If someone thought that the British pound would return to normal after reducing the chances of a disorderly Brexit to a low, then the beginning of November showed that they are wrong. The leader of the Brexit party, Nigel Faraj, fundamentally disagreeing with the main provisions of the project of Boris Johnson, said he would fight for every seat in the renewed Parliament. This can seriously complicate the position of the Conservatives and increase the risks of the victory of the party of Jeremy Corbyn. Labour promises to nationalize enterprises, raise taxes and hold a second referendum on divorce from the EU. The political landscape in Great Britain remains shaky, which allows Goldman Sachs to recommend that its client close long sterling positions as part of a "tactical retreat".

The dynamics of popularity of the main parties in Britain

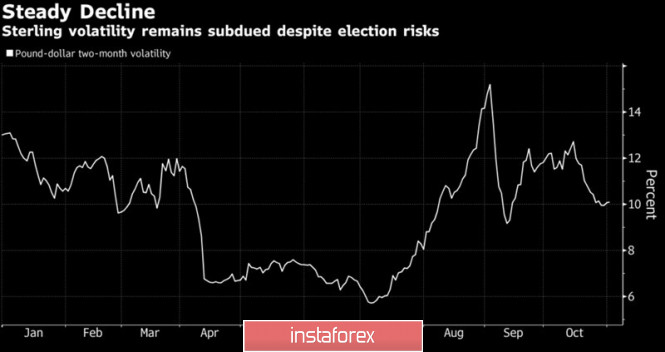

Thanks to the almost zero chance of a disorderly Brexit, the pound climbed to second in the list of the best performers of G10 since the beginning of the year. Sterling's two-month volatility has fallen to September lows, however, the intensification of political struggle can lead to an increase in the indicator, which will adversely affect capital flows and the short-term prospects of the British currency.

Pound Volatility Dynamics

The pound practically did not pay attention to the rapid growth of business activity in the manufacturing sector from 48.3 to 49.6 in October. Surveys of purchasing managers were conducted during a period of general euphoria about the fact that a disorderly Brexit was avoided. In addition, the PMI continues to be below the critical mark of 50, indicating a decline in the sector. I do not think that sterling will be very sensitive to the release of data on business activity in the construction and services sectors, but a meeting of the Bank of England can make it worry.

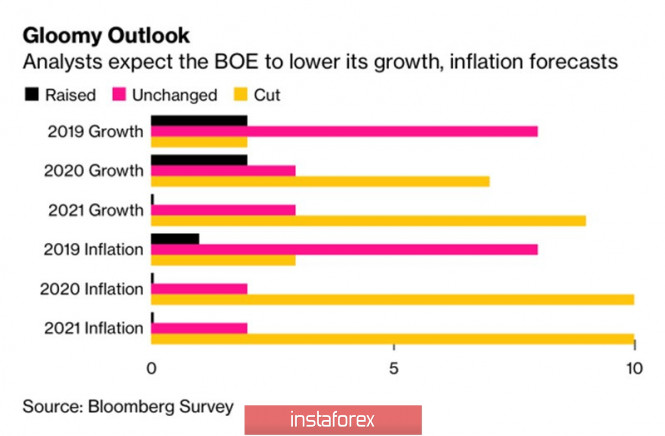

Only one out of the 19 Bloomberg experts predicts that the BoE will lower the repo rate, the rest are confident that it will remain at the same level of 0.75%. At the same time, most experts believe that the central bank will lower forecasts for inflation and GDP and increase estimates of unemployment. This is a hint of monetary expansion, which will increase the risks of a GBP/USD correction. On the whole, it's a rather unexpected turn, given the fact that BoE's previous forecasts were based on the assumption that a disorderly Brexit could be avoided.

Assessment of changes in Bank of England forecasts

If you add seasonal weakness to the growing political risks and potential dovish rhetoric of Mark Carney, then the immediate prospects for sterling can begin to be drawn in gray tones. According to the results of November in 1975-2018, it closed in the red zone in 28 out of 44 cases. Nevertheless, the bullish trend looks stable, so the correction at the end of autumn made it possible to buy a cheaper pound.

Technically, if the bulls on GBP/USD manage to keep the pair quotes above 1.29 and update the October high, then the chances of continuing the rally in the direction of the target by 88.6% according to the Bat pattern will increase. In the opposite case, we are waiting for a correction to 1.276 and 1.272.

The material has been provided by InstaForex Company - www.instaforex.com