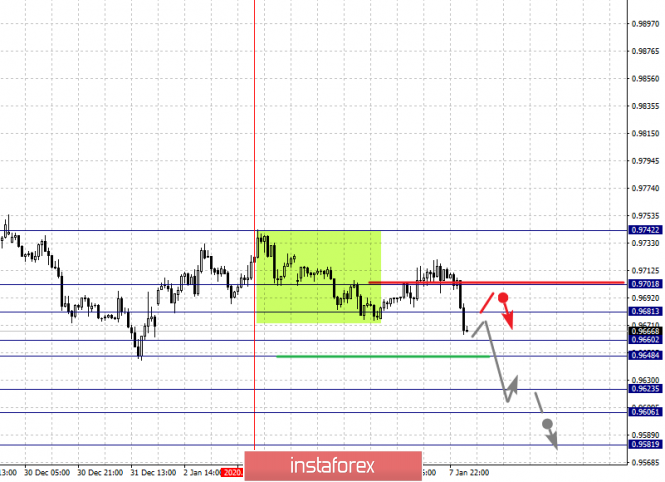

For the dollar / franc pair, the key levels on the H1 scale are: 0.9742, 0.9701, 0.9681, 0.9660, 0.9648, 0.9623, 0.9606 and 0.9581. Here, we determined the subsequent targets for the downward movement from the local structure on January 3. The continuation of the movement to the bottom is expected after the price passes the noise range 0.9660 - 0.9648. In this case, the target is 0.9623. Price consolidation is in the range of 0.9623 - 0.9606. For the potential value for the bottom, we consider the level of 0.9581. Upon reaching which, we expect a pullback to the top.

Short-term upward movement is possibly in the range of 0.9681 - 0.9701. The breakdown of the latter value will favor the development of the upward structure. In this case, the first target is 0.9742.

The main trend is the downward local structure of January 3

Trading recommendations:

Buy : 0.9681 Take profit: 0.9700

Buy : 0.9705 Take profit: 0.9740

Sell: 0.9648 Take profit: 0.9625

Sell: 0.9621 Take profit: 0.9607

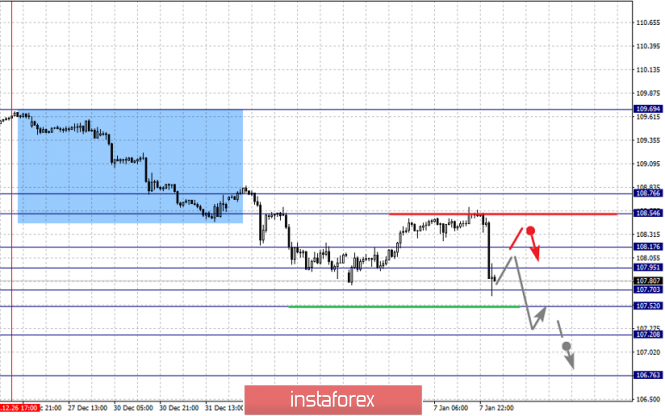

For the dollar / yen pair, the key levels on the scale are : 108.76, 108.54, 108.17, 107.95, 107.70, 107.52, 107.20 and 106.76. Here, the subsequent objectives for the downward trend are determined from the medium-term downtrend on December 26. The continuation of the movement to the bottom is expected after the price passes the noise range 107.70 - 107.52. In this case, the target is 107.20. Price consolidation is near this level. The breakdown of the level of 107.20 should be accompanied by a pronounced downward movement to the potential value - 106.76.

Short-term upward movement is possibly in the range 107.95 - 108.17. The breakdown of the last value will lead to an in-depth correction. Here, the target is 108.54. We consider the level of 108.76 as potential for the top. We expect the initial conditions to be formed for the upward cycle before it.

Main trend: medium-term downward structure of December 26

Trading recommendations:

Buy: 107.95 Take profit: 108.15

Buy : 108.18 Take profit: 108.54

Sell: 107.52 Take profit: 107.25

Sell: 107.18 Take profit: 106.76

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3058, 1.3045, 1.3019, 1.3000, 1.2950 and 1.2924. Here, we are following the development of the local descending structure of December 23. The continuation of movement to the bottom is expected after the breakdown of the level of 1.2950. In this case, the target is 1.2924. We expect a key reversal to the correction from this level.

Short-term upward movement is possibly in the range of 1.3000 - 1.3019. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3045. The range 1.3045 - 1.3058 is a key support for the downward structure. We expect the initial conditions for the upward cycle to be formed before it.

The main trend is the local descending structure of December 23

Trading recommendations:

Buy: 1.3005 Take profit: 1.3017

Buy : 1.3020 Take profit: 1.3045

Sell: 1.2950 Take profit: 1.2926

Sell: Take profit:

