To open long positions on EURUSD you need:

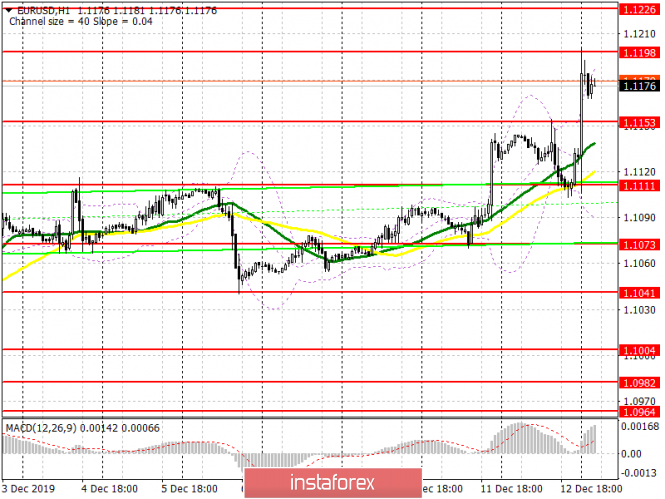

Yesterday's statements by ECB President Christine Lagarde on the topic of monetary policy, which will remain unchanged at the beginning of next year, exerted only temporary pressure on the European currency. All emphasis was shifted to parliamentary elections in the UK, which ultimately led to a sharp increase in EUR/USD. At the moment, bulls need to break above the resistance of 1.1198, which will only increase demand for the euro and lead to renewal of highs in the areas of 1.1226 and 1.1263, where I recommend taking profits. Given the absence of important statistics in the first half of the day, we cannot exclude the possibility of a downward correction to the support area of 1.1153, the formation of a false breakout will be a signal to open long positions in order to continue growth. Otherwise, it is best to buy EUR/USD for a rebound from a low of 1.1111.

To open short positions on EURUSD you need:

Bears will wait for an unsuccessful consolidation above the resistance of 1.1198, which will be the first signal to open short positions. A more important task will be the return and the breakout of support at 1.1153, which will lead to a downward correction of the euro to a low of 1.1111, where I recommend taking profits. However, one can count on such a movement only after the release of good data on US retail sales. With a EUR/USD growth scenario above the resistance of 1.1198 in the morning, it is best to return to short positions only after updating the high of 1.1226, or sell immediately for a rebound from a larger resistance of 1.1263.

Signals of indicators:

Moving averages

Trade is conducted above 30 and 50 moving averages, which saves a chance to continue the upward trend in the euro.

Bollinger bands

A breakthrough of the upper boundary of the indicator, which coincides with the resistance of 1.1198, will lead to a new growth wave. The downward correction will be restrained by the lower boundary of the indicator in the area of 1.1090.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20