Many traders who have at least three years of experience trading in the currency exchange market will probably remember the election night in 2016, when Britain summed up the results of the historical referendum on the country's withdrawal from the EU. That night, the GBP/USD pair showed tremendous price fluctuations: at first, it increased to the level of 1.50, and in the morning, it declined two thousand points to the base of the 30th figure. This is all because the votes were first counted in those regions of Britain that support the European Union, and closer to dawn, data came from other sections. Thus, when it finally became clear that the Eurosceptics won, the pound began to dive down, freezing at the levels of multi-year lows. In turn, British entrepreneurs suddenly realized that they could lose access to a single market overnight, after which the British currency paired with the dollar updated historical lows (which, subsequently, were repeatedly updated, up to the level of 1.1958).

Last night, the pound began to gain momentum also "ahead of schedule", that is, before the announcement of the official results. Therefore, I personally experienced a light deja vu, internally preparing for the subsequent dive of GBP/USD. However, apparently, the current situation cannot be compared with the situation in 2016, and even with the situation in 2017, when Theresa May recklessly decided on early elections in order to strengthen her position in parliament. Moreover, the data received by the morning of December 13 suggest that Boris Johnson did what his predecessor did not succeed: he was able to strengthen the position of conservatives in the House of Commons, and most likely will form a parliamentary majority with a large margin of several tens of votes.

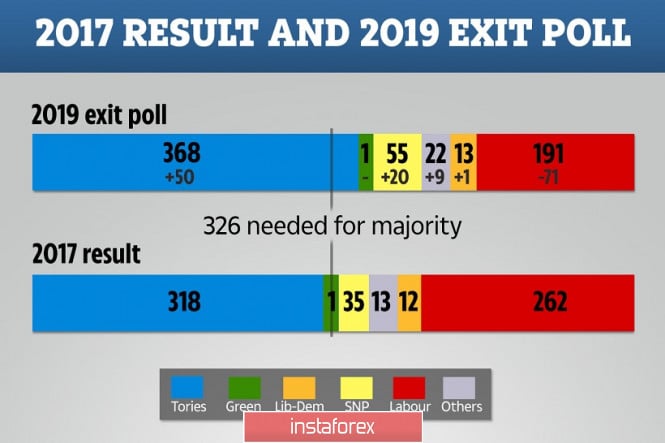

At the time of writing these lines in Britain, nearly half of the ballots were counted. According to the data received, conservatives receive 357 seats, Labor - 202, Scottish National Party - 46, Liberal Democrats - 10. Now, if we talk about the expected results in general, so far we can proceed from the results of exit polls, although they all confirm the optimistic forecasts of the YouGov research agency. In particular, Boris Johnson can get 368 seats in the new parliament. So if these exit poll data are confirmed, the conservatives will receive more than 50 mandates more than they had following the results of the early elections the year before last. Moreover, they are guaranteed to form a majority in the House of Commons and will be able to make legislative decisions independently of other political forces. Let me remind you that during the previous parliament, the Tories were forced to enter into a situational alliance with the Democratic Union Party. This fact negatively affected the approval process of the deal with Brussels - both during the time of Theresa May and under Johnson's reign. Not only were the conservatives "dissidents" who did not support the course of the Prime Minister, but the allies also put forward their own conditions, which were often impossible.

Now, Johnson got rid of this "anchor". If the exit polls are confirmed, the prime minister will be able to coordinate government initiatives (including the Brexit deal) without fear of possible internal party opposition, given the gap of several dozen mandates. By the way, according to Johnson himself, prior to the election, all candidates who went to the polls from the Conservative Party signed an assurance that they would support the agreement reached with Brussels. In fact, the deplorable results of the Labor Party (which, apparently, lost about 70 seats in parliament compared to the previous elections) indicate that the British want to put an end to the protracted negotiating epic. It was under Johnson that the Conservative Party rating went up sharply: residents of Foggy Albion are sure that he will be able to finish what he started, finally putting an end to the three-year negotiation process.

However, the "point" is still far away. By January 31, the UK will leave the European Union formally (judging by the preliminary results of the elections, this can already be said with confidence). Nevertheless, the country will finally leave the Alliance only at the end of the transition period. This period ends at the end of 2020. And although the parties can extend it, Johnson is determined in his usual manner: he plans to streamline trade relations between London and Brussels over the remaining (since January) 11 months in order to leave the EU not formally, but de facto. According to some experts, difficulties will arise again in relations between Britain and the Alliance at this stage, and this fact will put pressure on the pound.

However, these are problems not of today or even of the current year. At the moment, the bulls of GBP/USD are celebrating a well-deserved victory - after all, just a few days before the vote, YouGov experts did not exclude the option of a "suspended" parliament. Now, this scenario is practically excluded, so the pound is held at one and a half year price highs. Meanwhile, the nearest resistance level is located at around 1.3580 - this is the upper line of the Bollinger Bands indicator on the monthly chart.

The material has been provided by InstaForex Company - www.instaforex.com