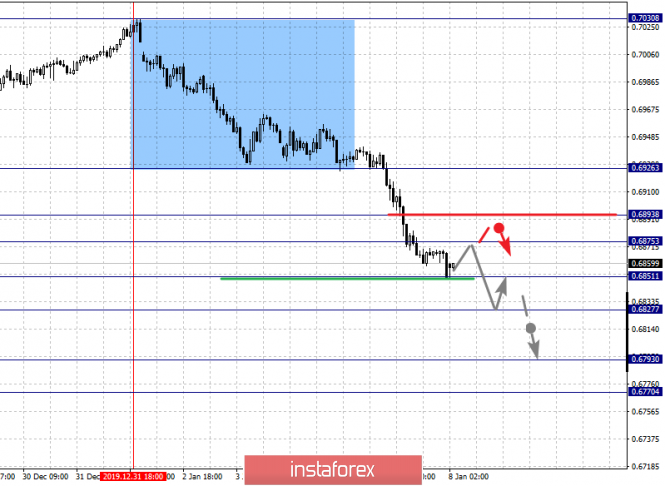

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6926, 0.6893, 0.6875, 0.6851, 0.6827, 0.6793 and 0.6770. Here, we continue to monitor the development of the downward cycle of December 31. Short-term downward movement is expected in the range 0.6851 - 0.6827. The breakdown of the last value should be accompanied by a pronounced downward movement. In this case, the target is 0.6793. For the potential value for the bottom, we consider the level of 0.6770. Upon reaching this level, we expect consolidation, as well as a rollback to the top.

Short-term upward movement is expected in the range 0.6875 - 0.6893. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.6926. This level is a key support for the descending structure of December 31.

The main trend is the descending structure of December 31

Trading recommendations:

Buy: 0.6875 Take profit: 0.6890

Buy: 0.6895 Take profit: 0.6922

Sell : 0.6850 Take profit : 0.6830

Sell: 0.6825 Take profit: 0.6795

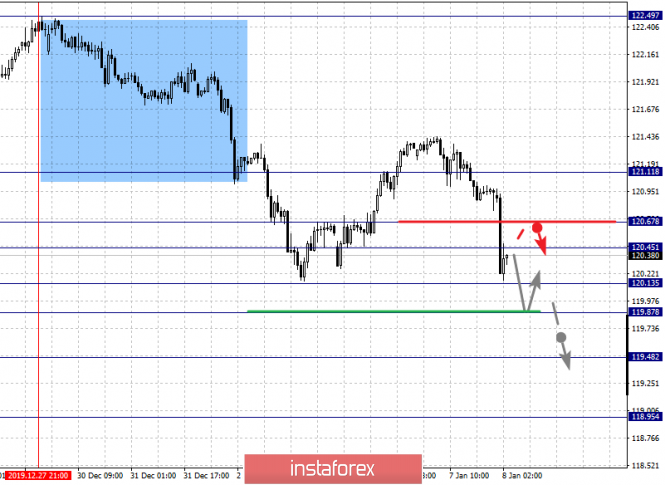

For the euro / yen pair, the key levels on the H1 scale are: 121.11, 120.67, 120.45, 120.13, 119.87, 119.48 and 118.95. Here, the next objectives for the downward movement we determine from the medium-term downward structure on December 27. Short-term movement to the bottom is expected in the range of 120.13 - 119.87. The breakdown of the last value should be accompanied by a pronounced downward movement. In this case, the target is 118.95. We expect a rollback to correction from this level.

Short-term upward movement is possibly in the range of 120.45 - 120.67. The breakdown of the latter value will lead to an in-depth correction. Here, the goal is 121.11. This level is a key support for the downward structure.

The main trend is the medium-term downward structure of December 27

Trading recommendations:

Buy: 120.45 Take profit: 120.65

Buy: 120.70 Take profit: 121.10

Sell: 120.13 Take profit: 119.88

Sell: 119.85 Take profit: 119.50

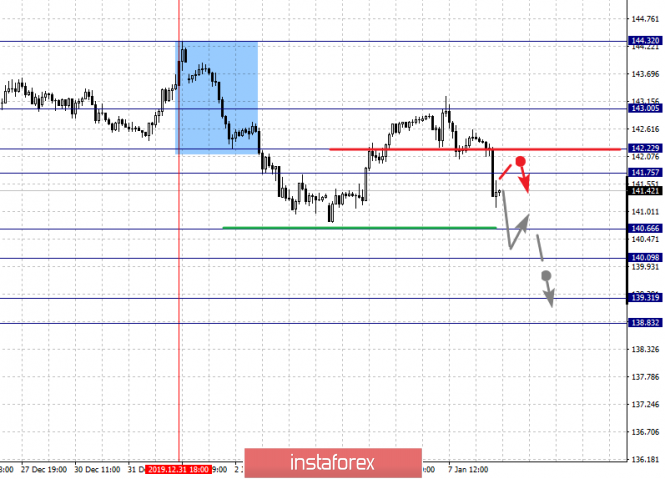

For the pound / yen pair, the key levels on the H1 scale are : 143.00, 142.22, 141.75, 140.66, 140.09, 139.31 and 138.83. Here, we are following the descending structure of December 31 as the main initial conditions. Short-term movement to the bottom is expected in the range of 140.66 - 140.09. The breakdown of the last value should be accompanied by a pronounced downward movement. In this case, the target is 139.31. For the potential value for the bottom, we consider the level of 138.83. Upon reaching which, we expect consolidation, as well as a rollback to the top.

Short-term upward movement is possibly in the range of 141.75 - 142.22. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 143.00. This level is a key support for the bottom.

The main trend is the descending structure of December 31

Trading recommendations:

Buy: 141.75 Take profit: 142.20

Buy: 142.25 Take profit: 143.00

Sell: 140.66 Take profit: 140.10

Sell: 140.05 Take profit: 139.35

The material has been provided by InstaForex Company - www.instaforex.com