The Japanese currency fell under a wave of sales: paired with the dollar, the yen fell to the 109th figure, returning to October positions. For almost the entire past month, the USD/JPY pair traded within the price range of 108.40-108.90, and only at the beginning of November did the price drop to 107.90, following a meeting of the Bank of Japan. But the pair's bears could not develop a downward movement - the anti-risk sentiment in the market decreased significantly, and defensive tools, which are primarily the yen, were no longer in demand. The Swiss franc and gold likewise lost their position, reflecting the general sentiment of investors. This dynamics is due to several factors that are somehow related to the prospects of the negotiation process between the United States and China.

It should be noted right away that there are still no obvious (official) reasons for optimism in this matter. At the same time, in recent times, numerous rumors have been circulating in the press that testify to the parties intentions to conclude a historic deal, thus ending the trade war. And if earlier the rumors circulated were contradictory, now they are quite homogeneous: information sources talk about the conclusion of the "first phase" of a trade deal between Washington and Beijing in the near future, possibly in November.

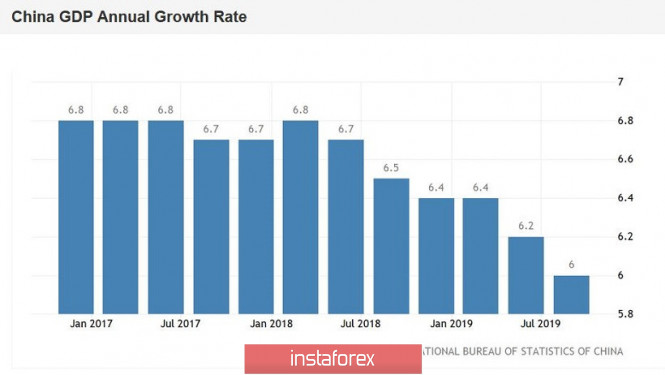

Each of the parties has its own reasons to make certain concessions. The arguments of China are obvious: according to the latest data, the level of GDP in the third quarter grew by only 6% year on year, after growing by 6.2% in the second quarter. This was the slowest growth over the past 27 years (!) and also below the forecast level - experts expected to see this indicator at around 6.1%. Obviously, the cooling of the global economy and the decline in China's GDP are links in one chain. Beijing continues to feel the effects of the global trade conflict.

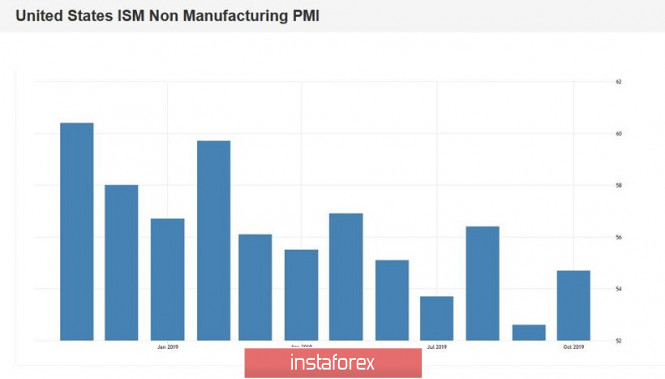

The US economy also does not have immunity from a slowdown in the global economy. Recent data in industrial production eloquently testify to this fact - for example, the ISM manufacturing index fell to a 10-year low. There are also problems in the export sector and in the field of business investment. But the White House may make certain concessions to China for other political reasons. The next presidential election in the United States will be held in just a year, while sociology continues to remain on the side of the incumbent head of state. So, according to recent polls, if the election took place today, then Donald Trump would lose to any of the three Democratic leaders. For example, Joe Biden is immediately ahead of him by 12% (51% against 39%). Bernie Sanders could beat Trump with a score of 49% versus 41%, Elizabeth Warren - 46% versus 41%.

However, in the six states that voted for the Republican in 2016, Trump is only two points behind Biden among registered voters, and this result remains within the sociological margin of error. The current president is two points ahead of Senator Elizabeth Warren, which corresponds to his victory over Hillary Clinton in these states three years ago.

In other words, despite the crushing, at first glance, ratings, Trump retains the chances of winning in 2020. But he needs a victory on the "Chinese front" - a path with even more significant concessions to earlier ambitions. The Chinese understand this very well, therefore, according to rumors, they put forward counter conditions. According to the American media, Beijing asked to cancel the fifteen percent duties that were introduced on September 1 and demanded to abandon the December increase in duties. Trump did not categorically refuse: the White House is now considering the proposal. If the US president makes these concessions, then his meeting in Xi Jinping may take place this month.

Here it is worth noting that some US news agencies, citing anonymous sources in the White House, have already managed to declare that Trump is inclined to go "on the world", agreeing to China's conditions. Actually, this is the basis for the US currency's growth with the simultaneous dying out of anti-risk sentiment.

Thus, the fundamental background has changed quite sharply in the foreign exchange market: this fact, on the one hand, made it possible for the dollar to strengthen throughout the market, and on the other hand, put significant pressure on the Japanese currency. The panic over Brexit's prospects also subsided. The lull will last until December 13th, when the results of the parliamentary elections to the House of Commons of the British Parliament become known.

In addition, today the dollar received an additional reason for its growth: the US ISM in the service sector recovered to around 54.7 after a record decline to 52.6. Against the backdrop of a general interest in risky assets, this fact served as an impulse to the growth of the USD/JPY pair.

If rumors about a possible meeting of US and China leaders and the signing of the deal intensify, the yen will more actively lose its position. In the context of USD/JPY, this means that the pair has a growth potential to around 110.00 - this is the upper line of the Bollinger Bands indicator, which coincides with the upper boundary of the Kumo cloud on the weekly chart. The closest resistance level is the price of 109.30 - this is the upper line of the Bollinger Bands on D1.

The material has been provided by InstaForex Company - www.instaforex.com