Boris Johnson made a commotion in the markets once again. However, with a negative result for the pound this time. The unexpected proposal by the British Prime Minister to submit to the House of Commons a bill prohibiting the extension of the transition period after Brexit was received by investors extremely negatively. The reason is that if there will remain some unresolved issues between the United Kingdom and the European Union during the year, and this is how much the transition period should last, then nothing will be done with this. Moreover, there is a very high probability that these issues will be just the trade, as well as the border between Ireland and Northern Ireland. Thus, the British business will suffer the most from this, which is reflected in the pound, which rapidly went down.

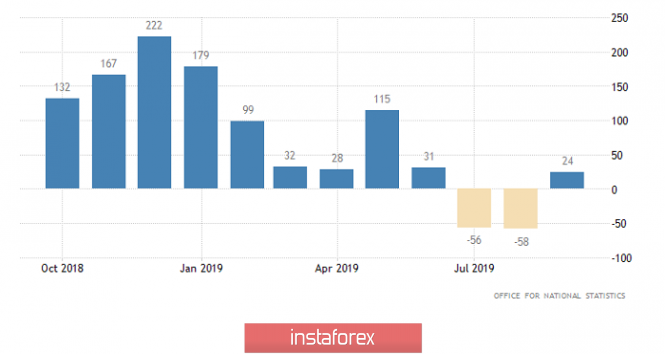

At the same time, the pound had reasons to decline if you look at macroeconomic statistics. Although, not when it happened. After all, the data on the labor market in the UK, which were published about the same time when the pound declined, turned out to be at least neutral. Yes, the growth rate of average wages has slowed, and more than expected. Thus, if you look at salaries in their pure form, that is, without bonuses, then their growth rate decreased from 3.6% to 3.5%, which coincided with forecasts. But the growth rate of the average wage, taking into account premiums, decreased from 3.7% to 3.2%, with a forecast of 3.5%. However, this was offset by the fact that the unemployment rate remained unchanged, rather than rising as expected. In addition, employment has not decreased by 10 thousand, but increased by 24 thousand. So in general, the data are relatively good, since the slowdown in wage growth may well be due to employment growth.

Employment Change (UK):

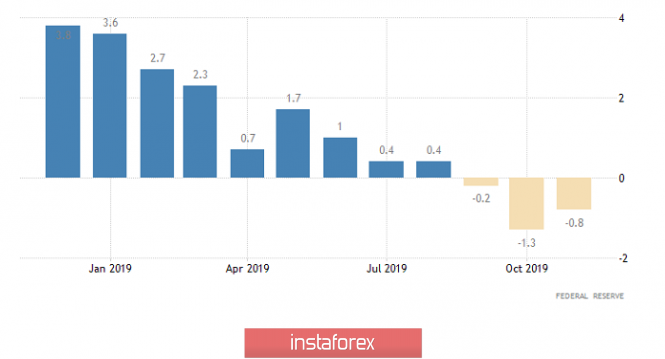

However, the weakening of the pound stopped, just before the publication of statistics in the United States, and after that, it remained at the reached values. We can say that American statistics justified the hasty weakening of the pound, as it turned out to be better than the boldest forecasts. Indeed, as expected, the number of new construction projects increased, but not by 2.5%, but by 3.2%. Nonetheless, the complete surprise was the increase in the number of building permits issued. After all, it was supposed to decrease by 3.2%, but it turned out that it increased by 1.4%. Thus, a decline in construction volumes should not be expected. Moreover, we have here the industrial production. The decline rate of which was supposed to increase from -1.3% to -1.6%, suddenly showed a slowdown in the decline to -0.8%. To simply put it, American statistics clearly presented a pleasant surprise.

Industrial Production (United States):

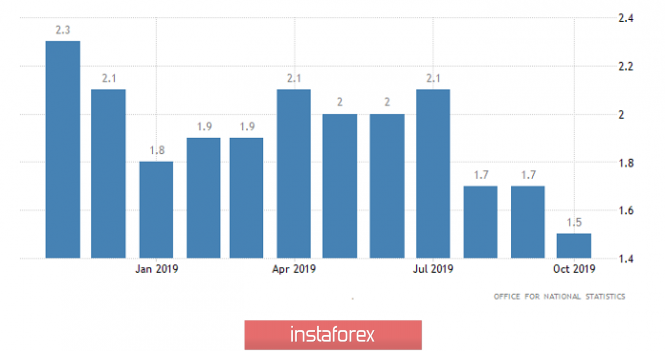

Today, great interest is caused by data on inflation in the UK, which can show its decline from 1.5% to 1.4%. This will mean that inflation has only been doing what is decreasing since August. Investors do not really like such tricks, as this leads to an increase in the payback period of investments. Due to this, a further decline in inflation is an excellent reason to weaken the pound even more.

Inflation (UK):

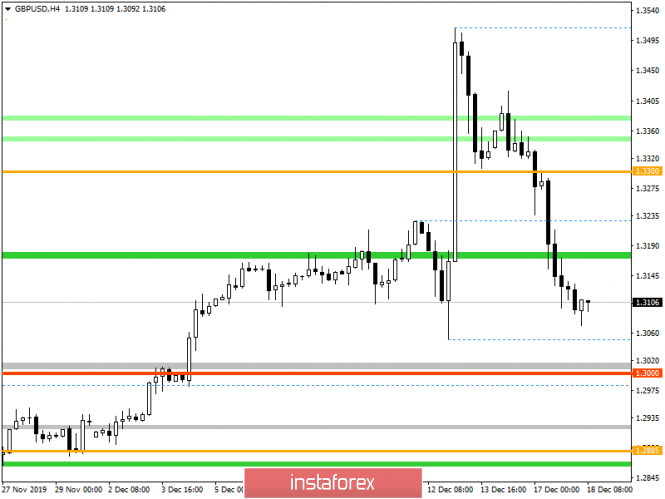

In terms of technical analysis, we see that the GBP/USD pair continues to follow in a downward direction, resulting in the complete refinement of the past rally and control rapprochement with the previously passed psychological level. In fact, we see the back of the V-shaped model, where the base plays a variable fulcrum. The total size of the model was about 440 points, and the formation time was less than a week.

Considering the trading chart in general terms, we see a rapid upward move, which basically has an emotional component, which is not a stable material of the structure.

It is likely to assume that the downward interest will continue to focus on the interest of market participants, where the psychological level of 1.3000, which is given special attention, will serve as a possible support.

Concretizing all of the above into trading signals:

- Long positions are considered in case of price fixing at higher than 1.3140.

- Short positions are considered in case of price fixing at lower than 1.3070.

From the point of view of a comprehensive indicator analysis, we see that indicators are gradually moving into the sales area, relative to all the main time sections.