The yen is trading restrained, being within the 109th figure in anticipation of the December meeting of the Bank of Japan. As you know, the Japanese currency is primarily affected by the external fundamental background, while the most worrying issues for traders (trade war and Brexit) have received temporary permission at the moment. As a result, the yen froze in place, awaiting the outcome of the last meeting of the Japanese regulator this year.

Throughout 2019, the head of the Bank of Japan Haruhiko Kuroda repeated with enviable regularity that the Central Bank was ready to apply further easing of monetary policy, expanding incentives and lowering the interest rate. However, verbal interventions had little effect on the position of the Japanese currency - the market was mainly used to such rhetoric, which had no practical consequences. In addition, recent trends in the Japanese economy suggest that the regulator is unlikely to realize its threats at the December meeting, especially given the fiscal stimulus from the state against the backdrop of a temporary armistice of the United States and China in a trade conflict.

Let me remind you that GDP increased immediately by 1.8% in annual terms during the third quarter. This result surprised investors, because the Japanese economy grew only by 0.2% according to initial estimates, while most experts expected to see growth of 0.6%. Nevertheless, the revised data exceeded even the most optimistic forecasts. Now, if we talk about quarterly calculation, then the situation is similar - according to revised data, the country's GDP grew by 0.4%, whereas initially it was reported only 0.1% growth. The structure of indicators indicates a significant increase in business investment - this indicator jumped 1.8% in quarterly terms with a growth forecast of 1.4%. The consumption level also increased. This indicator rose to 0.5% in the third quarter.

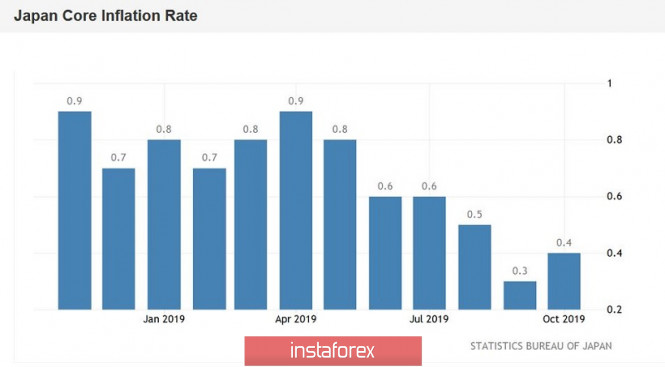

Meanwhile, inflation also showed positive dynamics in the last study period, although not as strong as GDP indicators. Thus, the consumer price index excluding the cost of fresh food (the main indicator for the Japanese regulator) in October increased by 0.4% year on year after rising 0.3% in September. However, this dynamics did not come as a surprise to most experts, since the indicator reached the forecast level.

According to some experts, a sharp increase in consumer spending in Japan is a temporary phenomenon, as this trend was recorded in anticipation of an increase in sales tax from 8% to 10% (the tax took effect on October 1). The last time this tax was raised 5 years ago, after which consumer sentiment worsened significantly. This time, the cabinet of ministers envisioned such a scenario: the government exempted a certain list of food products and soft drinks from the increased rate. However, there is a risk that consumer demand will show a downward trend in the near future, leaving the Japanese economy without a "driving force" (about half of the country's GDP falls on private consumption).

Nevertheless, recent inflationary data (which covered the period of the increased tax effect) showed minimal, but still positive dynamics. Therefore, the Bank of Japan may take a wait-and-see attitude on this issue at tomorrow's meeting.

In addition, it is worth recalling that the country's prime minister presented a package of fiscal incentives totaling $ 120 billion in early December. However, Shinzo Abe did not give any details, limiting himself to general phrases. Now, it is only known that the expenses will be distributed according to the supplementary budget for the current fiscal year (which ends in March) and for the budget for the next fiscal year (which accordingly begins in April 2020). In spite of that, the head of the Japanese government promised to tell in more detail about the stimulus package after it was approved at a cabinet meeting.

Thus, recent macroeconomic reports and the actions of the Japanese government can positively affect the position of members of the Bank of Japan in general, and Kuroda in particular. Most likely, the head of the Central Bank will repeat his rhetoric, which he announced at the end of November in the national parliament. He said that the regulator will continue to implement "aggressive monetary easing" and will take new measures if necessary. According to Kuroda, most of his colleagues support the idea of expanding incentives and lowering rates further into the negative area - but only if there is "a real threat to the economic momentum necessary to achieve the inflationary goal". By the way, in one of the subsequent speeches, the head of the Bank of Japan noted that in his opinion, the global economy has been showing "positive signals" recently, and the forecast for next year is "pretty good." He can also voice this speech at tomorrow's press conference.

The yen may ignore the December meeting, considering that the Bank of Japan takes a wait-and-see attitude (which is most likely), and Kuroda announces the usual rhetoric. Meanwhile, i the Japanese regulator clearly announces further easing of monetary policy, the USD/JPY pair will react with significant growth, gaining a foothold in the 110th figure. Perhaps, the most unlikely scenario is one in which the yen will rise in price tomorrow. For example, if the Bank of Japan unexpectedly declares that ultra-soft credit policy is weak and that there are corresponding side effects, while allowing part of its incentive program to be curtailed. Such a scenario is extremely unlikely, although such thoughts have recently been voiced by one of the members of the Governing Council of the Central Bank of Japan (Maokoto Sakurai). However, his position is unlikely to be supported by colleagues – at least in the last meeting this year.

The material has been provided by InstaForex Company - www.instaforex.com