Euro strengthened slightly against the US dollar. Yesterday's data showing that the number of Americans who applied for unemployment benefits decreased for the first time, did not affect the market significantly. Also, the report from the US Department of Labor is incomplete, as it is characterized by increased volatility between Thanksgiving and mid-January next year. However, even without these data, it is clear that the American labor market is in full order, gradually making its way to its historical lows.

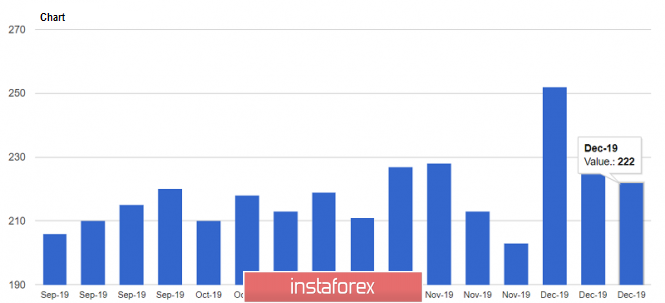

According to the report, for the week of December 15 to 21, the number of initial applications for unemployment benefits fell by 13,000 and amounted to 222,000. Economists have expected this number of initial applications to be at 220,000 only. Meanwhile, as for the revised data for the week of December 8 to 14, the number of initial applications increased by 1,000, and amounted to 235,000.

In total, the moving average of applications for four weeks rose by 2,250 and amounted to 228,000.

As for the figure on the secondary number of applications for unemployment benefits, which are Americans who remain out of work for more than a week, for the week from December 8 to 14, it fell by 6,000 as well, and amounted to 1.72 million.

Other important fundamental data were not released on Thursday. This led to a reduction in traders' long positions in the US dollar, enabling risky assets to strengthen slightly by the end of this week.

As for the technical picture of the EUR/USD pair, at the moment, the upward correction in euro may continue. This will lead to an update of the highs at 1.1130 and 1.1160. Without a good fundamental recharge, breaking above these levels is unlikely. If the pressure on risky assets returns, with such a thin market in pre-holiday days, it is quite possible, without the publication of statistics, that the pair will be supported by a minimum of 1.1070. A larger area is seen as well around 1.1040.

USD/JPY

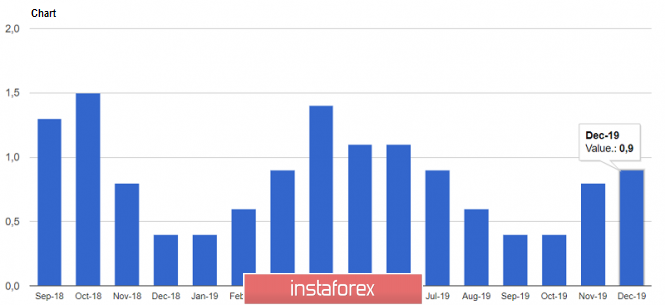

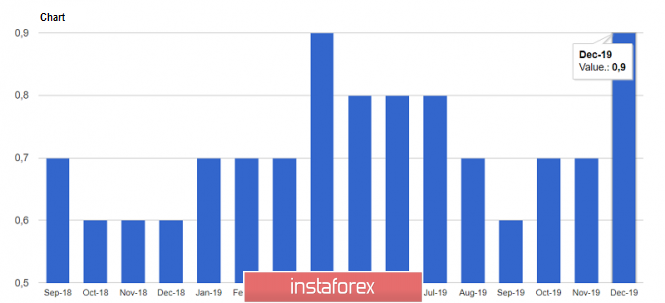

The Japanese yen strengthened against the US dollar after data that the core consumer price index (CPI) in Tokyo rose to 0.8% year-on-year in December. Economists had expected the figure to be at 0.6% only. As for inflation, taking into account the volatile categories, the Tokyo CPI in December was at 0.9% per annum, compared to November this year where it remained unchanged.

Yen was also supported by the unemployment rate data in Japan, which fell to 2.2% in November, returning to the lows of the year. Economists had expected it to remain at 2.4%. The ratio of jobs to job seekers in Japan in November is 1.57, as compared to 1.57 in October.

The real problems with the rising inflation in Japan remain even amidst such low unemployment and interest rates. Let me remind you that just recently, Bank of Japan Governor Haruhiko Kuroda said that if there are minimal signs of slowing the movement of inflation, he would not hesitate to resort on lowering interest rates and additional measures to ease monetary policy. Apparently, today's data indicate the continuation of a wait-and-see position on the part of the regulator, which will support the yen in the future.

Meanwhile, the annual drop in retail sales in Japan, as well as the reduction in industrial production, is unlikely to add optimism to traders who bet on the strengthening of yen in the short term. According to the data, sales in Japan decreased by 2.1% in November this year, as compared to the same period in 2018. Industrial production also decreased by 4.5% in November, as compared to October, while economists had predicted a fall of only -1.2%.

In general, the weakening of the Japanese yen and the upward trend of the US dollar, which was formed at the end of this summer, remains. While the pair is in a narrow side channel of 109.30-109.70, we can expect a breakthrough on the upper border, and a new wave of growth on the trading instrument in the area of highs 110.00 and 110.60. Breaking the lower limit of this range will push the dollar back to the support of 108.50

The material has been provided by InstaForex Company - www.instaforex.com