4-hour timeframe

Amplitude of the last 5 days (high-low): 28p - 44p - 34p - 41p - 44p.

Average volatility over the past 5 days: 39p (weak).

The EUR/USD pair ends the penultimate trading day of the week with a decline. From our point of view, this fall is simply obliged to receive development. Again, we are forced to list a whole list of factors that argue that the euro should decline. Let's start with the technical ones. The euro/dollar pair with grief in half overcame the critical line, formed a weak Golden Cross, hardly entered the Ichimoku cloud and was unable to overcome the Senkou Span B. line. At the moment, the pair's quotes have returned to the critical line. All this speaks in favor of the fact that the bulls do not have enough strength to form a new upward trend. We add average volatility here that has decreased to the value and it becomes clear that traders are slowly leaving the market, and not the other way around. We have listed the fundamental factors a great many times. The general fundamental background remains unchanged, clearly in favor of the dollar. To some extent, it can be noted that the signing of the first phase of the trade agreement between China and the United States plays into the hands of the euro currency, but this is a very subtle and ambiguous factor.

In any case, given the average volatility, we can say with more confidence that the signing of the deal did not help much of the currencies. Macroeconomic data also continues to delight buyers of the US currency, and upset investors in euros. Today in Germany the consumer price index for December was published, which has not changed compared to November and amounted to 1.5% YOY. There was no particular market reaction to it since there were no changes in this indicator. At the same time, NOT improving the situation in the locomotive of the European economy speaks in favor of the fact that pan-European inflation is unlikely to accelerate in December. The consumer price index in the EU will be published tomorrow, forecast +1.3% YOY. What do we have on the basis of inflation indicators? Inflation is weak in Germany, while it is extremely weak in the EU (and this is even taking into account the acceleration in recent months from 0.7% to 1.3%). What do we have in the United States? Inflation accelerated to 2.3% YOY. It seems that the only factor that restrains the euro from a new sharp fall is the fact that one of the currencies cannot constantly fall in price. Pullbacks, corrections are required, even if the fundamental background does not change. This is what the euro is saving now, as it was saving throughout 2019. A report on retail sales was also published in the United States today, which exceeded forecast values and amounted to +0.3% MOM. The "retail control group" increased by 0.5%, as well as retail sales excluding automobiles by 0.7%. It remains only to wait for the speech of Christine Lagarde and evaluate her rhetoric ...

Meanwhile, many analysts and experts continue to analyze the agreement between Beijing and Washington, trying to understand many issues. One of these questions is: "Can we assume that China has succumbed to American oppression?" To some extent, the answer is yes. However, this concession will benefit China, the United States, and the whole world. Now, traders need to focus their attention on pressing issues, and not on signing the "first phase", discussing the "second phase". It should be recognized that the topic of the trade war practically had no direct effect on the foreign exchange market for a year and a half . It had an impact through the economic indicators of the European Union and the United States (if we talk about the euro/dollar pair). As a result of this period of time, the European economy weakened, and the US sustained a blow thanks to three reductions in the Federal Reserve's key rate. Thus, the US currency has excellent reasons to continue to rise in price, and traders need to pay more attention to macroeconomic statistics.

Trading recommendations:

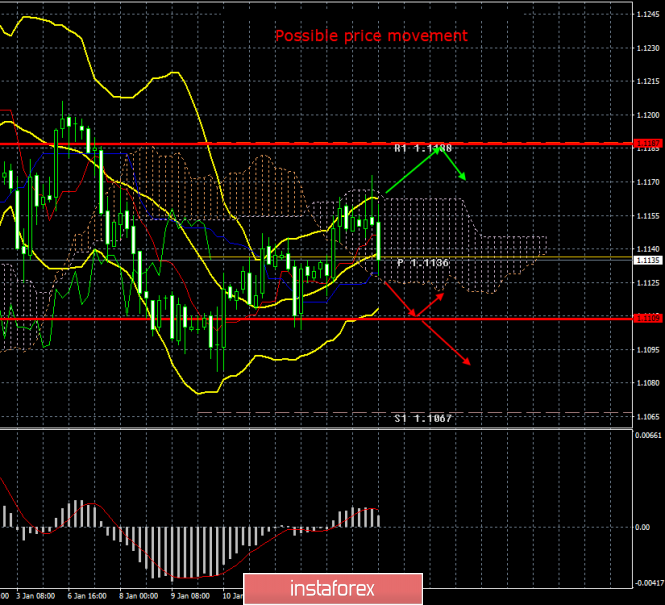

The EUR/USD pair continues to adjust and has failed to overcome the Senkou Span B. line. Thus, now it is recommended for traders to wait for the pair to consolidate back below the Kijun-sen line and resume trading on the decline with targets at 1.1109 and 1.1067. It will be possible to consider purchases of the euro/dollar pair no earlier than when traders of the Senkou Span B line have overcome the first goal, the resistance level of 1.1188.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

Support / Resistance Classic Levels:

Red and gray dotted lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movements:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com